Australian Crop Update – Week 24, 2024

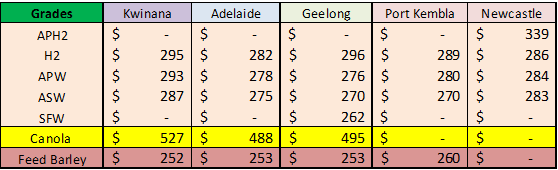

2024 Current Season – USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

Australian cash markets remained under pressure last week with increased grower selling after the recent rain in Western Australia (WA). Declines in global markets also weighed with CBOT wheat finishing the week down 2.3% and KC off 5.7%. There is no doubt that Australian market participants are becoming more comfortable with a reasonable production outlook for the 2024/25 crop. We have had a favourable start in New South Wales (NSW) and Queensland (QLD) and the late rains in WA, South Australia (SA) and Victoria (VIC) have settled nerves there.

SA’s PIRSA is pegging SA’s wheat crop at 4.8 million metric tonnes (MMT), barley at 2.1MMT and canola at 476 thousand metric tonnes (KMT). This numbers are slightly higher than ABARES

In the last week, old crop wheat grades were approximately USD5 per metric tonne (/MT) lower for FOB positions with new crop January also down USD6/MT. New crop bids however are hard to find with the trade a willing seller but there hasn’t been much farmer engagement. Demand has been an issue. Most of the Islamic world was heading into Eid holidays and the Asian buyer has covered his nearby requirements with cheaper Black Sea wheat were possible. The result is a wide bid / offer spread.

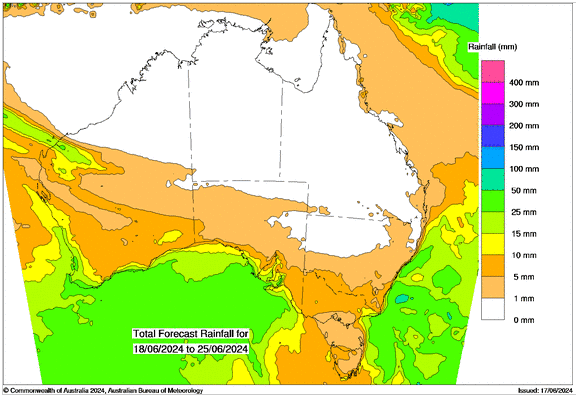

Looking forward, the Australian Bureau of Meteorology (BOM) issued its updated outlook for July to October on Friday, which showed the drier patterns for VIC and SA are expected to continue. For July, rainfall for much of Australia is likely to be typical for the season, however below average July rainfall is likely (60 to 70% chance) along the western slopes of the Great Dividing Range, and across much of southern Australia including Tasmania. The July to October forecast is drier than last week’s run.

Australian Pulses Update

Australian chickpea markets declined 1.5% last week with minimal trade reported in the domestic and international markets. Lentil trading was also muted. India’s Ministry of Agriculture released its third estimate for their domestic pulse crop. Total production this season is estimated at 24.5MMT which is down 6% from last year. This will no doubt prompt the importers to look at new crop supply from Australia and other origins to fill the short fall of domestic consumption.

PIRSA’s Lentil plantings are forecast at 332.4k ha which is 90k ha or 38% up on last year and 140k ha on 2022/23. They are forecasting a lentil crop of 511KMT up from 362KMT last year. PIRSA’s lentil forecasts are larger than ABARES, who also made significant increases. The increased lentil plantings are coming from other pulses but also barley. PIRSA made its assumptions and forecasts based on May 15, and flagged the dry start could jeopardise the current forecasts.

Ocean Freight & Shipment Stem Update:

After the recent decline in Ocean Freight, there is a consensus that the dry bulk market has turned the corner off the back of more demand appearing in the Atlantic. The Panamaxes in the Atlantic were well supported in the major grain loading areas causing rates to spike, which in turn helped push the Pacific rates up with the option to ballast to EC South America more appealing. A similar story developed for the Supra/Ultra market whereby the Atlantic led the way, especially the USG market which saw a week-on-week gain of 25% on the index. We haven’t seen USG Supra market at these levels since back in March. The Pacific market was more subdued but talks of a floor being found after the recent decline grew louder as the week progressed.

The transit concerns through the Red Sea and subsequent disruptions and congestion in Singapore have translated into container capacity shortages as well as significantly increased freight rates to European, Middle East and African destinations. In recent weeks, many shippers have struggled to secure capacity at agreed contract rates, faced peak season surcharges and general disruption to their supply chains caused by port delays. Once again, the sensitivities of the market to imbalance have been exposed and consumers and Australian shippers are once again facing nearby contract execution challenges.

In terms of export stem, weekly wheat additions climbed to 400KMT last week with 140KMT of this in VIC. Nonetheless, additions have slowed for the Jul/Sep quarter. There was 55KMT of canola added to the stem in WA.

Australian Weather:

WA has enjoyed some heavy rain over the past 10 days in the northern regions with falls ranging from 70mm to more than 140mm. Rainfall totals tapered away in the southern part of the state, but these areas received sufficient rain early to germinate crops. WA has had enough rain to germinate >95% of dry planted crop and now looks for top up rain to keep crops watered. WA crops have germinated quickly because of the unseasonably warm soil temperatures which is helping to make up for the late start. The state appears to be on track for an average year following the recent rains, despite the late start.

SA received light showers late in the week between 2-15mm. VIC also received some rain on Thursday/Friday last week ranging between 5-20mm in the cropping areas.

Forecasts are offering more rain for WA and SA this week.

8 day forecast to 25th June2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 18th June 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was slightly weaker to close out last week when valued against the USD trading at 0.6602. The AUD experienced additional losses against the US dollar on Friday despite strong labour market data from Australia reported earlier in the week, which prompted a more hawkish Reserve Bank of Australia (RBA). The RBA met yesterday, leaving interest rates on hold at 4.35%. Markets are now pricing the first rate cut will now only occur in May 2025.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.