Basis Commodities – Australian Crop Update – Week 19, 2023

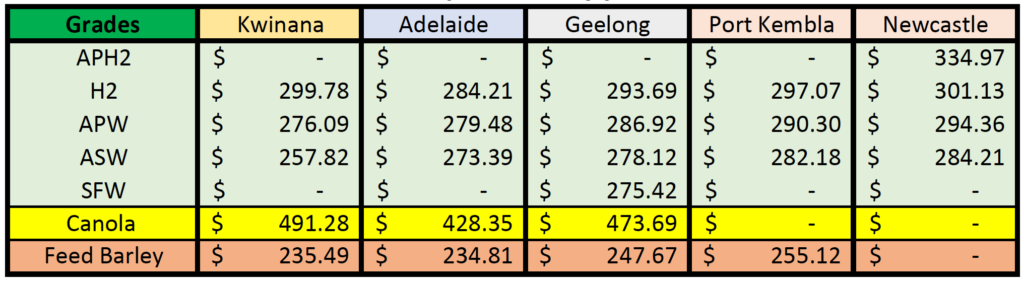

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Australian Grains & Oil Seed Market

Australian cash markets avoided the volatility of the international markets last week with some zones still trying to move grain into the export channel. Observations of the weekly farmer bid changes show Qld and NSW bids were generally a tad firm while prices in SA and WA where export supplies are much more comfortable, were notably softer.

Sizable areas of Northern NSW and Southwest Queensland remain dry, and this is slowing old crop farmer sales in the northern cropping areas.

Western Australia (WA) and South Australia (SA) wheat, barley and canola bids fell to varying degrees. Declines were larger in SA which looks to reflect the exporter coverage against shipping commitments. The SA bids tumbled for canola and barley with exporters showing no interest in chasing supplies. The absence of barley bids indicates that exporters are not convinced that a potentially positive outcome from China’s review of the import tariffs on Australian imports will translate to higher barley prices. The SA bid for canola fell more sharply than other states which we expect is related to coverage against export commitments and little willingness for ownership beyond this. WA was also softer for wheat, barley and canola.

Victorian bids were a tad softer as well. We get the impression farmer selling has picked up a little with farmers increasingly concerned that global markets may keep trending lower.

Australia exported a record 3.73MMT of wheat in March. This comfortably surpasses the previous high of 3.25MMT shipped in Jan-23. Combined wheat, barley and canola exports for March were 5.1MMT which was also a record. There was 1.134MMT of wheat shipped to China in March, and Australia has now shipped 4.44MMT of wheat to China in the Oct/Mar which is 1.4MMT more than last year. Australia has shipped 16.5MMT in the Oct/Mar which is 3.5MMT more than the same time last year. Most of this increase is in Asia. South Korea is up by close to 800KMT, Thailand and Indonesia were both up around 0.5MMT and the Philippines is up by 0.25MMT. Africa is down 0.5MMT on last year. A further 209KMT of wheat was shipped to Iraq in March to take the Jan/Mar total to 419KMT.

Barley exports were solid at 778KMT. This was mostly shipped from WA and SA. Saudi took 285KMT. Total Oct/March shipments to Saudi are 1.47MMT which is down on last year’s 1.68MMT at the same time. Vietnam took 115KMT and the Philippines took 60KMT. Malting barley continues to be shipped to Mexico and South America. Total barley exports for Oct/Mar are 4.1MMT vs 4.36MMT at the same time last year. Sorghum exports for March were 276KMT. This included 242KMT from Qld and 25.7KMT from NSW. China took 245KMT.

Pulses Market Update

Australia exported 53,448MT of chickpeas and 168,650MT of lentils in March, according to the latest export data from the Australian Bureau of Statistics. The chickpea figure is down 32 percent from 78,213MT shipped in February, while the lentil figure is down 14pc from the 196,224MT on the month.

