Australian Crop Update – Week 2, 2024

Welcome to our first report for 2024 from the team at Basis Commodities. We hope that you have a prosperous and safe 2024 and we are looking forward to working with you and supporting your agri-product requirements.

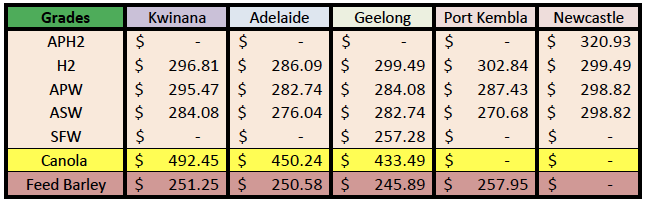

2023/2024 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT - LH feb/Mar 24 Shipment

THE BELOW PRICES ARE INDICATIONS TO THE MAIN CONTAINER DESTINATION, NOT FIRM OFFERS. TO OBTAIN SPECIFIC PRICING FOR SPEICIFIC GRADES AND QUALITIES, PLEASE CONTACT STEVEN FOOTE ON STEVEN@BASISCOMMODITIES.COM.

Australian Grains Market Update

Australian domestic markets remained quiet last week with many participants yet to return from the holiday window, although there was slightly more activity

at the end of the week. Harvest is now complete across Australia. Overall, wheat harvest in New South Wales (NSW) and Victoria (VIC) came in better than expected as crops responded to the early October rain. However, wheat and barley crops in South Australia (SA) and Western Australia (WA) have reported lower than initial expectations, based on bulk handler receivals.

In NSW and VIC, GrainCorp reported its total harvest deliveries to around 4.1 million metric tonne (MMT). Farmers were astounded how well crops had performed given the in-crop rainfall through most of the season. Many are putting the extraordinary yield performance to the mild finish and the early October rains which hindsight indicates were perfectly timed. In WA, CBH has received 12.5MMT of grain deliveries in its storages which is down 45% on last year. Wheat deliveries came in smaller than expected which means the state’s wheat crop is approximately 7.7MMT. In SA, Viterra reported grain receivals were below industry pre-harvest expectations.

Ocean Freight & Shipment Stem Update:

There was 520 thousand metric tonne (KMT) of wheat put onto the stem in the first week of 2024. SA accounted for 270KMT of this with 138KMT in WA and 112KMT in NSW. This puts the combined January stem at close to 2.1MMT. Weekly barley and canola additions were modest at 37KMT and 85KMT respectively.

