Australian Crop Update – Week 18, 2024

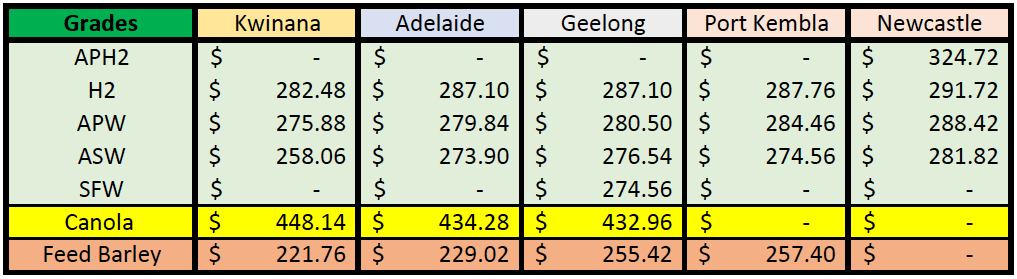

2024 Current Season – USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

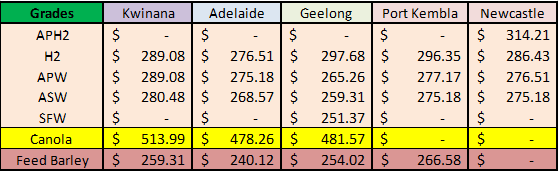

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

The Australian domestic markets were stronger again last week. Traders are saying barley is now being drawn up from southern New South Wales (NSW) to apply against commitments into the Darling Downs in Queensland (QLD). Cattle on feed numbers are expected to remain high despite the high grain prices. Feedlots have reportedly been active buyers of wheat and barley.

NSW wheat exports continue to move along which will leave the ending stocks extremely tight at the end of September. Exporters have been active buyers into the Port Kembla zone in recent weeks consuming stocks in NSW. It is expected that wheat held in NSW will end up back into the domestic market as traders take advantage of the old crop premiums.

South Australia (SA) and Western Australia (WA) APW prices were also higher, up some USD8-12 per metric tonne (/MT) on exporter short covering. The strength in the SA and WA wheat values indicates the exporters have a sizeable commitment for May and June and most likely into July. Strong exports and dry weather are putting upward pressure on prices.

2.57 million metric tonne (MMT) of wheat was exported from Australia in March 2024. Container wheat exports were strong at 238 thousand metric tonne (KMT) which is the most since May last year.

Barley exports remained strong at 628KMT with 436KMT of this coming from WA. China accounted for 570KMT of the exports. A further 524KMT of canola was shipped in March. Pulse exports were very strong. This included 210KMT of lentils, 368KMT of chickpeas and 283KMT of faba beans.

Australian Pulses Market Update:

Last Friday, the Indian Government announced it has removed its tariffs on desi chickpeas until March 2025. Believed to be effective immediately, the much-anticipated announcement has come ahead of planting, which will start later this month in southern and central QLD and northern NSW.

India’s tariff on desi chickpeas has equated to around 66 percent of the price. It was imposed after much of Australia’s record 2016-17 crop of 2MMT had been exported. Challenging seasons and the Indian tariffs mean no crop since has exceeded 1MMT. Excellent subsoil moisture in Australia’s major growing regions, as well as anticipation about the reopening of the Indian market, mean a crop of more than 1MMT seems certain this year.

Planting of the lentil and faba beans crops is well advanced with area on track to at least match last year’s crop. Prompt prices for chickpeas and lentils have firmed in the past month based on bulk and containerised demand for dwindling current-crop stocks.

In the case of faba beans early indications are its area will be down on last season’s due to a swing into lentils in the state’s lower-rainfall areas and current dryness in South Australia the main export state.

Ocean Freight & Shipment Stem Update:

There was around 215KMT of wheat added to the Australian shipping stem last week. This included 115KMT in VIC, and around 50KMT each in WA and SA. A further 195KMT of canola was put on the stem as well and 30KMT of sorghum in Newcastle.

With Japanese Golden week as well as Labour Day and Greek Easter holidays last week, the market took a breather as we saw a drop in activity levels from the previous few weeks. There was an expectation rates would ease off slightly as a result of the holidays, but as the week progressed, we saw rates hold/trend sideways.

The panamax market was noticeably quiet compared to other segments and rates drifted in the Atlantic as a result of minimal fresh activity. The Pacific market showed more resistance with rates tending to hold steady.

Handysize remained healthy off the back of more TC orders appearing, especially ex Australia.

