Basis Commodities – Australian Crop Update – week 38 2022

Market Update

New crop wheat, barley and canola bids were mostly softer for the last week as we started the wheat harvest in Central Queensland where yields are expected to be above average. However, showers are slowing early harvest progress.

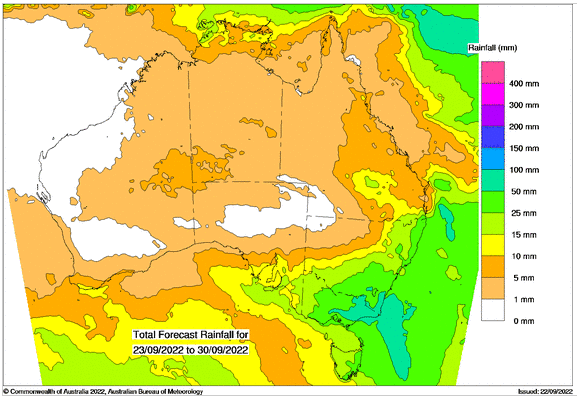

From a weather perspective, New South Wales received more unwanted rain last week. Most of the state’s cropping areas received a general 20-30mm while the northwest received 30-60mm. An already saturated water table means rivers are running at capacity and flooding risk is high ahead of more rain hitting the state yesterday and today.

Our analysts drove back from the NSW central west to Melbourne during the week. The Canola crop on the drive was at varying degrees of very good to excellent. Most of the canola was planted early and thereby avoided the worst of the excessive rain that NSW saw in May and June. However, there is still a question mark over yield due to the danger of disease loss. Wheat and barley on the other hand are struggling with the excessive moisture and much of the trade is now nervous we will lose milling wheat quality if the wet weather continues through October. In general, the cereal crops in central and southern NSW looked well-behind last year with many farmers only talking of average yield potential in these parts. Further south, the yield potential remains very high.

Victoria and South Australia are both in better shape than last year. South Australia has improved significantly in August and early September with some timely rains. Western Australia has a similar vegetative profile to last year.

Overall, Australia is in for another big crop year. Production declines in NSW will partially offset better crops in Vic and SA, and another huge WA harvest. At this stage, the losses in NSW have seen the wheat crop come back to 32.6MMT, 12.2MMT for barley and 6.7MMT for canola.

ABARES released its September crop report. Total winter crop production in 2022/23 is forecast to reach 55MMT, which would be the fourth largest ever. Wheat production is forecast to be the second highest on record at 32.2MMT, which is an 11% decrease from the record level reached last year. Barley production is forecast to reach 12.3MMT, the fourth largest on record. Canola production is forecast to also reach the second highest on record at 6.6MMT, a 2% decrease from the record reached last year, although we think this is understated and could still surprise to the upside.

Ocean Freight

After the last two weeks of weakness, the ocean freight market finally started to consolidate last week with indexes all having a firmer feel. Bunker prices have also eased off and charterers remain wary of fixing too far ahead of their shipment windows.

Australian Dollar

Last week saw some consolidation in rates and FX, but not before fresh USD strength saw more milestones reached in the FX market with the AUD trading down to .6610 overnight – a year to date low.

Stronger monthly Chinese activity data, across retail sales, industrial production, and fixed asset investment, were brushed off by the market, with investors still focused on the headwinds to Chinese growth from the ongoing slowdown in the property sector and China’s zero-Covid approach (although the lockdown of Chengdu was lifted over the weekend).

One final piece of economic data to note is the fact that Russia-China Bilateral trade has increased 32% versus last year’s pace. Payments between the countries are in Yuan and Rubles – food for thought.

The post Basis Commodities – Australian Crop Update – week 38 2022 appeared first on Basis Commodities.

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.

Newsletter Signup

Thank you for signing up to the Basis Commodities email newsletter.

Please try again later

Quick Links

Basis Commodities Pty Ltd

PO Box 340, Northbridge

NSW 1560, Australia

Basis Commodities Consulting DMCC

PO Box 488112

Dubai, UAE

Copyright © 2024 Basis Commodities Pty Ltd. All rights reserved.

site by mulcahymarketing.com.au