Basis Commodities – Australian Crop Update – Week 20, 2023

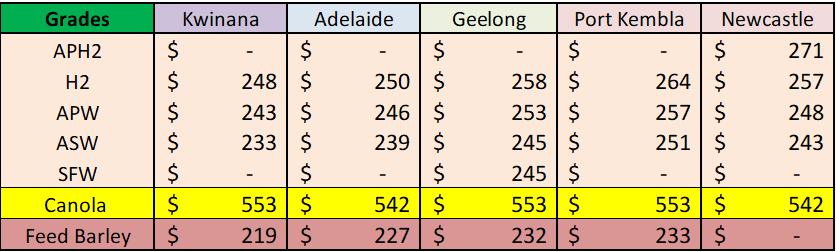

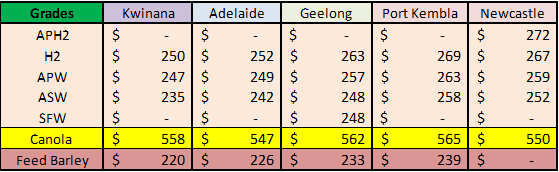

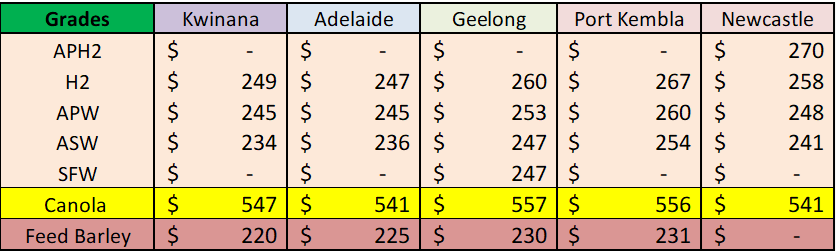

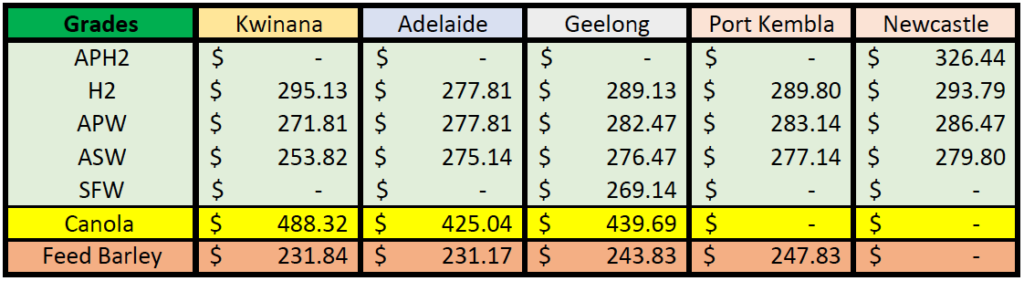

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Australian Grains & Oil Seed Market

Last week, Australian domestic markets were relatively quiet. Grain bids were mostly steady to a tad softer. If buyers need the grain in the near term, they are having to pay up, but for the most part, buyers are comfortable enough with the nearby coverage to sit back and wait a little longer.

A few themes are emerging. Barley bids continue to firm with the feedback that the Australian Government is continuing talks with Beijing on lifting the export ban. The wheat market isn’t showing the same strength as barley which suggests farmers are still selling enough to keep prices at the same levels. Australia exported 777,823 tonnes (MT) of barley in March, according to the latest data from the Australian Bureau of Statistics. Feed barley shipments for the month totalled 636,233MT, down 30 percent from the 911,105MT exported in February. The three largest markets for March-shipped feed barley were Saudi Arabia on 285,171MT, Vietnam on 82,358MT and The Philippines on 60,036MT. March malting barley exports at 141,590MT more than tripled from the February figure of 41,278MT. The largest market were Vietnam on 32,615MT followed by Mexico on 31,733MT and Japan on 21,000MT.