Australian Weather:

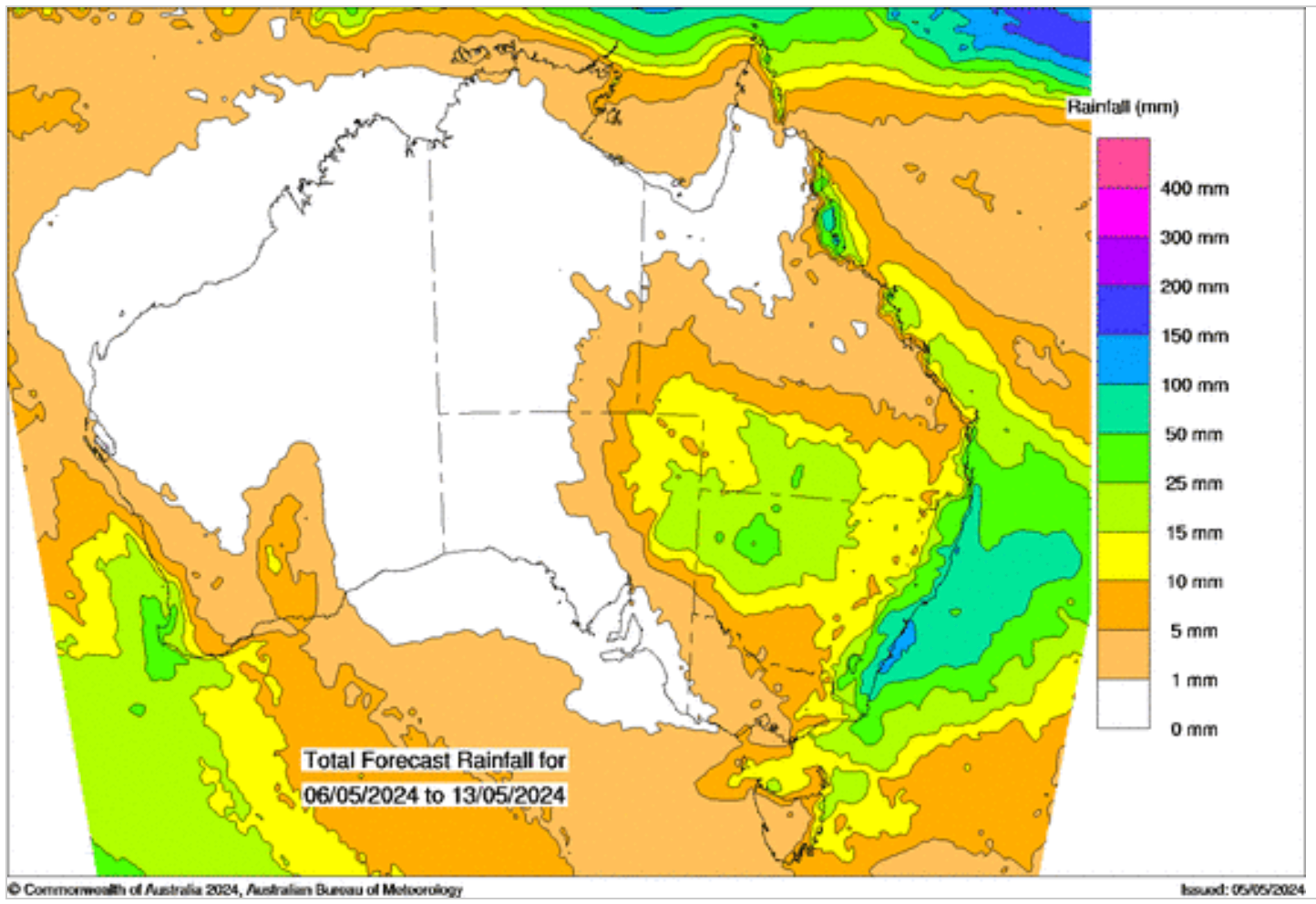

WA received light showers and isolated storms through last week but no significant rain. There were some isolated heavier falls associated with the storms in the south west of the state. Farmers are content to plant dry, but the dry weather market anxiety is building. NSW received rain on over the weekend, but the best of the falls were west of the cropping areas. More rain is expected for NSW over the next week, but this doesn’t offer any rain for VIC and SA.

The Bureau of Meteorology released its latest seasonal update. This forecasted a continuation of the dry pattern through May before improved rain in June. A drier May is likely to be followed by more typical conditions to start winter in June. Forecast rainfall for May is likely to very likely (60% to greater than 80% chance) to be below median for most of Australia. During June, there is a shift to roughly equal chances of above or below median rainfall for most of the country. For scattered areas for the southern mainland, forecast rainfall is likely (60 to 80%) to be above median. May to July maximum and minimum temperatures have an increased likelihood of being unusually warm for most of Australia.

8 day forecast to 13th May 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 6th May 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar had a stronger week closing at 0.6606 against the USD. The AUD continued its strengthening for the third successive session based on the hawkish sentiment from the Reserve Bank of Australia (RBA) although they kept rates on hold on Tuesday. Inflation has come in higher than expected during the March quarter, dampening expectations of interest rate cuts later in the year. The sentiment is that there are no expected rate cuts until at least the 4th quarter of 2024.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.