Australian Crop Update – Week 19, 2024

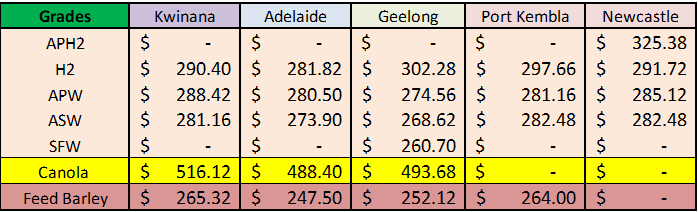

2024 Current Season – USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

Australian cash wheat was up by around US$7 while the new crop for January was US$11 FOB higher over the last week as the local market responded to continued dryness in Western Australia (WA) and South Australia (SA) and global weather concerns. The sharpness in the Chicago rally is outpacing the local market which is making the basis look cheap at the moment and may encourage some basis buying. Markets are tight and exporters continue to short covering against sales commitments. More domestic demand has surface as domestic customers become increasingly nervous about the old crop supply outlook.

Australia exported 627,353 metric tonnes (MT) of barley and 100,734MT of sorghum in March 2024, according to the latest data from the Australian Bureau of Statistics.

Feed barley exports at 390,828MT were down from 415,454MT shipped in February 2024, with China on 384,651MT the destination for 98% of the March 2024 volume.

Malting barley exports at 237,055MT more than doubled over the month from the 117,338MT shipped in February 2024. China was also the major destination for malting barley exports on 185,299MT, followed by Vietnam on 21,768MT and Peru on 19,800MT.

Sorghum volume also surged, almost doubling from 50,766MT shipped in February 2024, with China on 92,224MT the biggest market, followed by Taiwan on 6,850MT and The Philippines on 1,569MT.

Australian Pulses Market Update:

Chickpea prices have jumped to around USD800 per tonne FOB following India’s announcement of an immediate removal of tariffs until March 2025. There are reports that a cargo of Australian chickpeas, which was sailing to other destinations, has been diverted to India. Lupins values have jumped in recent weeks and continue to firm which is reflective in the increased farm feeding with the dry weather. Bids are up to US$400 FOB Melbourne.

Ocean Freight & Shipment Stem Update:

There was 332 thousand metric tonne (KMT) of wheat, 210KMT of canola and 70KMT of barley put on to the shipping stem in the past week. Two thirds of the wheat was added in Victoria (VIC). A further 68KMT of wheat was added into Port Kembla in New South Wales (NSW) which will further tighten the NSW supplies. There was also 55KMT added in WA which was a mix of Geraldton and Kwinana. WA accounted for 145KMT of the weekly canola additions.

On current pace, Australia’s final 2023/24 wheat exports will exceed 20 million metric tonne (MMT) and barley exports will be around 7MMT. Stem and exporter short covering indicates Australia’s Apr/Jun exports will remain solid and this leaves a relatively easy task to achieve the mentioned targets with more modest shipments in the Q4 (Jul-Sep) quarter expected given northern hemisphere competition.

In terms of ocean freight, the dry bulk market has firmed steadily over the past week, primarily led by strong demand in the Pacific on all sizes. Panamaxes were well supported in the Pacific with significant uptick in demand ex Indonesia which in turn helped lift the rates for Supra/Ultras tonnage in Southeast Asia. By the end of the week, there had been multiple fixtures reported in the mid 20k's for Indonesia rounds on Ultras/Supra. A jump of roughly 4-5kpd week-on-week. This increase started to trickle down to the Handy tonnage who managed to secure 16-17kpd for a Pacific round.

In contrast to the Pacific, the Atlantic was rather subdued throughout the week with rates for Panamax/Ultra/Supras trending sideways and actually lost some ground on Handies. USG market has been quiet while the ECSA market has been steady.

Period enquiry has sprung back to life in the Pacific with Ultramax now fetching 19-20kpd for short/medium period and Handies achieving 16-17kpd for same. Contrary to vessels rate, bunkers have either held or eased slightly over the past week helping stall freight rates climbing too fast.

Australian Weather:

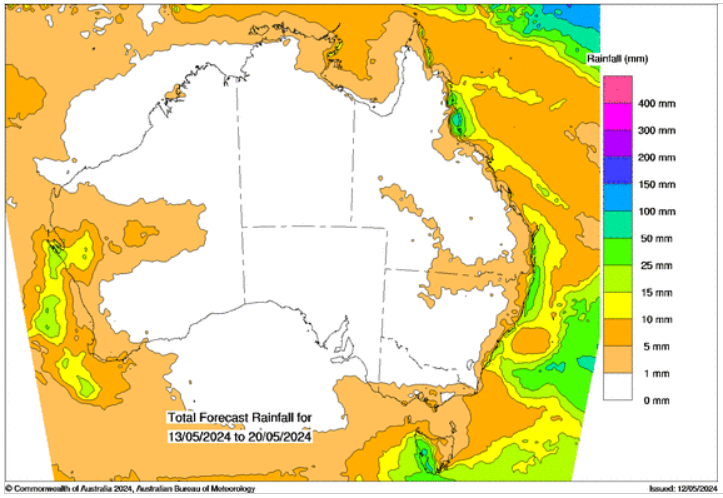

NSW received general rain through the week with more expected in the coming days. There was 15-30mm across the North West. Some of the best rain has been in the western areas, which will encourage large plantings in some of the more marginal areas where rains can be more problematic. There was 20-60mm across the Central West of the state. Queensland (QLD) didn’t see much rain last week. VIC received some patchy rain on the tail end of the NSW system. SA remained dry throughout the week. WA saw some patchy rain, with the southern coastal cropping areas enjoying the best of it. There was 2-10mm in the Great Southern. The coastal fringe areas in the south saw 10-15mm with the odd 20mm. There is some useful rain starting to creep into the 14 day forecast for SA which will need to be watched.

8 day forecast to 20th May 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 13th May 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was slightly weaker to end last week trading at 0.6591. The USD held its ground on Friday but seems stuck as markets await drivers to continue placing their bets on the next Federal Reserve (Fed) decisions. The US economy remains on shaky ground, and markets are expecting signs of decelerating inflation, which gives the Fed confidence to start cutting. In the meantime, the bank’s officials remain hawkish.

Last week the Reserve Bank of Australia left its cash rate on hold at 4.35% for a fourth consecutive meeting on Tuesday in a result that was widely expected.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.