Ocean Freight Market & Export Stem

It was a very uninspiring week, and it remains to be seen whether the passing of regional holidays brings players back to the market with cargoes in their hands or not. At risk of stating the obvious, the former will see the market regain some semblance of stability and positivity, the later will see rates continue to ease off. Ominously backhaul numbers are again generally parity to a Pacific round voyage as Owners lose faith in the Atlantic market.

In the Pacific there is no clear driving force – the market is just ticking over. China remains subdued and the positivity we have previously seen in the FFA curve towards the end of Q2 and through Q3 is flattening out.

There was 447KMT of wheat, 107KMT of canola and 90KMT of barley added to the stem in the past week. Nearly half of the wheat additions were in SA and Vic with smaller volumes in WA, NSW and Qld.

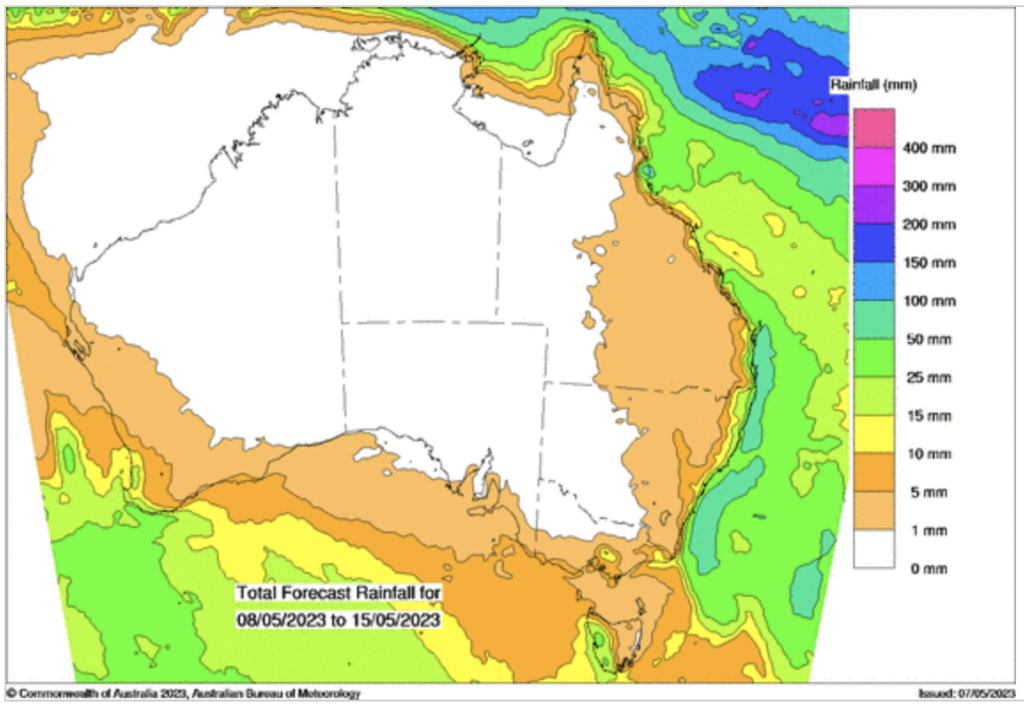

Australian Weather

Last week, Basis Commodities published an article about Australian weather, looking at the difference between La Nina and El Nino and the climate drivers weather analysts watch to predict the long range forecast. You can read it by clicking here.

AUD – Australian Dollar

The Australian dollar is slightly stronger to start the week when valued against the Greenback. The AUD/USD pair climbed to a two-week high on Friday 5th May on the back of US Nonfarm Payrolls exceeding expectations. Last Tuesday the Reserve Bank of Australia (RBA) raised its cash rate by 25 basis points (bp) to 3.85% after first-quarter Consumer Price Index (CPI) came in at 7% year-on-year to the end of March, well above the 2-3% mandated target band.

The post Basis Commodities – Australian Crop Update – Week 19, 2023 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.