Australian Crop Update – Week 24, 2023

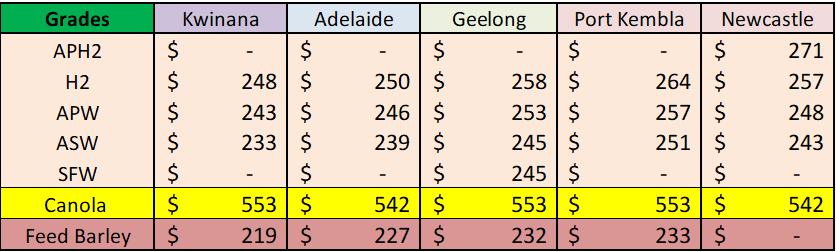

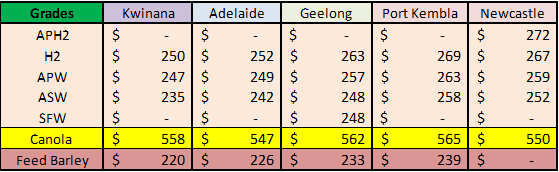

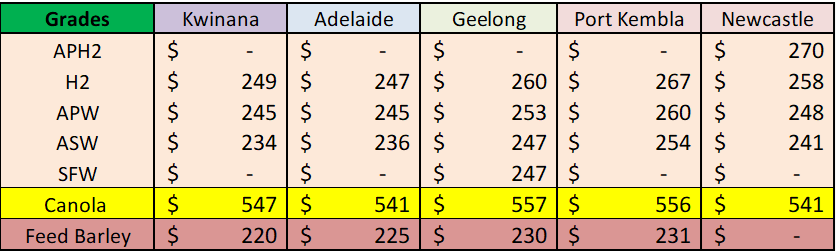

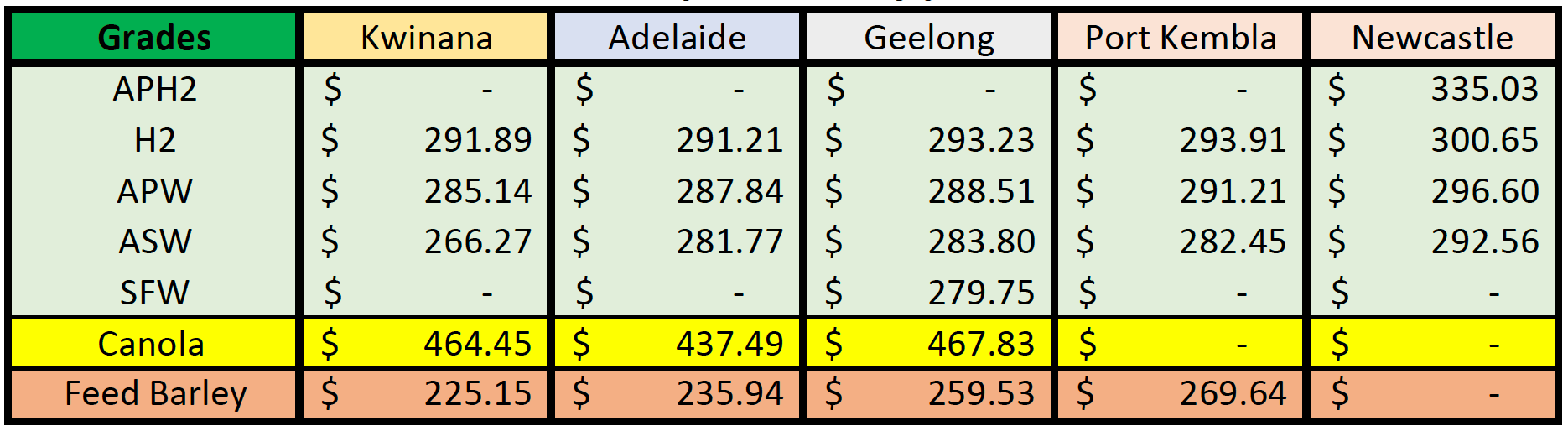

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Australian Grains & Oil Seed Market