Sorghum shipments surged to reflect new-crop availability, with the March total of 255,066MT being almost five times the 53,117MT exported in February. China on 232,996MT accounted for 91pc of March sorghum exports, with Japan on 14,360MT and Taiwan on 4454MT the second and third-biggest markets respectively for the month.

Canola bids were back $30-40/MT in most port zones last week with few buyers chasing supplies. Exporters and crushers look to be comfortably covered and it’s just a case of how much canola is carried into the 2023/24 season where early assessment suggest global supplies are set to remain comfortable. Australia exported 600,853MT of canola in March, up 1 percent from the 592,027MT shipped in February, according to the latest data from the Australian Bureau of Statistics. The United Arab Emirates on 169,938MT was the biggest market for March-shipped canola, followed by Germany on 148,004MT and France on 96,672MT. At 3.4 million tonnes (MMT) shipped in the first half of the 2022-23 marketing year, a new canola export record has been and is up 28pc on the record 2.66MMT shipped in the corresponding 2021-22 period.

Farmers are occupied with planting and remain reluctant sellers as global markets continue to sag. At the same time, some are starting to question if the weaker global grain markets are here to stay and thereby need to make further sales. This seems to be the case in Victoria where the farmer selling has picked up a little.

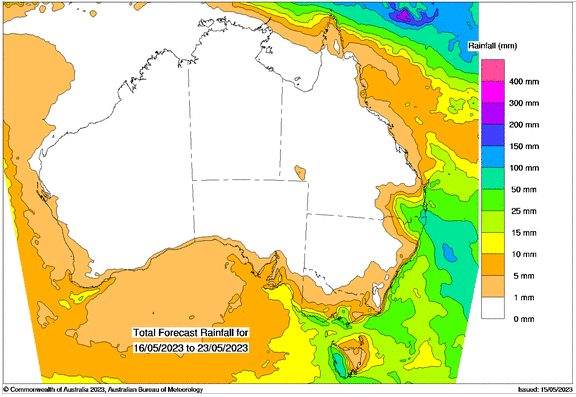

Farmers have already stopped planting as they wait for more rain in some parts of Queensland, New South Wales and the northern zones in Western Australia. Planting is progressing quickly in Victoria, South Australia and most of Western Australia with the fine weather, but some of these areas are also looking for follow up rain to ensure even germinations in the crops that have already been planted.

Pulses Market Update

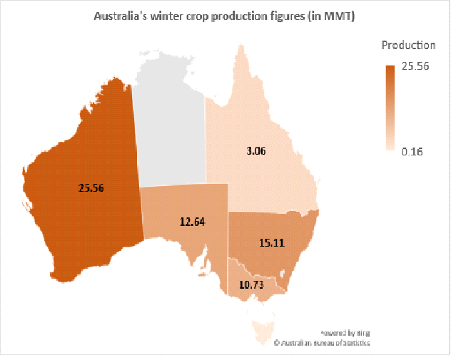

The most recent winter crop production figures have been released by the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES). According to the forecast, Australia is expected to achieve a new record in winter crop production (which includes all winter grains, oilseeds and pulses), with an estimated 67.26MMT in 2022/23. This represents a 6.40% increase from the previous year’s total winter crop production, which amounted to 63.22MMT.

Looking at pulses specifically, Australia is projected to reach a record lentil production of 1,412 thousand tonnes (KMT) for the year 2022/23, a notable increase from the 999KMT produced in 2021/22. The primary regions in Australia for lentil crops are Victoria and South Australia, with the latter contributing 64% and the former contributing 34% to the overall lentil production in 2022/23.

