Australian Crop Update – Week 23, 2023

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Australian Grains & Oil Seed Market

Australian domestic bids were softer last week with rain on the forecast for much of southern Australia. Buyers are hopeful rain will flush out farmer selling but the offers were little changed as we entered the week. That said, the rain received has been helpful across several areas and it has highlighted the danger of running ahead of the weather with crop forecasting as ABARE’s did with their 26.2MMT forecast for the wheat crop. Whilst one has sympathy for their dilemma given the chorus of El Nino forecasts and the correlation with droughts / reduced crops, we still have a lingering La Nina in play and changes in systems of this scale are rarely quick. So we are more cautious in terms of crop predictions this far out from harvest.

On the demand side, the bottom line is that Australian wheat and barley are globally uncompetitive at current values and its old crop shorts, slow farmer selling and new crop weather concerns that are keeping Australian cash values supported versus Black Sea cash values, which have been in free fall from week to week. It remains to be seen whether Australian values will be further supported by Chinese wheat quality concerns. It is a question of watch this space, but the promise of further exports cannot be discounted.

Ocean Freight Market & Export Stem

In terms of ocean freight, it is again a narrative of ‘different week, same story’. There has been limited activity with Indonesian coal, and Chinese iron ore markets are still weak. Very little to get excited about.

Another 900KMT of wheat was added to the stem in the past week. SA was the largest contributor accounting for 385KMT of the weekly additions followed by WA with 240KMT, and Vic and NSW both chipping in with 100KMT plus. A further 115KMT of sorghum was added to the stem in the past week (55KMT Newcastle and 60KMT Brisbane) as well as 116KMT of canola and 60KMT of barley.

Australian Pulse Market

Last week, the PULSE 23 conference in Sydney welcomed guests from all over the world. The sentiment was that Australia would see smaller crops this season.

Australian Weather

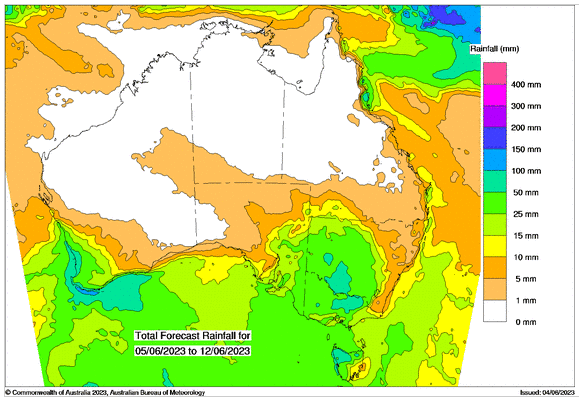

Weather forecasts continue to point to general rain across many cropping regions for the coming week. Coastal areas of WA saw heavy rain over the weekend. Parts of western NSW saw 20-30mm which is consistent with forecasts from the major models for most of last week. The rain in WA is expected to cling to the coast and not offer additional moisture for the cropping areas, but showers are expected to persist throughout the week. The trough across SA and NSW is expected to deliver widespread rain for much of SA and VIC cropping areas and then develop into more general rain across NSW later in the week. The heaviest of the NSW rain is expected to be in the south with only lighter falls reaching the dry northwest of the state. Below is the ACCESS model through to next weekend.

Source: bom.gov.au

AUD – Australian Dollar

The Australian dollar finished stronger to end last week when valued against the Greenback and is currently trading above 66 US cents. The RBA is expected to hold rates at 3.85% in June but economists and money markets remain divided over its next move as lingering price pressures and recovering home prices suggest a hike may be needed while weaker activity and rising unemployment argue for a pause.

The post Basis Commodities – Australian Crop Update – Week 23, 2023 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.