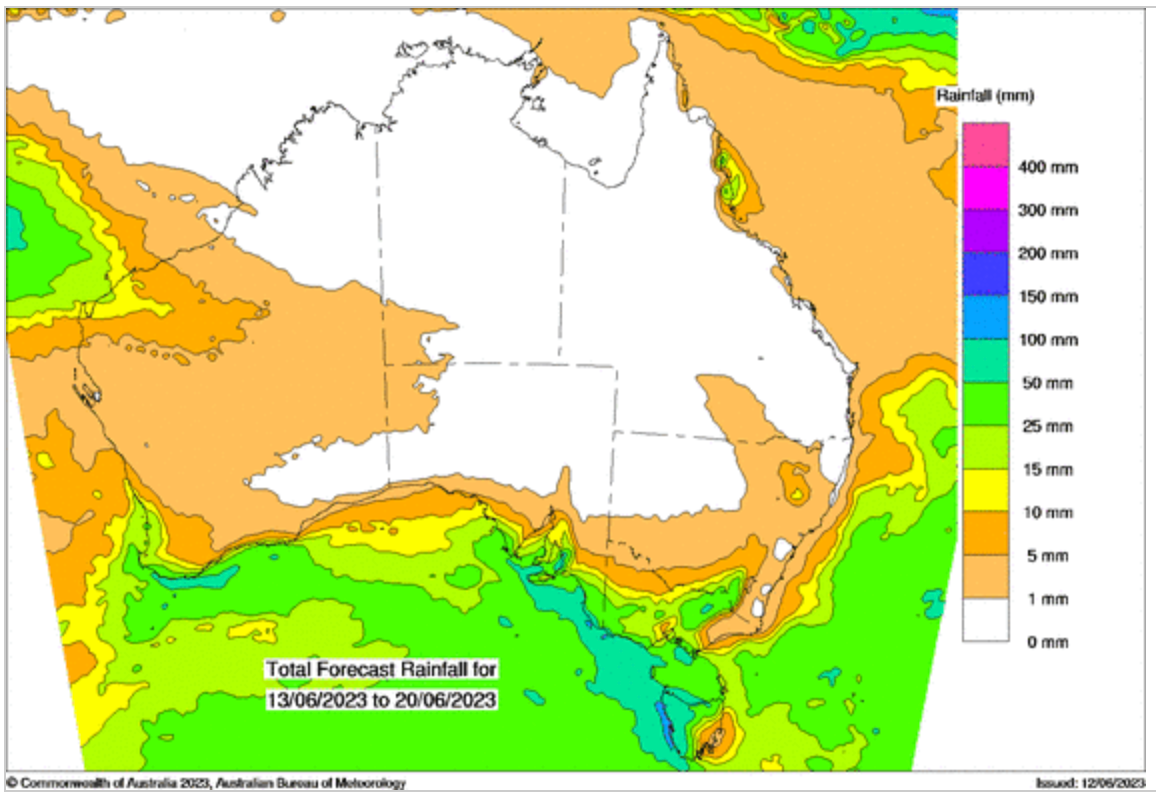

Australian domestic markets were little changed in the past week, except for canola which rallied with the gains in Europe. There was good rain across most cropping areas with only the North West of NSW coming up short. They only received 5-10mm which isn’t enough to progress planting. Further south most of the areas received at least 25-40mm for the week which will consolidate crops and allow roots to meet up with subsoil moisture. Victoria also received soaking rains in the past week. This included 25-50mm across the Mallee and Wimmera and 40-60mm through central Victoria. Falls were variable in South Australia. The Murray Mallee, Southeast and Adelaide Plains received 20-30mm plus, but it was lighter across the Yorke Peninsula, Mid North and Upper North as well as the central Eyre Peninsula. Most of these areas only received 8-15mm. Most of Western Australia received good falls through the week as well. Despite this rain the grower remains relatively disengaged as they continue to focus on planting and drier longer term forecasts.

