Australian Crop Update – Week 22, 2024

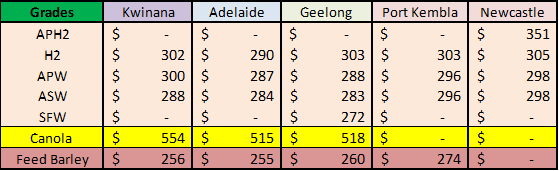

2024 Current Season – USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

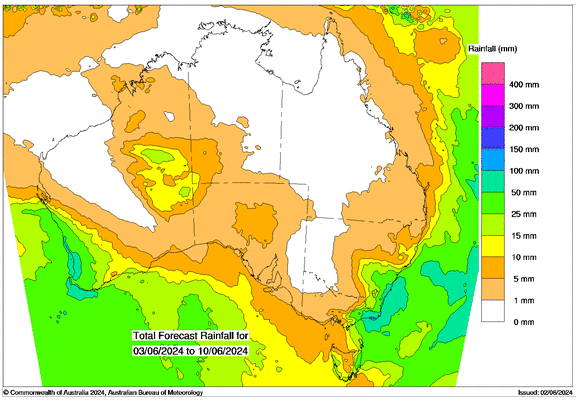

Domestic markets are softer following last week’s rain with more in the forecast for later this week. Traders are reporting more offers coming forward from growers. Buyers have backed away as more offers have emerged. Numerical models are forecasting 15-40mm across most of the Western Australian (WA) wheat belt this week. However, forecasts remain dry for South Australia (SA) and Victoria (VIC), apart from possible traces. SA’s Eyre Peninsula picked up some more light showers which will help with emergence.

Wheat and barley prices were down USD3-5 but are still holding above levels that have more international engagement. Markets in some areas however remain firm where farmers are still looking for more rain to ensure all crops are germinated. The Australian market is very much in a holding pattern with a full export program for existing crop commitments, awaiting further rainfall to define ideas for the production of the season and lower carry stocks underlying prices for those with any length. The industry is therefore looking at the weather carefully over the next four weeks and beyond ahead of any new crop business which is expected to start harvest in October 2024.

The Bureau of Meteorology (BOM) issued its latest climate update last week where they said rainfall for parts of eastern Australia is likely to be below average in June, while in July and August, rainfall for parts of the interior is likely to be above average. For June, they said, there is no strong signal towards above average or below average rainfall for the month, however below average June rainfall is likely (60 to 70% chance) for parts of eastern Australia. They said climate models suggest that ENSO will likely remain neutral until at least July 2024. Early signs of La Niña are most relevant to the climate of the tropical Pacific; the long-range forecast for Australian rainfall and temperature provides better guidance for Australian climate. BOM isn’t saying it, but their wetter forecast is being influenced by the La Nina bias.

ABARES released its initial 2024/25 Australian winter crop estimates. Australia’s wheat production for 24/25 is forecast at 29.1 million metric tonne (MMT), barley at 11.5MMT and canola at 5.4MMT. The area planted to wheat is forecast to rise by 3% year on year to 12.7 million ha in 2024/25, and barley area at 4.3 million ha is seen as being up 3%, mostly reflecting an increase in Queensland (QLD) and northern New South Wales (NSW) area after a dry season last year. The area planted to canola is forecast to fall 9% to 3.2 million ha, with lower relative expected returns have also seen some substitution towards other crops, including wheat, barley and pulses. Large planting will see pulse production climb in 2024/25. ABARES is forecasting chickpea production at 1.1MMT and lentils at 1.6MMT. Area planted to chickpeas is forecast to increase by around 80% to 730,000ha in 2024/25. The increase reflects the high prices and a favourable start to the cropping season in QLD and NSW. The area planted to lentils is forecast to increase further in 2024/25 to a record 885,000 ha, reflecting high lentil prices. Lentil production is forecast to remain steady on last year at 1.6MMT, following last year’s bumper yields. ABARES also raised its forecast for the 2023/24 lentil crop to account for the stronger than expected exports.

Ocean Freight & Shipment Stem Update:

A quiet week. The Panamax suffered from minimal fresh enquiry in both basins, albeit Pacific faired better by weeks end with more demand appearing ex Aussie and Nopac which helped steady the rates. The Ultra/Supra market followed suit where we saw an oversupply of tonnage worldwide with rates generally easing by 2-3kpd across the board. The Handies in the Altantic have continued the recent downward trends, especially in the Cont/Med areas where owners are having to settle sub 10kpd for quick Atlantic rounds.

