Australian Crop Update – Week 15, 2024

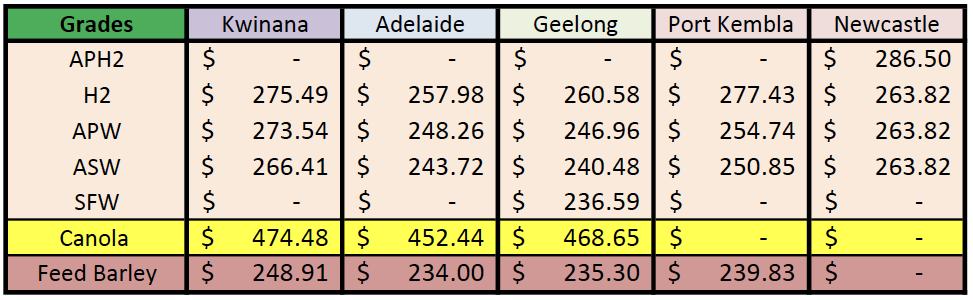

2023/2024 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

The Australian cash markets were mostly firmer last week despite the 2% drop in the AUD against the USD towards the end of the week. The biggest gains were in the sorghum bids after recent heavy rain across Queensland (QLD) and Northern New South Wales (NSW) resulted in widespread quality downgrades. Wheat values were also broadly firmer across most port zones on exporter short covering.

Sorghum harvest is just getting started again following the widespread rain received the week before last. Southern markets were quiet with farmers busy with early planting for canola and barley crops for the 2024/25 season.

Australian Crop Forecasters has released its preliminary estimates for the crop now being planted, and puts national wheat area at 13.6 million hectares (Mha), up from last year, barley at 4.4Mha, up 3%, and canola at 3.2Mha, down 4%. Our analysts see planting up in QLD and NSW, unchanged in South Australia (SA) and Victoria (VIC) but down in Western Australia (WA) as things currently stand.

Australian Export Update:

Australia exported 2.312 million metric tonne (MMT) of wheat in February down from 2.621MMT in January. WA accounted for 941 thousand metric tonne (KMT) followed by SA with 630KMT, VIC 428KMT and NSW with 301KMT.

Container wheat exports were strong at 223KMT which is the most in nine months.

China was the largest destination with 589KMT although Indonesia wasn’t far behind with 545KMT. This included 92.3KMT of durum to Algeria.

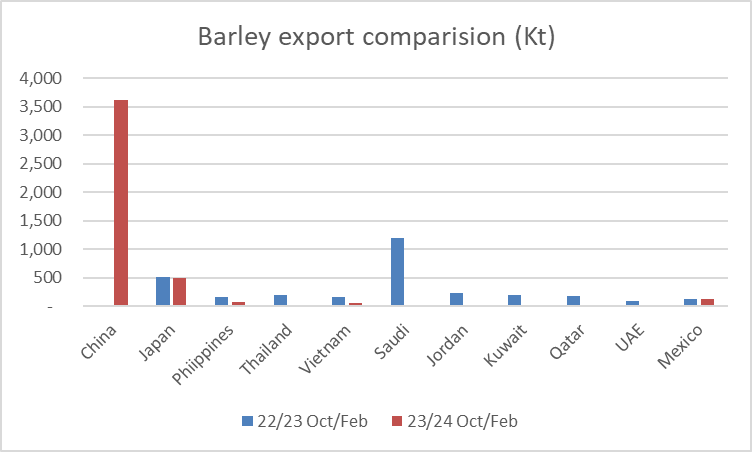

National barley exports fell to 499KMT in February down from 926KMT in January. China was the largest destination in February with 384KMT, Japan was the next largest destination with 100KMT.

There was 56KMT of sorghum exports in February. This included 24.1KMT to China and 24.6KMT to Japan.

Canola exports jumped to 763KMT in February up from 425KMT in January. About 44% of the exports went to Europe. Japan was the next largest with 164KMT followed by Mexico with 86KMT.

