Australian Crop Update – Week 21, 2024

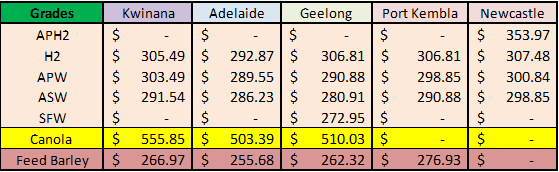

2024 Current Season – USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

Russia, and more recently Ukrainian, weather challenges continue to drive the global markets higher. Recent gains in Australian wheat have been less than those in both the US and EU and as a consequence, Australian basis is looking cheaper than it has done for some time. In terms of demand, the markets are on edge with international consumers, for the moment, unwilling to feed the rally. However, some demand for nearby and food security positions are appearing in Middle East.

Buyers continued to pay up for grain with growing tightness in old crop supplies and dry weather concerns for the new crop slowing farmer selling in both the old and new crop. Markets remain firm, and supplies are hard to buy with farmers now expecting the rally may have further to go as dry weather continues to fuel values.

In Australia, growing conditions in Queensland (QLD) and New South Wales (NSW) are close to ideal. However, sizable parts of Victoria (VIC) are dry and even some parts of southern NSW have been forced to plant dry. Western Australia (WA) and South Australia (SA) are very concerned about the dry weather where crops have been planted dry and farmers are waiting for rain to germinate crops. The good news is most models now call for rain later this week and next week across most growing areas.

Our analyst's, Ag Scientia, balance sheet analysis indicates Australia will end up with tight carry over supplies heading into the 2024/25 season at the end of September. We expect this tightness in QLD and NSW will be acute. It’s going to be a similar situation for barley.

Australian Pulses Market Update:

Chickpea prices increased 5% over the week after demand continued to increase from India due to government regulation changes. Australian farmers have increased their plantings of desi chickpeas for the new season as they have seen prices increase 20% since April 2024. Analysts are forecasting a deficit of 2 million metric tonnes (MMT) in India for the 2024/25 season which is unlikely to be satisfied by chickpea imports, with peas needed as substitutes. As a result, the Australian market is preparing for upside in prices.

Ocean Freight & Shipment Stem Update:

There is a sense of uncertainty in the ocean freight market after a rather subdued period as holidays in Asia last week and Europe had an impact on recent activity levels. The Panamax market in Asia has held with enough demand to keep rates steady. However, the Atlantic basin continued to disappoint (particularly trans-Atlantic business). The lack of activity also filtered through to the smaller sizes as the Ultramax and Supramax sector was starved of any momentum as an oversupply of tonnage became more and more apparent. Although period interest has slowed on the handysize, rates have generally maintained in the Pacific with the lack of tonnage outweighing any influence a lack of fresh enquiry might have.

The container market is continuing to struggle with the challenges set by global conflict, weather issues and the northern summer demand. This means that rates are likely to remain high for a sustained period. Particularly as there are still some dislocation, box location issues caused by the Red Sea attacks, Panama canal and low US inventories.

In Australia, It was a busier week for shipping stem additions. This comes as no surprise given the market strength in WA. There was 303 thousand metric tonne (KMT) of wheat put onto the shipping stem in the past week as well as 132KMT of barley and a further 29KMT of canola.

Australian Weather:

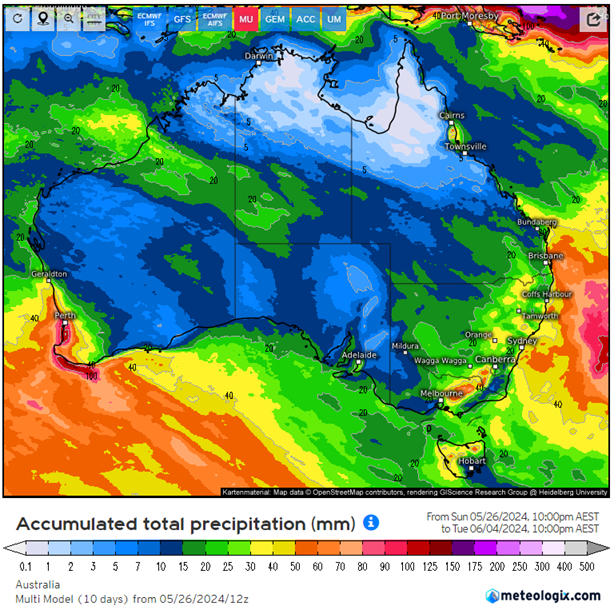

The major models are now in agreement that WA and eastern Australia will see general rain later in the week and early next week. Australia’s ACCESS is forecasting general rain for QLD, NSW and the eastern half of VIC as moisture is drawn down from north west WA across to eastern Australia. The rain is forecast to reach NSW and QLD on Friday and through the weekend. Southern WA will also see a series of cold fronts which started on the weekend but will continue through to next week. The stubborn high-pressure system that has sat over the southern waters for weeks, preventing the cold fronts from making it to WA, looks to finally move this week. This allows the cold fronts to reach WA, offering the best chance of rain for the winter cropping season so far. Most areas are forecast to see rain later in the week.

8 day forecast to 4th June2024

Source: http://www.bom.gov.au/

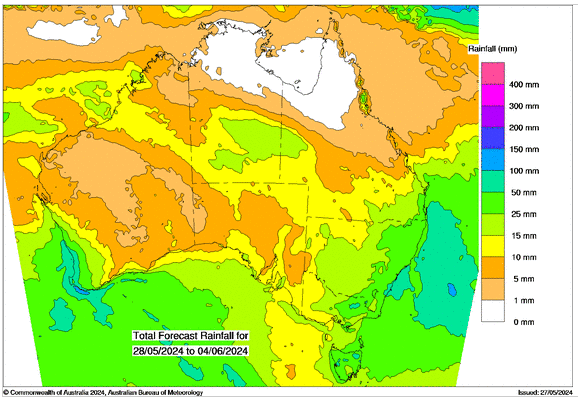

Weekly Rainfall to 27th May 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was slightly weaker to end last week when valued against the USD 0.6620. The AUD lost 0.20% against the US dollar for the third straight day on Friday as investors digested the latest S&P Global PMI report in the US. The first support for AUD/USD is at 0.6600 and if this level is breached, it will expose the 100-day moving average (DMA) at 0.6562. Last week the RBA board kept the cash rate on hold at a 12-year high of 4.35 per cent, citing that recent data still pointed to an easing in inflation. Looking ahead this week all eyes will be on the release of the Consumer Price Index (CPI) which is expected to fall from 3.5% to 3.4%.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.