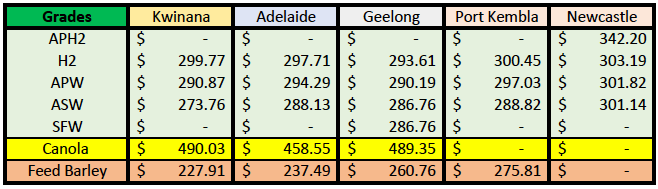

Australian Crop Update – Week 25, 2023

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Australian Grains & Oil Seed Market

The cropping regions of Western Australia, South Australia and Victoria have seen great rainfall over the past two weeks but unfortunately for Northern New South Wales and Queensland, the rainfall vastly underdelivered versus expectations.

Consequently, the cash markets are a tale of north and south. The northern feed market edged higher last week on the strength in the domestic market and continued dryness. The southern markets were steady to softer where crop conditions are favourable and edged lower with more sellers emerging late in the week with forecasts offering more rain this week. South Australia and Western Australia wheat was slightly higher for the week on exporter short covering. There weren’t a lot of new grain shipments added to the stem in the past week as Australia continues to struggle for competitiveness and overseas demand remains lacklustre.

Australia exported 593,671 metric tonnes (MT) of barley and 400,170MT of sorghum in April, according to the latest data from the Australian Bureau of Statistics. The barley figure comprises 470,448MT of feed and 123,223MT of malting, with the feed total being down 26 percent from the 635,917MT shipped in March, and malting total down 12pc for the month.

Sorghum exports jumped 73pc for the month from the 231,216MT shipped in March to reflect the arrival of new-crop volume, with around three-quarters of it leaving Brisbane in bulk bound for China. The sorghum harvest is going at full pace in Central Queensland and is complete in New South Wales and southern Queensland.

Australian Pulse Update

Recent rain across south-eastern Australia has helped faba bean and lentil crops get off to a strong start in a mostly steady market, while patchy conditions in north-west New South Wales are limiting the new-crop chickpea area. ABARES last week issued its initial forecasts for Australia’s five major pulses, which are estimated to weigh in at 2.684 million metric tonnes (MMT) this year, down 32pc from 3.95MMT grown in 2022-23. The national forecaster is predicting a 1pc increase in chickpea production to 544,000MT, but has forecast big drops for Australia’s other major winter pulses, namely faba beans, field peas, lentils, and lupins. Climate modelling suggests El Niño conditions are likely to develop in spring, and this has contributed to southern Australian growers reducing area planted to pulses, which are likely to produce average yields at best if spring brings hot and dry conditions.

Ocean Freight Market & Export Stem

The ocean freight market continues to consolidate at lower levels this week with most eyes set on what is/is not happening in China. When Chinese cargo activity grows then the freight market moves up and vice versa. That said we are entering a traditionally quiet mid-year period. India is still in monsoon, the northern hemisphere is entering a holiday period and the NOPAC is quiet.

The strong export pace for Queensland and New South Wales will leave minimal carry-over grain supplies heading into the 2023/24 season in these eastern states. This means the 2023/24 northern grain supplies remain at the mercy of the weather and the market will maintain the large freight premiums in the north to draw supplies up from the south by road or potentially by ship around from South Australia or Western Australia.

Shipping stem additions continued to slow with just 314 thousand metric tonne (KMT) of wheat added in the past week. All but 20KMT of this was in Western Australia and South Australia. There was 50KMT of barley added to the stem in the past week which included 20KMT from South Australia and 30KMT from Western Australia. There was 30KMT of sorghum added to the stem in Queensland.

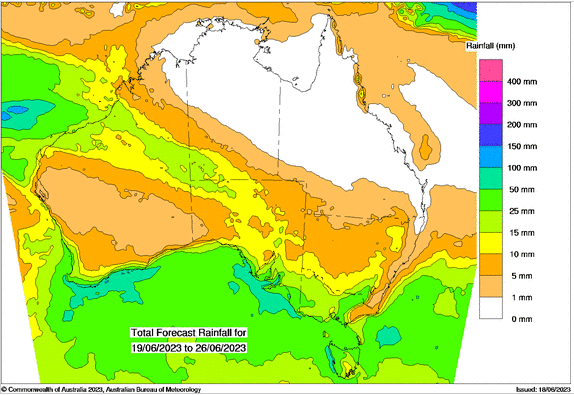

Australian Weather

More rain is forecast for South Australia and Victoria this week. Western Australia and Southern New South Wales are expected to see light showers but nothing significant. Northern New South Wales and Queensland will be mostly dry. Another trough is set to develop from northern Western Australia mid next week which will pull moisture down into South Australia late next week and this will also bring widespread rain across Victoria. The southern slopes of New South Wales are expected to see rain from this event as well. The situation is becoming more serious for Northern New South Wales where time is running out for winter crop planting. This is in contrast to the very good start for South Australia, Victoria and Southern New South Wales for the growing season.

8 day forecast to 26th of June 2023

Source: http://www.bom.gov.au/

Weekly Rainfall to 19th June 2023

Source: http://www.bom.gov.au/

AUD - Australian Dollar

The Australian dollar is slightly stronger to open the week when valued against the Greenback, opening trading at US$0.68. On Friday the Australian dollar reached its highest in four months, after surging 1.3%, all of which is not helping Australian grains export competitiveness. If AUD/USD manages to move higher, the next resistances to watch are at the daily high at 0.6890, followed by the psychological mark at 0.6900 and the 0.6920 area.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.