Basis Commodities – Australian Crop Update – Week 18, 2023

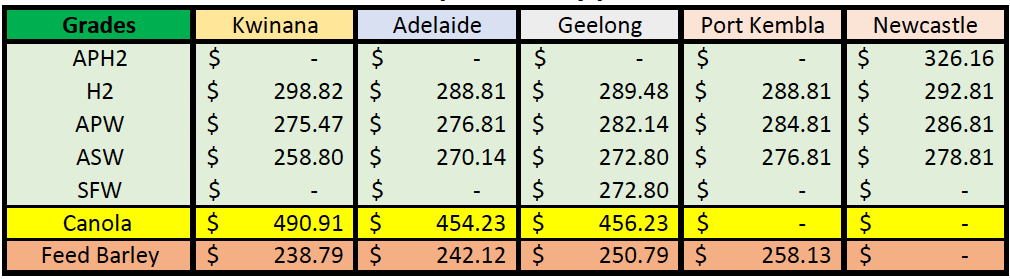

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Australian Grains & Oil Seed Market

Australian cash markets came under further pressure last week with the sharp declines in U.S. wheat futures and forecast rain for North-West New South Wales which had missed earlier rain events.

With bids retreating quickly, farmer selling has been slow, but it seemed to pick up a little late last week according to trader reports. The reality is that new export sales now must be made at significantly lower levels than where the previous sales have been made to be competitive with Northern Hemisphere new crop prices. Traders have been giving away elevation margins for some time now, but even now Australian wheat looks expensive compared to other origins.

Grain Trade Australia provided an update on the China barley situation. They said the review would take three months with the possibility of a one-month extension. Any hopes that China may turn buyer are now giving way to the negative global feed grain outlook and Barley values are also being dragged lower.

Planting ahead of the new crop is progressing well in most areas with timely rains encouraging farmers in most areas. The general consensus is that there has been little drop off in the planted area and the start is as good as last year.

Ocean Freight Market & Export Stem

The back end of last week was pretty dire for owners as cargo interest dried up ahead of the global May-day holidays. Owners with near-spot tonnage had to take whatever they could to get covered and so some ugly numbers were reported. Red ink prevailed across the board from Panamax to Handysize. Is this representative of the wider market when China returns today is anyone’s guess. It feels like this is going to be a very flat week already.

More than 1.3MMT of grain and pulses were added to the shipping stem in the past week. This included 875KMT of wheat, the most in four weeks. Barley and sorghum additions were also strong at 193KMT and 150KMT respectively. East coast wheat additions improved in the past week with a combined 383KMT between Queensland, New South Wales and Victoria. There were serval sorghum boats added in the past week into Brisbane and Newcastle over multiple berths. No new canola ships were added.

In general however, wheat shipments continue at a record pace. The March wheat departures by the stem equate 3.1MMT before container shipments are added, and April and May are close to 2.8MMT. Western Australia continues with its impressive shipping pace with the stem indicating 1MMT plus a month Jan/May.

Pulses Market Update

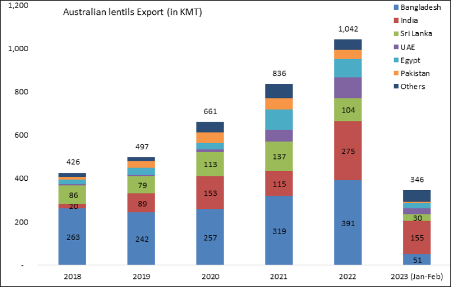

In 2022, Australia exported 1,042KMT of lentils, marking a 25% increase from the previous year. The top destinations for Australian lentils were Bangladesh, India, Sri Lanka, UAE, Egypt, and Pakistan. Notably, Bangladesh was the leading importer, purchasing 391KMT of lentils. India was the next significant consumer, buying 275KMT, followed by Sri Lanka at 104KMT. The trend continues in 2023, as the country has had a strong start in the lentil export market. In the first two months of the year (January-February), Australia exported a total of 346KMT of lentils, a substantial 65% increase compared to the same period in the previous year. India remained the top consumer, importing 155KMT, followed by Bangladesh with 51KMT, and Turkey with 36KMT of total Australian lentils exported during this period. It is anticipated that the export of Australian lentils will reach close to 1 million tonnes in the year 2023.

Source: AgPulse Analytica https://agpulseanalytica.com/

Australian Weather

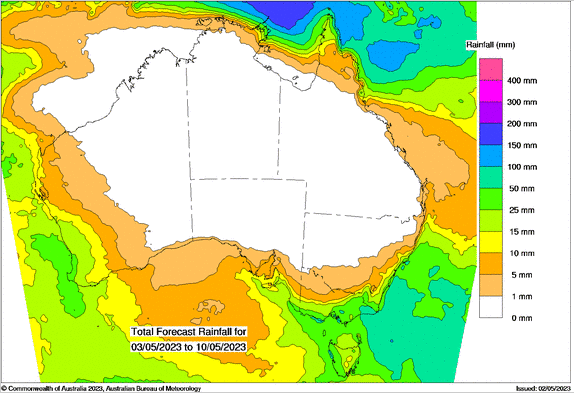

Australia is off to a very good start with 85-90% plus of national cropping areas having received enough rain to germinate winter crops by the end of April. Extended weather models continue to point to a drier and normal winter. The Bureau Of Meteorology updated its outlook during the week and pointed to drier than average for May to July across most of Australia. ENSO conditions are neutral with signs of that an El Nino could form during the winter. Similarly, the IOD is also neutral, but a positive IOD could develop in the coming months. Both are bad news for Australian rainfall for the winter and spring.

| AUD – Australian Dollar The Reserve Bank board lifted the official cash rate from 3.60% to 3.85% in a surprise move just a week out from the federal budget, amid signs households are continuing to feel cost-of-living pressures. Reserve Bank governor Philip Lowe said inflation, at 7%, was still too high and would take some time to come back down to the bank’s target range of 2-3%. The dollar remains range bound for the time being. |

The post Basis Commodities – Australian Crop Update – Week 18, 2023 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.