In terms of export stem additions there was 256 thousand metric tonne (KMT) of wheat, 135KMT of barley, 88KMT of canola and 32KMT of sorghum put on the shipping stem in the past week.

Container shipping rates are on the rise once more. This rates surge is due to a limited supply of containers caused by rerouting around the Red Sea and healthy demand in multiple regions associated with the traditional northern hemisphere summer surge. The busy season has started early, pushing rates on major east-west routes to their highest levels since September 2022. This boom is affecting nearly all routes, including those to Latin America, Africa, and within Asia.

Australian Weather:

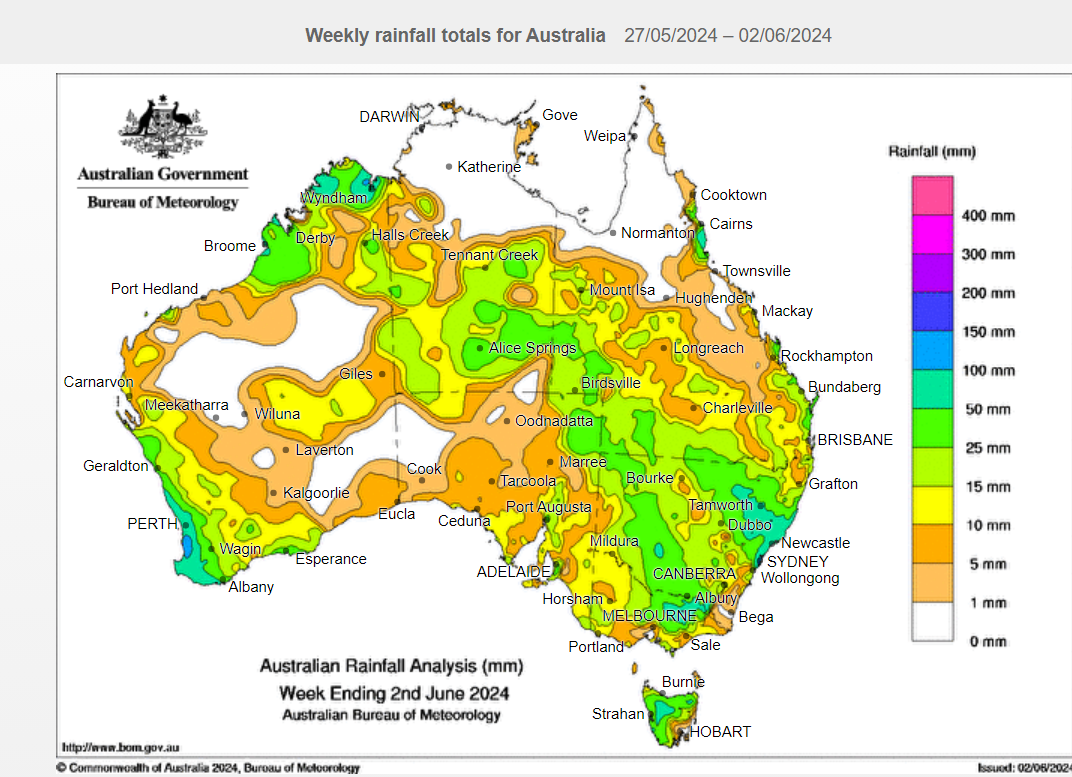

WA received enough rain last week to germinate crops (>12mm). This region accounts for around 40% of the Australian wheat output so it is critical for Australian export that rainfall is received. WA is forecast to see more rain this week with 10-20mm expected across the northern cropping areas. Last week’s rainfall was disappointing for most areas of SA and they require more rain for a uniform germination of winter crops with most areas seeing 10-15mm. They need another 5-10mm to ensure a uniform germination. Forecasts are mostly dry for the next week. VIC rainfall was also lighter than what was expected whereas NSW and QLD received general rains supportive of the area planted.

The weekly rainfall map below includes Sunday’s rains across NSW.

8 day forecast to 10th June2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 2nd June 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was slightly stronger to close out last week when valued against the USD closing at 0.6651. The AUD/USD pair traded about a half of a percent higher on Friday as the Aussie dollar continues to rise following a bounce from the May lows. Last week on the data front Australia’s CPI rose by 3.6% year on year in April, up from 3.5% in March and higher than the market estimate of 3.4%. This was the highest reading since last November and was driven by higher food prices and clothing. Core CPI, which excludes food and energy, remained unchanged at 4.1%. This marks the second straight month that CPI accelerated and beat the estimate and that could give the Reserve Bank of Australia reason to delay rate cuts.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.