ABARES 23/24 Crop forecast

Given the rain it was interesting to see ABARES (Australian Bureau of Agricultural and Resource Economics and Sciences) pull down its estimate for Australia’s 2023 wheat crop at 26.2MMT, slightly below the 10-year average, saying the drier than normal forecast will hamper yields. ABARES said a significant downside risk to the 2023/24 winter cropping season is the potential for an El Niño event and positive Indian Ocean DIapole event (IOD) to both eventuate later this year. We still feel it is too early in the development of the crop to write it down. The rain received last week was timely, most areas have good moisture profiles and crops will progress into winter in good condition in most areas. Importantly looking at the models, we have yet to get clarity on the amplitude of the event or timing so who’s to say we might not see a weak event only consolidating in October when the crops are closing in on harvest. To be candid, this scenario has as much weight as the gloomier forecasts but does not fill the global media’s need for the dramatic and this is the danger when you attach a crop forecast to a long-term weather forecast.

Australian Wheat Exports

Australian wheat exports continue at pace while barley and canola exports are slowing relative to last year’s pace. Australia exported 3MMT of wheat in April down from the record 3.7MMT shipped in March. This lifts Australia’s Oct/Apr cumulative to 19.45MMT which is nearly 4MMT more than the same time last year. Western Australia exports are up 1.8MMT on last year’s pace, South Australia is up 1.2MMT, Victoria is up 0.5MMT and Queensland is up 0.25MMT while New South Wales is close to unchanged.

China was the largest destination, taking a further 985KMT of wheat. Thailand was the next largest with 330KMT followed by Indonesia with 300KMT and then South Korea with 268KMT and then Vietnam with 260KMT. Middle East exports are higher than last year largely because of increased sales to Iraq.

Barley exports for April were 594KMT which is the second smallest month since November. Exports to Saudi Arabia fell to 42.5KMT which is the smallest in seven months and well down on the Nov/Mar average exports of 295KMT. Australian barley lost its favour with Black Sea and Eastern European barley much cheaper.

Sorghum exports were 408KMT with 345KMT going to China, 24.2KMT to Japan and 31KMT to Keny

a.Canola exports fell to 355KMT in April down from 660KMT in Mar and 592KMT in Fe

b.Lentil exports remain solid with the further 160KMT of shipments in April. India was the major destination taking 65% of the shipment

Ocean Freight Market & Export Stem

The Ocean freight market continued to remain quiet with limited activity and a sentiment remaining negative. Increasing discussion about how well China is really coping economically and some even raising the possibility that China may already be or going into recession.

Lack of cargo enquiry world-wide is the big issue - and especially to/from China. The freight market has been stopped in its tracks. It is usual to see a mid-year hiatus in the market as seasonality plays a role with the northern hemisphere holiday season approaching but the level of general economic malaise is concerning for the freight market. Freight rates have tumbled again over the week to levels which many hoped they would not see again for a long time. Sub-index supramaxes can be fixed between $5-6k per day and panamaxes are still trading sub-$10k per day for the pacific round. Period numbers are finally beginning to edge off as owners realise the scale of the negativity and reign in their ideas.

It was also a quieter week on the Australian shipping stem with only 475KMT of wheat added since last Friday, down from 900KMT in the previous week. However, most of the weekly wheat additions were on the east coast while Western Australia was quiet. This included 169KMT in New South Wales with the bulk of this out of Port Kembla. A further 160KMT of wheat was added in Victoria and 112KMT in South Australia. Only 10KMT of wheat was put on the Western Australia stem in the past wee

k.No barley was added to the stem in the past week with only 250KMT put on in the past four week

There was 104KMT of sorghum added to the stem. This included 25KMT in Brisbane with the other 79KMT in Gladstone and Mackay.

Australian Weather

8 day forecast to 20th of June 2023

Source: http://www.bom.gov.au/

Weekly Rainfall to 13th June 2023

Source: http://www.bom.gov.au/

USDA Report

The USDA report came out late last week with little fanfare or market impact. The numbers were bearish. Wheat added 10MMT of 2023/24 production (across a few different countries) and although demand was increased it doesn’t feel like that at the moment, so the balance sheet was forecast to rise. Corn was also bearish – adding 3.1MMT] of production and 2.2MMT of demand so stocks are up just over 1MMT.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.