Source: Agpulse Analytica

Ocean Freight Market & Export Stem

Last week’s push in Southeast Asia seems to be losing momentum once again. The market did view the week as if Owners were talking up a small increase in the amount of coal stems from Indonesia. That seems to have ebbed away again and now the feeling is that there is always a ship there to do a piece of business – albeit it might be an older sub index vessel. Japanese built ships remain a premium and if anything, there is a two-tier market emerging – anything Ultramax-Handymax built in Japan in the last six years is earning a premium, especially on period. This is forcing some Charterers to compromise on their desire to only fix good quality tonnage because the discrepancy between voyage numbers and period operator numbers is simply too high to make sense of. Pacific round voyage on Supramax remains around $10kpd – though again there is a split. Southeast Asia is probably a bit more and the feast delivery gets a little less. Likewise for large Handymax, feast is the weaker zone in the Pacific. The Atlantic remains subdued (excepting for USG) and back haul numbers continue to rise which is a bad signal for the freight market. Handymax vessels are now attracting a premium to go back haul. So, a pacific round voyage is paying region $10.5 but b/h to Cont/Med is edging closer to the $12k lvl.

A further 700KMT of wheat and 126KMT of canola was added to the shipping stem in the past week. Western Australia accounted for 370KMT of the wheat additions and 170KMT from Victoria. There was also another 100KMT put on the New South Wales stem and 25KMT in Queensland. We will have to raise our export forecasts for both Queensland and New South Wales as the combined Oct-March exports plus the stem exceed what we are forecasting.

There appears to be a delineation between eastern markets, compared to the southern and west. This divide line is clear in the state’s Supply and Demand charts when looking at the shipping pace against our forecast exports. Queensland and New South Wales are already at 100% of the Australian Bureau of Statistics Oct/March exports forecast. Add in the shipping stem additions that are already reported for April-June with another three months remaining in the 22/23 beyond this, the exports will exceed the forecasts easily. Other states (Victoria, South Australia, and Western Australia) still have some way to go to reach our export forecasts based on the current exports plus the reported stem additions.

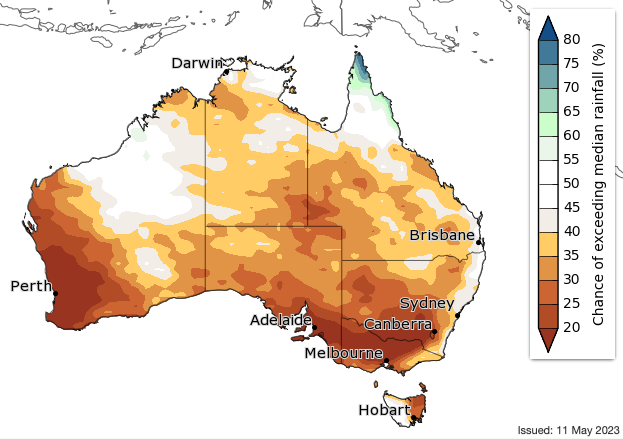

Australian Weather

Weather forecasts remain dry this week although there is a chance of some storms across Southern Queensland early next week. Extended weather outlooks continue to point to a drier than average June to August for Australia’s cropping areas. In its latest seasonal outlook statement, the Bureau Of Meteorology said for June to August, below median rainfall is likely (60 to 80% chance) for the majority of Australia, with south-western Western Australia, south-eastern South Australia, the majority of Victoria and southern New South Wales very likely (greater than 80% chance) to be below median.

Source: bom.gov.au

AUD – Australian Dollar

The Australian dollar is slightly weaker to start this week when valued against the Greenback. The Aussie dollar fell on Friday after Wall Street’s opening bell, as the US dollar strengthened and equity and commodity prices declined. The pair dropped to 0.6650, the lowest level in more than a week. Last week the Aussie dollar peaked at 0.6817, the highest level since February, before reversing its course losing more than a hundred pips. On Friday, it broke below the 0.6680 support area. The next relevant support zone is around 0.6635, below this attention will turn to 0.6600. To alleviate the bearish pressure, the Aussie needs to regain 0.6680 initially. The AUD/USD is currently trading at 0.6644 at the time of writing.

The post Basis Commodities – Australian Crop Update – Week 20, 2023 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.