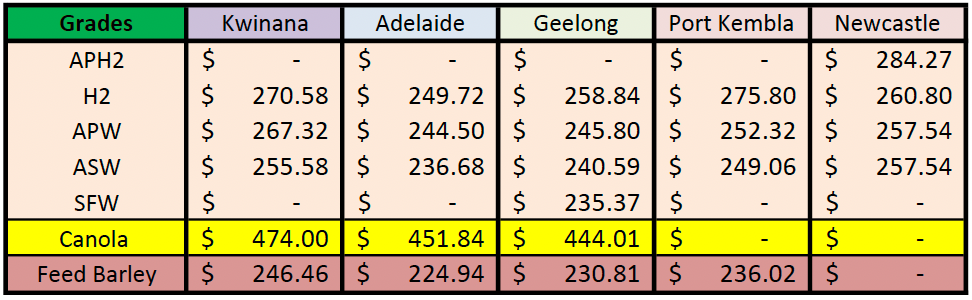

Australian Crop Update – Week 13, 2024

2023/2024 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

The Australian Domestic markets remain very quiet with few participants willing to chase offers higher as the overall demand is comfortable with the existing old crop supplies. The shortened Easter holidays made it even quieter with the four day weekend and also the Ramadan period in the middle east meant that there was little activity.

The southern Qld Downs wheat and barley bids remain firm amid an absence of sellers. WA was also firmer at times through the week on exporter shorts although the bids cooled by the end of the week as soon as the sellers emerged. Domestic market influences remain unchanged with buyers only chasing the bid for nearby shorts, otherwise they are content to see the farmer carry it. Also, there is limited willingness to chase the new markets either.

Farmer selling in the north is slow on relatively tight supplies and they are occupied on summer crops. Sorghum harvest is advancing, and yields remain strong in Southern Queensland (QLD) and Northern New South Wales (NSW). We expect the national sorghum crop will top 2.2 million metric tonne (MMT) based on the strong yield results so far. A crop of this size would mean another large export year of >2.0MMT. Selling in the south has also slowed to a trickle, as the focus switches to autumn rain. Victorian (VIC) farmers are anxious for rain following two and half months with little to no rain.

Ocean Freight & Shipment Stem Update:

There was 421 thousand metric tonne (KMT) of wheat, 101KMT of canola and 65KMT of barley put onto the shipping stem in the holiday shortened week. Western Australia (WA) accounted for more than half of the wheat additions followed by South Australia (SA) with 85KMT and then NSW and VIC chipping in. VIC accounted for 55KMT of the barley additions and 56KMT of the canola.

Australian Weather:

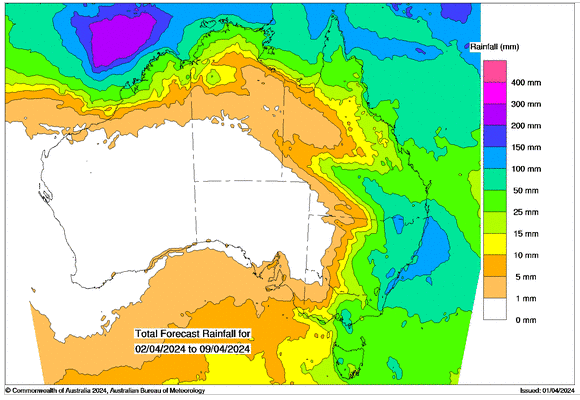

Remnants of ex tropical cyclone Megan delivered patchy rain for Southern QLD cropping areas ahead of the winter crop planting window. Southern Central QLD received lighter showers for the week with 20-60mm. South QLD cropping areas received good falls with 50-150mm across the growing areas supporting planting for the next season winter wheat and pulses crop. Falls were lighter in NSW with most areas limited to light showers. Nonetheless, most parts of NSW have seen scattered showers through March amounting to 30-120% of the monthly average leaving them well positioned winter crop planting. The Australian Bureau of Meteorology (BOM) is forecasting more rain for Northern NSW in the week ahead with 10-20mm. Forecasts have also improved for VIC with most models now predicting a general 10-20mm across the state early in the week. SA and WA remain dry. The BOM’s latest April-June outlook has intensified expectations of dry conditions over Western VIC and Southern WA.

8 day forecast to 9th April 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 2nd April 2024

Source: http://www.bom.gov.au/

Elsewhere, VIC is relatively dry as is WA. Although inevitably some people are getting concerned about a slightly drier long term forecast.

Longer term - The US CPC (weather agency) said the current El Nino conditions are rapidly weakening and said the ENSO conditions should return to neutral by the end of April and through the second quarter of 2024. They expect a La Nina to develop by the US summer and continue through the autumn months. Some respected meteorologists are leaning towards the development of a La Nina in the Australian spring. Both the SOI (atmospheric pressure off Darwin) and Nino3.4 (SST in mid Pacific) are pointing in this direction.

AUD/USD Currency Update:

The Australian dollar is weaker to start the week when valued against the USD trading at US$0.6486. The AUD resumed its bearish trend on Monday, weighed by the US dollar’s strength following better-than-expected US manufacturing data. The AUD/USD pair is now testing support at US$0.6480, which closes the path to the big target, at US$0.6440. To the upside, the mentioned reverse trendline, at US$0.6530 is the immediate resistance before US$0.6555. Looking ahead this week the Reserve Bank of Australia (RBA) will release the Monetary Policy Meeting Minutes, a detailed record of the RBA Reserve Bank Board's most recent meeting, providing in-depth insights into the economic conditions that influenced their decision on where to set interest rates.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.