Australian Crop Update – Week 10, 2024

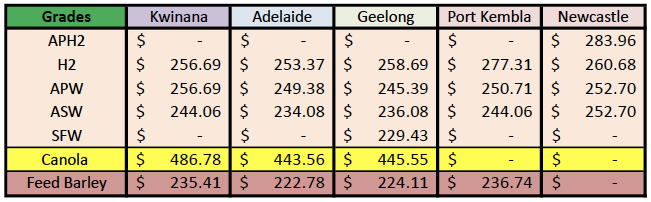

2023/2024 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

Australian wheat bids tumbled last week as buyers pulled back prices amid the sliding cash markets. East coast wheat bids were back USD5-12 per metric tonne (/MT) depending on the locations. Adelaide zone tracked the east coast values with wheat down USD9-12/MT. Western Australia (WA) saw the biggest declines with bids pulling the calculated FOB values back into line with the South Australia (WA) and Victoria (VIC).

Barley bids were softer but didn’t collapse like wheat. Barley was down USD8/MT equating to around USD225/MT FOB equivalent but this is still far above its Black Sea competition.

ABARES raised its final numbers for Australia’s 2023/24 wheat production by 500 thousand metric tonne (KMT). For winter crops, whose harvest is now complete, the bureau estimated that 26 million metric tonne (MMT) of wheat, 10.8MMT of barley and 5.7MMT of canola were produced in the 2023/24 season.

Australian Pulses Market Update:

There has been limited changes to pulse prices over the last week in the local Australian market. There is continued strong demand in India for pulses and this is maintaining a supportive price environment for lentils and chickpeas. Fava bean demand remains stable as boat after boat leaves for Egypt despite the economic headwinds the country is facing.

Australia exported 41,122 metric tonnes (MT) of chickpeas and 87,055MT of lentils in January, according to the latest data from the Australian Bureau of Statistics.

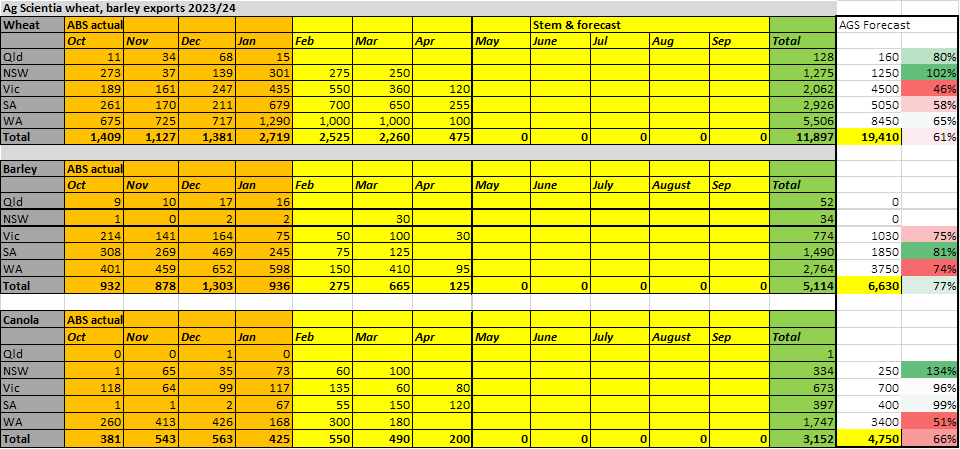

Export Progress:

Australia’s wheat exports climbed to 2.72MMT in Jan’24 up from 1.38MMT in Dec’23. It was the largest monthly wheat export number in eight months. WA exported 1.29MMT with 678KMT from SA, 435KMT from VIC and 301KMT from New South Wales (NSW). China was the largest destination with 982KMT, the most since April last year. Indonesia was second with 548KMT, which was the most since August. The Philippines and Japan both took more than 200KMT.

Barley exports for Jan’24 were 928KMT with close to 600KMT of this coming from WA and 244KMT from SA. China was the largest destination with 724KMT. Australia has shipped 3.6MMT of barley to China since Sep. Japan was the next largest destination with 91KMT and then Mexico with 61KMT.

Ocean Freight & Shipment Stem Update:

The Pacific dry bulk market caught its breath last week after the rapid rise over the previous weeks. There was a stand off between the owners trying to push the rates to the next level while charterers exercised caution, anticipating the market would settle and correct itself. Towards the end of the week, it felt charterers had a small win in this respect with FFA values coming off a little and owners becoming open to engaging at last done levels rather than push for an additional 1-2K more on hire rates.

The Atlantic market has stabilised over the past few week and seems to have found the floor in the short term. The exception to this remains the USG which continues to ease. With the Ramadan holiday starting, there’s been a noticeable slowdown in the Indian Ocean with rates easing across the board.

It was a good week for stem additions in SA, but not so much in other states. There was 280KMT of wheat, 120KMT of canola and 34KMT of barley added to the stem for total weekly additions of 434KMT. SA accounted for 313KMT or 72%. This was made up of 193KMT of wheat added to the SA stem in the past week and 120KMT of canola. Weekly wheat stem additions of 280KMT were the smallest in six weeks.

Australian Weather:

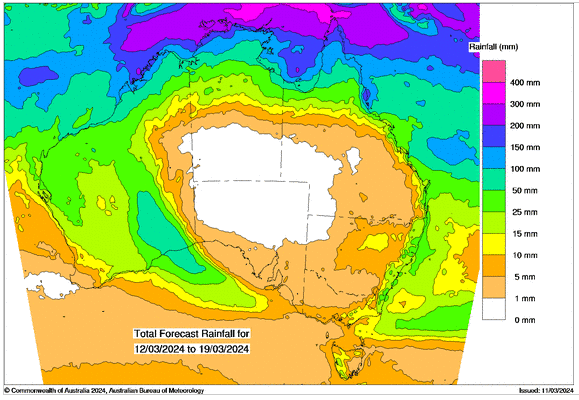

WA received some patchy rain last week in the cropping areas although it was hit and miss. There was 3-30mm across the Geraldton zone. Most of the Kwinana zone received 15-20mm although it was lighter on the eastern fringe with 5-6mm. There were some patchy storms across the Great Southern ranging from 5-100mm. Most areas seemed to get 15-30mm for the week.

Parts of WA and western VIC have seen limited rainfall since January and some of the zone soil moisture maps from the Bureau of Meteorology are starting to clearly show the drying impact. While some WA farmers caught a break, many cropping regions received no rainfall or are still significantly below the 10 year average rainfall range.

8 day forecast to 19th March 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 5th March 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was stronger to close last week at US$0.6630. The AUD/USD extended its rally while US Treasury bond yields edged lower. Australia's economy grew by 0.2% in the December quarter, the smallest increase in more than a year, but one that pushed the nation to nine successive quarters of growth. On the other hand, Iron Ore was the biggest mover yesterday, dropping 6.6% over the last 24 hours with the Chinese property market debacle impacting demand for the ore and sending stockpiles to the highest levels in a year. The AUD has (so far) managed to largely ignore the move in iron ore but one would suspect a correction should be coming.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.