Australian Crop Update – Week 11, 2024

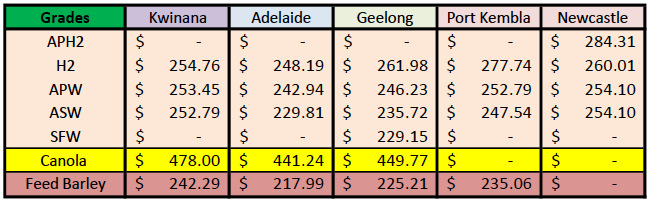

2023/2024 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

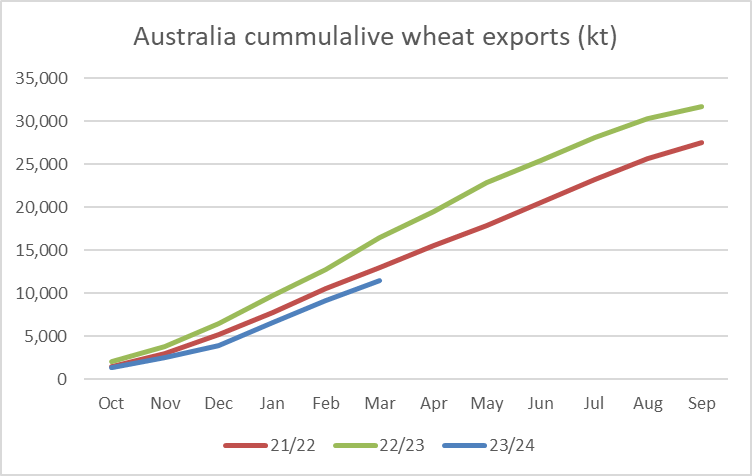

News surfaced in the Australian market last week that Chinese wheat importers have cancelled or postponed about 1 million metric tonne (MMT) of Australian wheat purchases. In discussions, rolling rather than cancellation has been the preferred route which sets up an interesting dynamic towards the end of the year. News of the Australian wheat delays or cancellations came after a reported cancellation of more than 0.5MMT of U.S. wheat exports last week to China. As a result, buyers pulled back their bids by USD20 per metric tonne (/MT) to the farmer but, in reality, Australian values are still some way above those needed to pick up the export pace. There has already been around 1.7MMT of wheat shipped to China from Oct-Jan for the 2023/24 season.

The cancellations have freed up shipping slots allowing fresh sales to be made in the nearby positions.

There were reports of fresh export sales through the week at significantly cheaper values than are currently being quoted by IGC. However, the sense we have is sales were limited. Domestic consumers remain well covered in. Trade remains very thin as growers finish their fieldwork ahead of the main planting window opening.

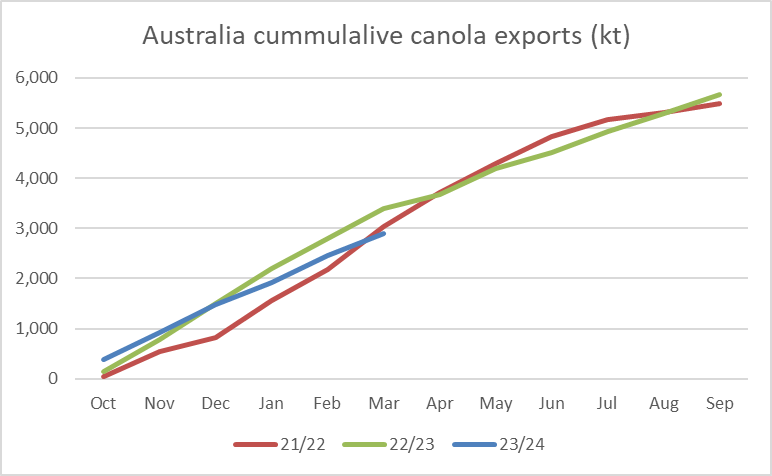

Relative Export Pace:

Ocean Freight & Shipment Stem Update:

It was a tale of two stories in the Pacific shipping market last week. Monday through to Wednesday was quiet compared to the last few weeks causing many players to believe the recent bull run at come to its end. However, by the time Thursday and Friday arrived the activity levels had ramped up again giving a new sense of optimism to owners. The Atlantic market was the main driver with gains seen across the board but especially by Panamax off the back of healthy fronthaul demand. This filtered through to the Pacific by the end of the week where owners were holding their asking levels with the growing temptation of ballasting back towards the Atlantic helping underpin the market.

Looking forward, owners have begun to increase asking levels again in an attempt to push the market to the next level and there have been some early signs that some charterers are willing to entertain to cover prompt requirements. Tonnage lists remain tight which is helping the owners cause and there has been a healthy supply of fresh inquiry.

On the other hand, there are early indications that spot supply is increasing from its recent lows, which may limit further rate rises.

There was 594 thousand metric tonne (KMT) of wheat added to the stem in the past week, which is the most in five weeks. 80% was in Western Australia (WA). There was also 70KMT added in Victoria (VIC) and 30KMT in Queensland (QLD).

A further 274KMT of canola was put on the stem in the past week. The distribution of this was mostly VIC and New South Wales (NSW) which both added around 120KMT.

There was also 246KMT of barley added to the stem with around 80KMT added in South Australia (SA), VIC and WA.

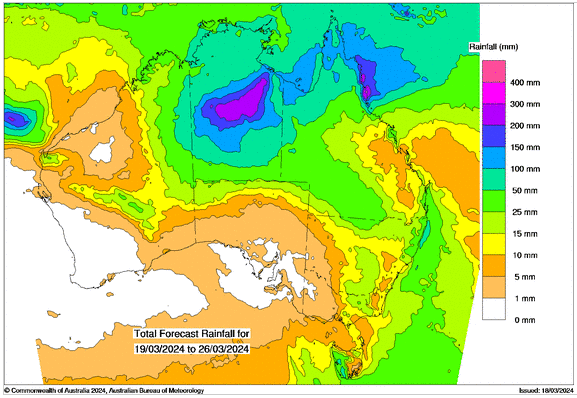

Australian Weather:

Two tropical lows are dominating weather patterns in northern Australia, and these are likely to influence weather patterns for the next couple of weeks. The Australian Bureau of Meteorology (BOM) rainfall forecast shows the system is expected to offer some rain for NSW next week as a developing trough draws the moisture southwards.

The 15-day weather forecasts are showing heavy rain for QLD and NSW over the next couple of weeks but the amounts and where the rain falls vary considerably depending on the model.

The BOM’s long-range outlook for April to June is pointing to below average rainfall across most of the north and west, and parts of the south and east of Australia. For April, rainfall is likely (60 to 80% chance) to be below median for most of Australia, except central and eastern NSW, south-eastern QLD, and Tasmania. For April to June, below median rainfall is likely (60 to 80% chance) for most of the north and west, and parts of the south and east of Australia.

8 day forecast to26th March 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 18th March 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was weaker to close last week at US$0.6548. The AUD extended Thursday’s sell-off into the weekend feeling the pressure from negative Chinese housing and lending data which indicates the property sector of the world’s second largest economy is in real trouble. China’s struggling real estate developers won’t be getting a major bailout. Authorities have since announced measures to provide some developers with financing. But the national stance on reducing the role of real estate in the economy hasn’t changed. The RBA decided to leave rates on hold for another month at 4.35% where it has been for five months.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.