Basis Commodities – Australian Crop Upcate – Week 5 2022

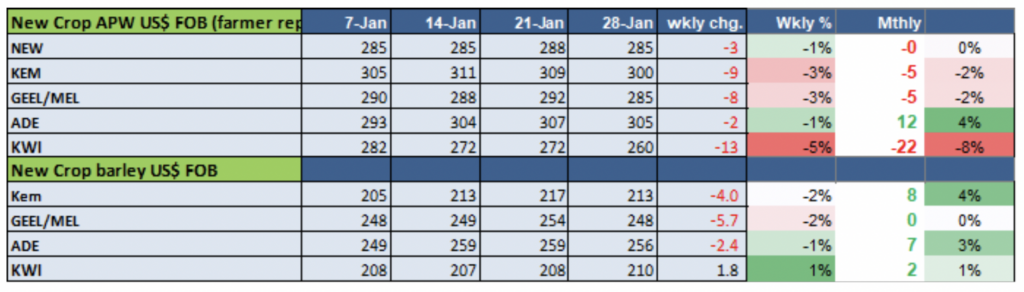

FOB replacement values using the Australian track bid/offer (AUD) – not a FOB Indication

Market Update

The local market remains relatively benign with the cash markets a little firmer week on week but largely ignoring overseas volatility. Farmers continued to trickle out sales in most states, but volumes appear to be small. ASX wheat futures finally traded on Monday after taking a week off. Most exporters are well sold and are instead focusing attention on logistics. With the exception of some smaller slots, most sellers are focusing on June forward now.

As always, the devil is in the detail and milling wheat bids were variable depending on the shipping zone which reflects exporter coverage against upcoming commitments for the regions.

South Australian wheat and barley remains firm in both the Adelaide and Eyre Peninsula while Western Australia was broadly softer as exporters get more comfortable. SFW and Barley 1 into Melbourne remain well supported due to a big container program while milling wheat grades appeared easier to buy.

Solid export demand continues to underpin SFW wheat bids which has encouraged domestic buyers to step up or potentially miss out. Additional feed wheat sales were made into both South Korea and the Philippines last week at about $335-340 C&F. This message is resonating with the domestic feed buyers, some of which were left chasing supplies through much of 20/21.

Sorghum harvest is being interrupted by the unsettled weather. Domestic demand at these values will be limited which means the vast majority of the 2MMT plus crop will flow into export pathways.

Weather

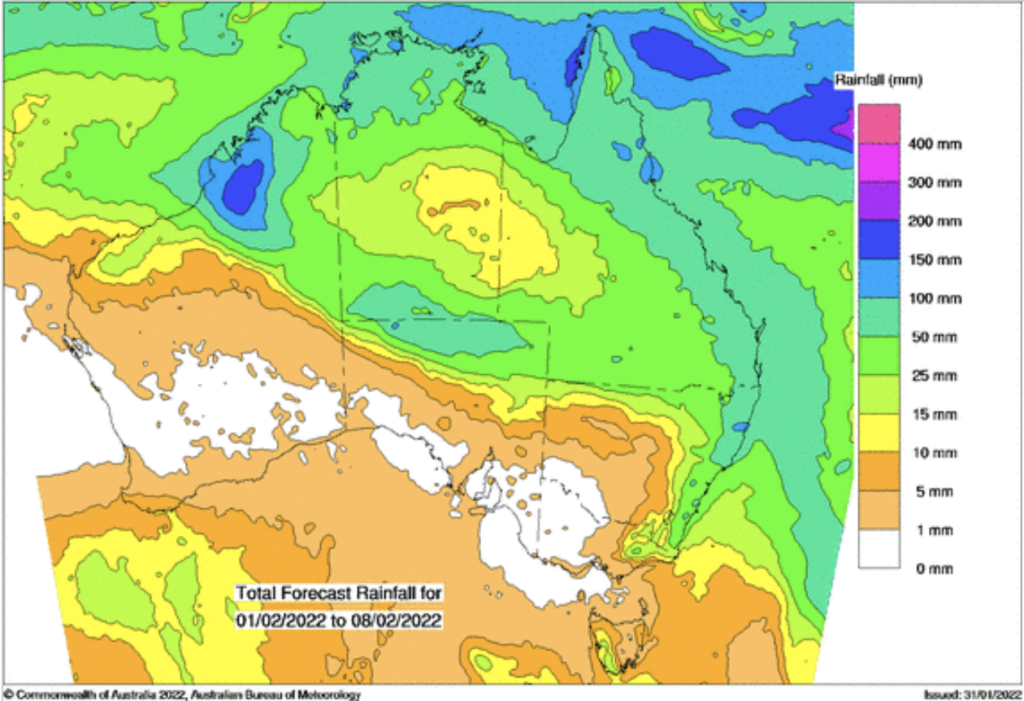

Unsettled weather patterns continue to draw moisture down from the tropical north into eastern Australia and the moisture profile should give the 2022/23 crop a good start when it goes in the ground in April. Western Australia remains hot and dry with the Bureau of Meteorology calling La Niña back to neutral by April.

Ocean Freight

The Ocean freight market is currently in hibernation as it waits for Chinese New Year (CNY) to end. Most owners anticipate a stronger market and so any forward demand is attracting a premium. Clearly, there is only so long this stand-off can prevail unless of course the expected does become reality and the wider market picks up after CNY. Indonesia is now back up and running for coal shipments and that appears to have stopped the rot in Asia but is not providing enough momentum in itself to push the market significantly higher. Rates in Southeast Asia, which have been weak for nearly a month, are improving but it’s not the vertical jump some expected. Needless to say, Bunker prices remain extremely firm as oil prices close in on 100 USD a barrel.

Australian Dollar

The Australian dollar bounced away from its downward correction on Monday. Fears inflation, an extended period of central bank monetary policy tightening and a slowdown in the global growth outlook prompted a further downward correction in markets appetite for risk. Having tested a break above 0.73 just two weeks ago the AUD has now given up over 3 cents. Key support is in place at 0.6930/50, a break below this handle could well signal an extended downturn toward 0.68.

The post Basis Commodities – Australian Crop Upcate – Week 5 2022 appeared first on Basis Commodities.

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.

Newsletter Signup

Thank you for signing up to the Basis Commodities email newsletter.

Please try again later

Quick Links

Basis Commodities Pty Ltd

PO Box 340, Northbridge

NSW 1560, Australia

Basis Commodities Consulting DMCC

PO Box 488112

Dubai, UAE

Copyright © 2024 Basis Commodities Pty Ltd. All rights reserved.

site by mulcahymarketing.com.au