Lentils exports remain strong at 128.6KMT. India was the largest destination with 68KMT followed by Pakistan with 28KMT.

Australian Pulses Update:

Australia exported 53,818 tonnes (MT) of chickpeas and 128,620MT of lentils in February, according to the latest data from the Australian Bureau of Statistics. Chickpea volume was up 44% from the 37,449MT shipped in January, with Pakistan on 22,690MT the major market. This was closely followed by the United Arab Emirates on 21,436MT, with Bangladesh on 3671MT the third-biggest chickpea market. February 2024 chickpea exports were well down from the 78,213MT shipped in February 2023.

Lentil exports posted a 61% jump from 80,134MT shipped in January, with India once again the major market on 68,431MT. Pakistan on 28,383MT and Sri Lanka on 14,949MT respectively were the second and third-biggest markets for February-shipped lentils. The February 2024 lentil figure is well below the monthly record set in February 2023 when 196,224MT was shipped.

Ocean Freight & Shipment Stem Update:

With the regional holidays over the past few weeks behind us, the freight market once again has pushed for higher rates. The Panamax sector has led the way off the back of more demand appearing in South America causing the tonnage list to start decreasing across the week. The Pacific has been slower to follow suit, but an uptick on cargo ex Australia has started flowing. The Supra/Ultra market is improving with more cargo appearing ex Australia and Indonesia helping support the renewed push. As a result, owners are choosing to sit and wait rather than engage charterers, particularly given the market is keen to gauge the fall out, if any, from the Iran/Israel escalation over the weekend.

There was 668KMT of wheat added to the shipping stem in the past week, which is the most in more than two months. WA and VIC accounted for most of the wheat additions, each with 260KMT. There was also 314KMT of canola put onto the stem and 91KMT of barley.

USDA Summary:

Wheat futures were pressured following a largely subdued WASDE report by the USDA on Friday. Wheat futures rallied off the back of ongoing reports that Russia continues to hold up the departure of vessels carrying wheat from Russian ports.

Corn futures led the CBOT grains higher on Friday, reversing Thursday's decline after the USDA's WASDE estimates showed less in the way of changes for South American production than expected, as well as little stress to U.S corn production.

Australian Weather:

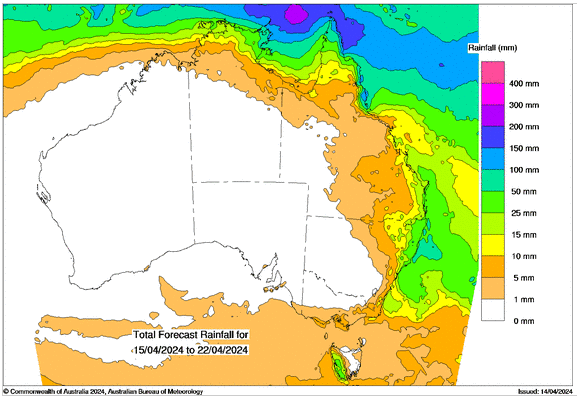

Weather forecasts remain dry for this week and next. This is beneficial for sorghum harvesting and early winter crop planting on the east coast but it’s not good for WA and SA, where they are still awaiting an autumn break to the season. WA and SA remain dry for the next week at least. The extended ACCESS outlook is calling for the dry pattern to continue through May which will add to the growing weather tensions. VIC planting moisture will disappear quickly given they only saw light showers of 10-20mm and following 2-1/2 months without much rain and it needs more. NSW and QLD are in good shape and the grower will plant onto good moisture.

8 day forecast to 22nd April 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 15th April 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar had a weak finish to last week closing at 0.6458 against the USD following the release of weaker Chinese trade data. In addition, the U.S. dollar rose to its highest since November on Friday, boosted by safe-haven demand amid geopolitical tension in the Middle East as well as increasing divergence in monetary policy between the Federal Reserve and other major central banks. U.S. inflation is holding at 3.5% which is expected to delay the timing of interest rate cuts.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.