Australian Crop Update – Week 23, 2024

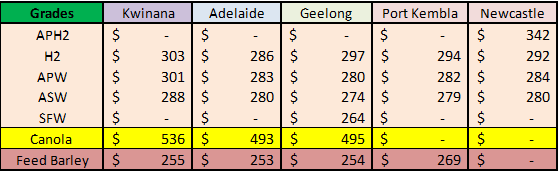

2024 Current Season – USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

The Australian cash markets had a weaker week last week. Better US production figures plus news Turkey had banned imports from Russia to support local prices saw the market sell off through the week. Although this was partly offset by a 1% decline in the AUD. On a positive note, further rain fell across parts of Western Australia (WA), as well as northern New South Wales (NSW) and Southern Queensland (QLD). Sellers emerged on the old crop and new crop in the eastern states, but most consumers seemed happy to sit on their hands for the time being in the international markets – no doubt waiting for some market consolidation. WA remained firm against exporter short covering.

South Australia (SA) received some early week showers. This included 3-8mm across most of the Eyre Peninsula but it remains and is in need of more rain to ensure a complete germination.

Australia’s April wheat exports fell to 1.86 million metric tonne (MMT) in April down from 2.57MMT in March. This lifts the Oct/Apr wheat exports to 13.26MMT. Wheat exports to China were 549 thousand metric tonne (KMT) down from 740KMT in March. Yemen was the next largest with 184KMT followed by Indonesia with 155KMT and then Philippines with 136KMT.

Barley exports for April were 697KMT up from 627KMT in March. This puts Australia’s Oct/Apr barley exports at 5.9MMT up from 4.7MMT at the same time last year. Malting barley exports are up by 1.52MMT while feed barley exports are down 284KMT. Among the barley exports for April was 70KMT of malting barley shipped to Europe (Netherlands). China was the largest destination with 478KMT shipped in April. Barley exports to Japan remain strong at 99KMT.

Canola exports for April were strong at 648KMT with all the production state’s shipping multiple cargoes.

Lentil exports continue to impress with a further 117KMT shipped in April. This lifts the Oct/Apr exports to 944KMT up from 818KMT at the same time last year (+15%). ABARES lifted its 2023/24 lentil production in the recent update to account for the larger exports.

Ocean Freight & Shipment Stem Update:

Last week started off on a sluggish note and never really kicked into gear causing freight rates to soften across the board. The Panamax market was noticeably quiet in both basins with minimal fresh demand appearing throughout the week. Tonnage on the coast appears to be growing for end June/early July dates so without more demand it is likely these rates may ease further. Minimal period fixing heard this week however owners were less reluctant to revise their asking in the hope this week is an anomaly rather than the new norm. Bunkers have been easing over the past few weeks and have settled a tic below 600pmt in most major bunkering ports in Asia.

It was a very quiet week for stem additions. There was 212KMT of wheat added to the stem and 10KMT of canola.

Australian Weather:

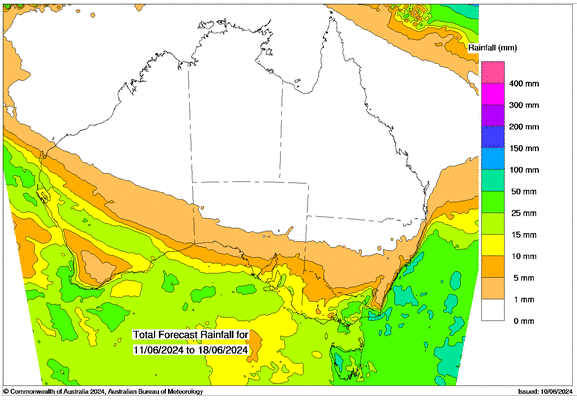

WA received soaking rains in the past week over several days. Weekly falls were a consistent 50-100mm for most areas. This should be enough to get 90% plus of the dry planted crops in the region germinated. SA received some showers early in the week up to 3-8mm across most of the state. SA and VIC remain dry and in need of more rain to ensure a complete germination. Rainfall has been light and patchy over the past couple of weeks through SA, VIC and even parts of southern NSW. Falls over the past couple of weeks have been around 8-20mm with most areas seeing 15mm or less.

Parts of NSW received more rain last week adding to the favourable start. Heavy rain fell along the southern coast but falls in the cropping regions were limited. There was 15-25mm across the southern and central growing areas. Southern QLD also received showers last week with up to 5-15mm recorded.

Forecasts for the upcoming week remain drier than normal for SA and VIC. High pressure cells have returned to the south and there is one siting over central Australia, both of which are making it difficult for southerly fronts and rain systems to push into the southern cropping zones.

8 day forecast to 18th June2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 2nd June 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar closed last week having clawed back losses suffered in the wake of stronger than anticipated US non-farm payroll print. An upside surprise in job creation and strong wages growth pushed global yields upward, driving the USD higher against all majors through trade on Friday. The AUD slipped off highs approaching US$0.6680 as market participants cut expectations for Federal interest rate cuts.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.