Australian Crop Update – Week 25, 2024

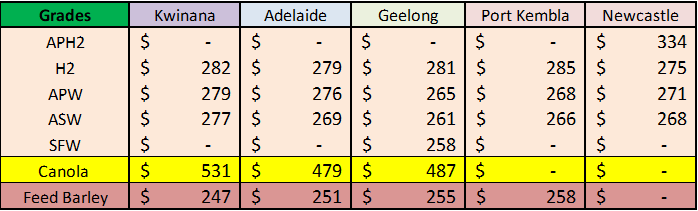

2024 Current Season – USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

The Australian cash market was sharply lower over the past week with the biggest declines in New South Wales (NSW) where the winter crop is off to a favourable start. Limited new crop selling has been the main catalyst for the declines, but this has also flushed out old crop sellers who are keen to make the most of the old crop premiums. Declines in barley were also less than those seen in wheat.

At this stage of the year, it is hard to buy and equally hard to sell. Exporters have been quick to pull bids to realign local markets with overseas values after the late May and early June rains secured germination in Western Australia (WA), South Australia (SA) and VIC. Markets are comforted that the crop has been planted and is mostly germinated, albeit some parts of SA and VIC remain anxious for more rain to consolidate the late, dry start. Declines in Australian wheat is not keeping pace with the falls in global markets which is making local wheat even more expensive into key Asian markets and Middle East markets were exporters were already struggling to make sales against cheaper northern hemisphere competition.

On pulses. In the north, growers have taken advantage of good moisture to plant one of the biggest chickpea crops seen for some time while in the south, growers have planted more lentils in less than favourable planting conditions. On Favas, the northern crop is well established while in the south, we are again in watch and wait mode for reports on its progress.

Ocean Freight & Shipment Stem Update:

A week of stabilisation in the shipping market. The recent strength in the Atlantic has cooled while in the Pacific, more demand appeared to stem the recent downward pressure. Supra’s in the Pacific are achieving around 15kpd for Pac rounds and slightly more for Aussie. Ultras are able to achieve 16-17kpd depending on the specifics on the requirement. Aussie coastal tonnage showed some resistance this week with larger handies not willing to go below the low 20k's for outbound trips while supras were targeting closer to mid 20k's for same. The exception to the norm was the Panamax which experienced softening throughout the week in both basins. The main reason was a reduction in demand in the Atlantic main loading areas which in turn seeped through to the Pacific which was unable to maintain its levels. Bunkers prices have creeped back up to the low 600's pmt for most major ports in Asia.

The slowdown in shipping stem additions continued this week. There was 193 thousand metric tonne (KMT) of wheat put onto the stem in the week, 60KMT of barley (SA) and 24KMT of canola.

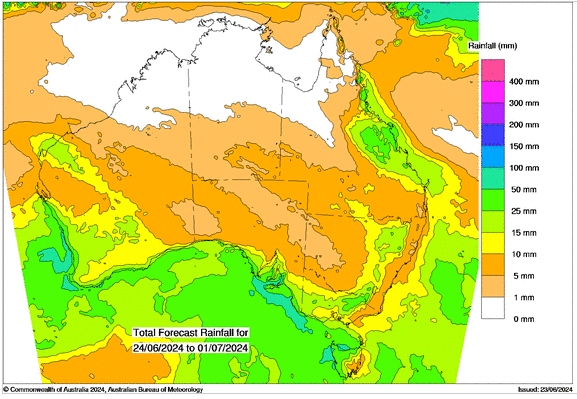

Australian Weather:

Weather forecasts are little changed for the upcoming week. WA is forecast to see another rain front late next week. Models vary on how much rain this will offer but it could be 15-20mm. The forecast is rain for SA and VIC next week but the Australian Bureau of Meteorology is only predicting light showers. This will keep markets comforted that the 2024/2025 crop is off to a reasonable enough start.

8 day forecast to 1st July 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 24th June 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was slightly weaker to close last week when valued against the USD closing at 0.6627. The Reserve Bank has kept interest rates on hold at 4.35 per cent. The cash rate target has been steady for seven months now. Interest rates will remain at this level for another six weeks at least, until the RBA Board's next meeting in early August. The RBA board said the path of interest rates that would ensure inflation returns to target in a reasonable timeframe remained uncertain and further rate hikes could be on the cards.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.