Australian Crop Update – Week 12, 2024

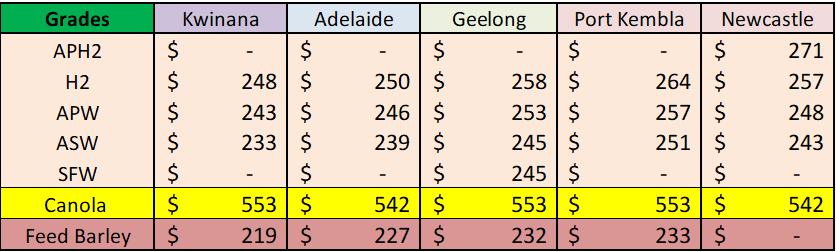

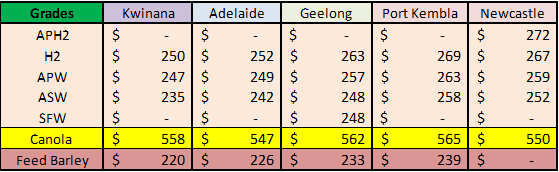

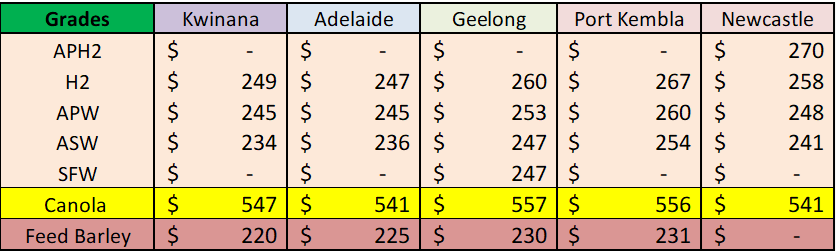

2023/2024 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

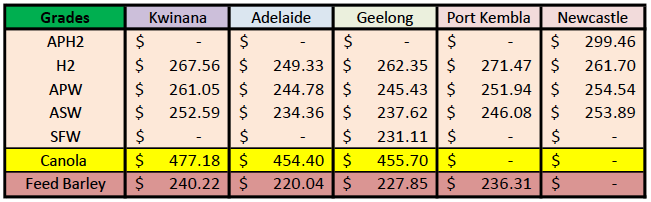

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

News surfaced in the Australian market last week that Chinese wheat importers have cancelled or postponed about 1 million metric tonne (MMT) of Australian wheat purchases. In discussions, rolling rather than cancellation has been the preferred route which sets up an interesting dynamic towards the end of the year. News of the Australian wheat delays or cancellations came after a reported cancellation of more than 0.5MMT of U.S. wheat exports last week to China. As a result, buyers pulled back their bids by USD20 per metric tonne (/MT) to the farmer but, in reality, Australian values are still some way above those needed to pick up the export pace. There has already been around 1.7MMT of wheat shipped to China from Oct-Jan for the 2023/24 season.

The cancellations have freed up shipping slots allowing fresh sales to be made in the nearby positions.

There were reports of fresh export sales through the week at significantly cheaper values than are currently being quoted by IGC. However, the sense we have is sales were limited. Domestic consumers remain well covered in. Trade remains very thin as growers finish their fieldwork ahead of the main planting window opening.

Ocean Freight & Shipment Stem Update:

The shipping market appears to be settling at its new equilibrium after the recent fireworks. Hire rates on the Panamax have softened a touch over the past week but healthy demand levels remain, which is a good sign that the market won't collapse going forward.

We think that generally improved supply levels will make it hard for the Panamax market in the nearby to support the >20k levels priced by FFAs last week. Although, the well documented demand disruptions that are reducing ton/miles available to the market will keep the market well supported until the middle of the year. The general consensus is the market should hold within its current range until mid year and then the predictions start to differ depending on who you speak with.

It’s been a lean week for shipping stem additions to Australian Ports. There were 440 thousand metric tonne (KMT) of wheat added to the shipping stem in the past week with 165KMT of this in South Australia (SA) and 80KMT WA with the remaining 50KMT in Victoria (VIC).

There was 85KMT of barley added to the stem in the past week, all in WA.

The question stemming from the past couple of weeks is how the Chinese wheat postponements/cancellations will impact the 2023/24 export program. The expected size of the cancellations as opposed to postponements has most likely been overstated. It is estimated that some small cancellations have occurred, however most adjustments were shipment deferrals potentially into later positions.

Australian Weather:

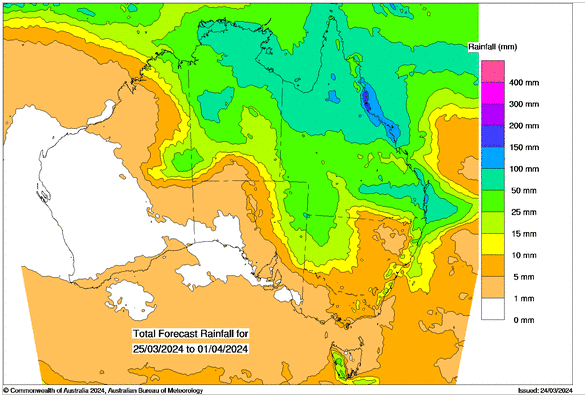

Patchy rain fell in southern New South Wales (NSW) early last week. The best of the rain was around the Young, Wagga Wagga and areas to the east which saw 10-30mm. Temora and Ardlethan only received 10-15mm while areas to the west were less than 10mm. it was all helpful though. Southern Queensland (QLD) and parts of Northern NSW are on track to see 15-40mm starting on Sunday and extending through the first half of next week. It is expected farmers in the north will plant more chickpeas at the expense of other winter crops including wheat and canola.

8 day forecast to 1st April 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 25th March 2024

Source: http://www.bom.gov.au/

Elsewhere, VIC is relatively dry as is WA. Although inevitably some people are getting concerned about a slightly drier long term forecast.

Longer term - The US CPC (weather agency) said the current El Nino conditions are rapidly weakening and said the ENSO conditions should return to neutral by the end of April and through the second quarter of 2024. They expect a La Nina to develop by the US summer and continue through the autumn months. Some respected meteorologists are leaning towards the development of a La Nina in the Australian spring. Both the SOI (atmospheric pressure off Darwin) and Nino3.4 (SST in mid Pacific) are pointing in this direction.

AUD/USD Currency Update:

The Australian dollar was weaker to end last week when valued against the USD closing trade at 0.6508 which is closer to the bottom of its multi-week range after positive US data led to a reversal in the pair. Looking ahead this week, all eyes will be on the Australian Bureau of Statistics monthly release of Consumer Price Index (CPI) which is expected to rise from 3.4% to 3.5%. Consumer prices account for a majority of overall inflation.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.