Australian Crop Update – Week 17, 2024

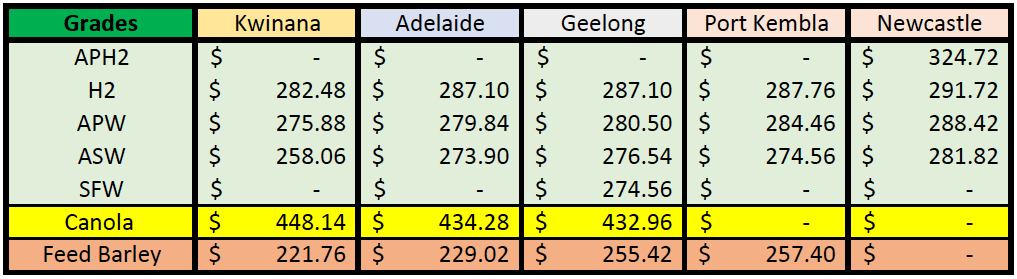

2024 Current Season – USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

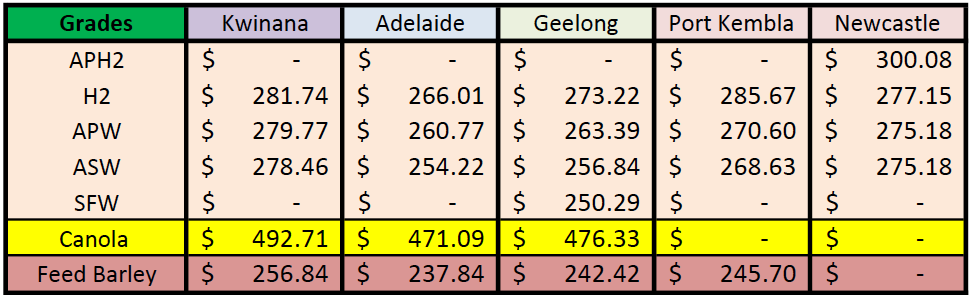

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

The Australian grains market continued to strengthen in all states last week. All grades from ASW, APW, H2 and AHP2 are up 8% in the past two weeks on the back of higher global futures as the dry weather in Kansas and southern Russia triggered investor short covering. Australian wheat markets were further supported by the dry weather concerns in Western Australia (WA) and South Australia (SA) and to a lesser extent Victoria (VIC). In addition, many farmers were absent from the market due to a long weekend last week for ANZAC day, continued planting in all areas and the usual tax year considerations. There is no doubt some trade shorts have been flushed out by the recent market moves to further add support to the rally.

We expect markets remain supported now until there is some broader rain across WA, SA and VIC.

Ocean Freight & Shipment Stem Update:

There was 318 thousand metric tonne (KMT) of wheat, 206KMT of canola, 105KMT of barley and 30KMT of sorghum added to the stem in the past week. Canola additions have been strong with 500KMT put onto the stem in the past three weeks with most of this in WA. Barley additions have slowed as supplies become more difficult to secure.

Ultramax/Supramax

It was a solid week for the sector overall. Although, as the week ended, some felt that a ceiling had been reached in the US Gulf and South Atlantic. From Asia, there was a good amount of fresh enquiry from Southeast Asia with a plentiful supply of Indonesian coal and nickel ore cargoes. With the upcoming holidays in China, it remains to be seen if this moment will continue and certainly it feels like the market is moving up too quickly given the fundamentals. Visible activity was muted across the Handysize sector, with a mixed week in the Atlantic as the Pacific showed more promise.

Australian Weather:

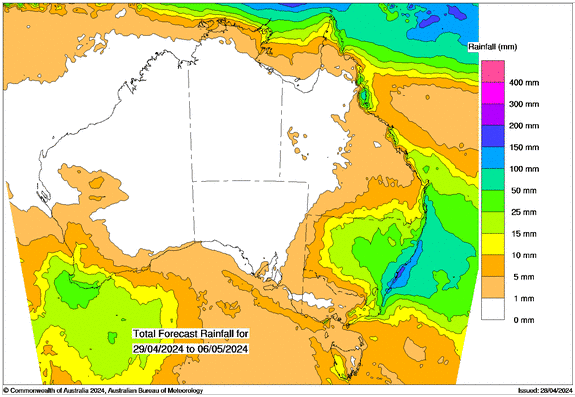

Weather forecasts remain mostly dry for the next 7-10 days in Australia. South West WA is seeing some light showers with some thunderstorms over the southern inland. Rainfall amounts have been light and limited to a patchy 1-3mm across the inland. Drier weather will then return for most of the state on the weekend before another similar system arrives next week. The Bureau of Meteorology has predicted some showers for New South Wales (NSW) which is forecast for later in the coming week. WA, SA and VIC remain mostly dry.

8 day forecast to 6th May 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 29th April 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was stronger to finish the week when valued against the USD trading at 0.6524. The AUD strengthened on the back of rising yields in Australian government bonds, with the 10-year yield hitting a 21-week high of 4.59%. On the data front, last week Australia’s inflation rate slowed less than expected in the March quarter as rents and education costs increased, dimming hopes the cost-of-living crunch was easing and lessening chances of a 2024 cut in official interest rates.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.