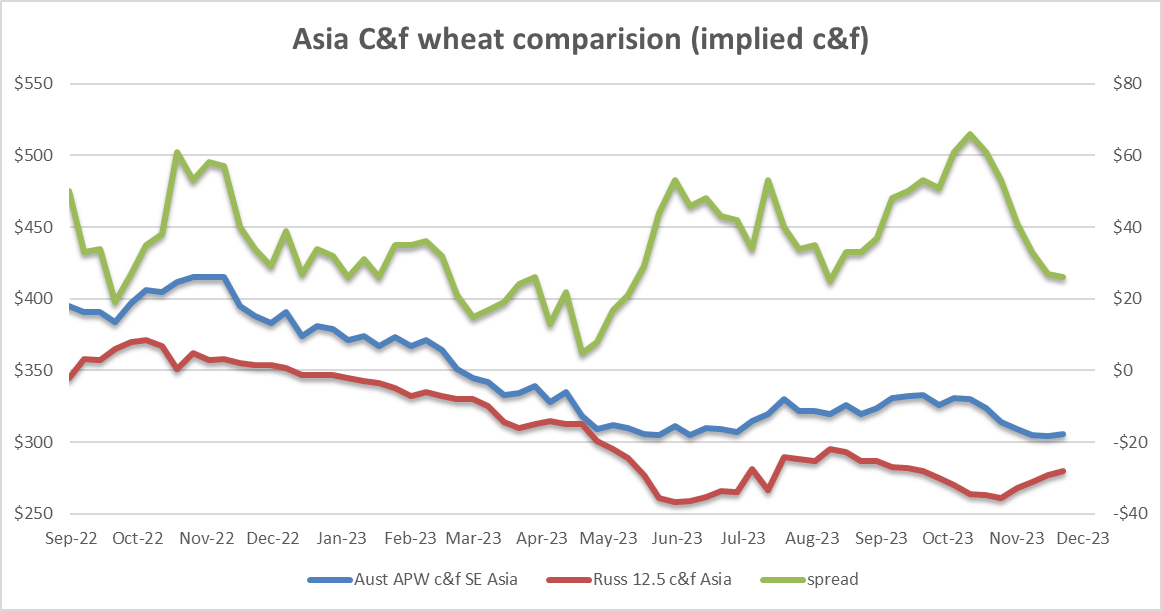

Volatility in the freight market is all due to the conflict in the Red Sea and if there is any escalation with counterattacks in Yemen, then the market will appreciate significantly. War risk premiums for the Red Sea/MEG region have already risen to near $100k from almost nothing two weeks ago. We would estimate that 80pct of bulk owners are now completely avoiding the Red Sea area and calculating new business via Cape Agulas (though some are still performing old cargoes if head owners allow it).

Aside from the Red Sea, the seasonal holiday period went exactly as anticipated - minimal activity and nothing of significant merit to say. We continue to hear rumblings of stimulus packages in China but unless you look at Iron ore prices, there is nothing much else to report. Predictably, the Atlantic came off from the really strong levels seen in November and much of December - though it remains a significant premium to the Pacific. This is probably a factor of the western holidays combined with the lead time to Chinese New Year.

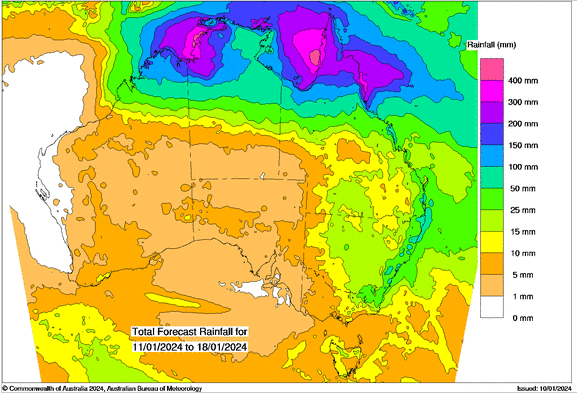

Australian Weather:

The growing areas of the eastern parts of Australia have continued to receive significant rainfall which is due to recent tropical cyclones affecting the north of Australia. There has been flash flooding in parts of Queensland (QLD) and northern NSW causing disruptions to logistics and residential communities. However, reports over the next week see the rainfall subsiding. Temperatures across Australia are mild compared to the initial expectation that it was going to be a very hot summer. Average temperatures around 30 degrees are seen in the country while in the south, temperatures are still in the low 20s. Based on the rainfall in the eastern parts of Australia and in the south, the expectation for subsoil moisture has improved and the metrics will be seen in the coming months with the moisture maps being provided by the technical bodies. Based on the long-term forecasts and sub-soil moisture, especially in the eastern states, the Australian grain crop looks to be forecast to have another decent season.

8 day forecast to 18th January 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 10th January 2024

Source: http://www.bom.gov.au/

AUD - Australian Dollar

The Australian dollar was slightly weaker to close out last week against the USD. The AUD dropped below the crucial support of 0.6700 after a short-lived rally sparked by improving risk sentiment on the back of a better-than-expected print in China’s Caixin Services Purchasing Managers’ Index (PMI) for December. The Aussie has closed in the red for five consecutive trading days, declining nearly 2.5% from late December’s peak near 0.6870. Looking ahead this week on the data front, investors will focus on monthly retail sales for November, which will be published on Tuesday. As per the estimates, the consumer spending grew by 1.2% after contracting 0.2% in October. This may allow Reserve Bank of Australia (RBA) policymakers to stay with the argument of keeping interest rates elevated for longer.

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.

Newsletter Signup

Thank you for signing up to the Basis Commodities email newsletter.

Please try again later

Quick Links

Basis Commodities Pty Ltd

PO Box 340, Northbridge

NSW 1560, Australia

Basis Commodities Consulting DMCC

PO Box 488112

Dubai, UAE

Copyright © 2024 Basis Commodities Pty Ltd. All rights reserved.

site by mulcahymarketing.com.au