Basis Commodities – Australian Crop Update – Week 4 2022

FOB replacement values using the Australian track bid/offer (AUD) – not a FOB Indication

Market Update

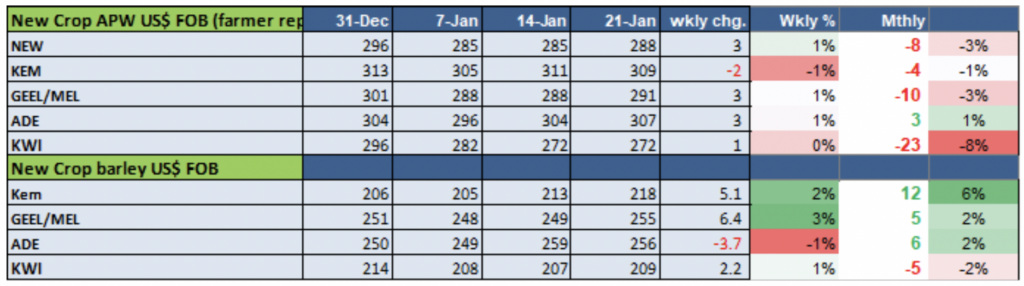

Local markets continue to be well bid following the hike in U.S. futures and slow farmer selling. However, gains in the local wheat cash bids were modest compared to the rally in overseas futures with basis doing most of the work. Demand for the lower wheat grades remains strong on the back of a well-advanced export sales program that has seen the bulk capacity well sold through April and into May.

Barley also remains well bid on the east coast where a lot of the New South Wales barley crop was downgraded because of the rain at harvest, so isn’t meeting the Bar1 export specs. It’s also expected Victoria yields came in a tad lower than forecast, also contributing to the tighter feel.

Sorghum harvest is just getting underway in southern Queensland while central Queensland farmers are planting. We expect strong yields should result in a large harvest. Most of the harvest will head into export markets at current prices, primarily China, with Australian feeders opting for feed wheat and barley.

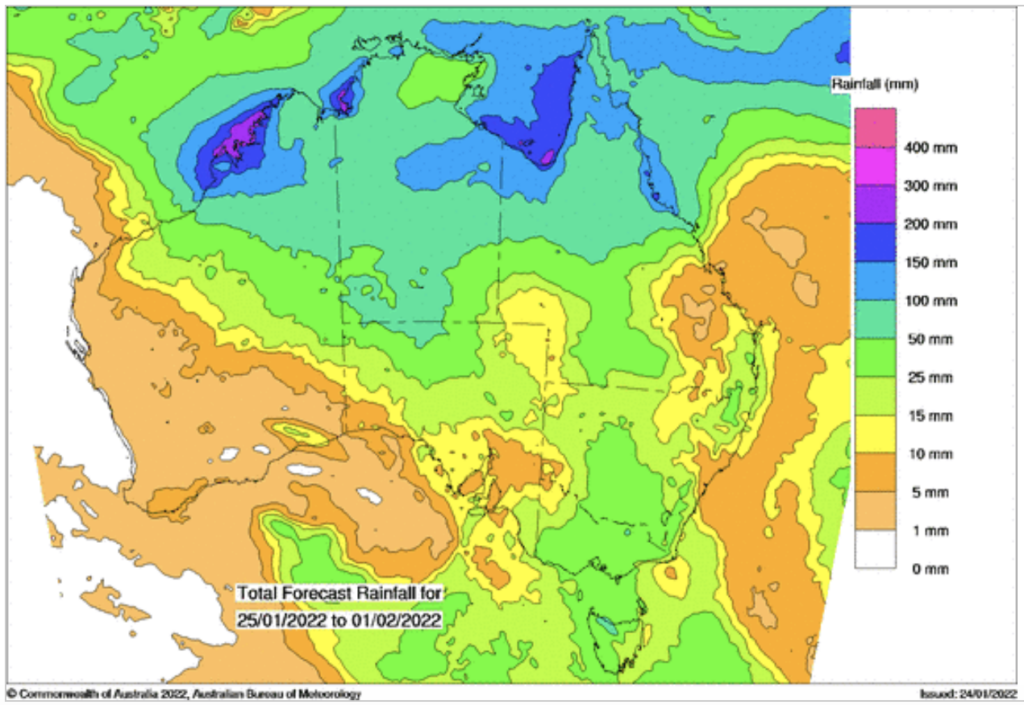

Looking forward, the La Niña weather pattern continues to pull moisture down from the north across the major east coast cropping areas. The Bureau of Meteorology (BOM) said the February to April rainfall is likely to be above median for parts of northern and eastern Australia which sets us up well for a good plant for the 2022/23 crop. The wet summer is topping up soil moisture levels and reduces the need for big autumn rains for a successful 2022/23 planting campaign.

In terms of export profile, at least half of Western Australia’s program will be low protein. On the east coast, 75% of New South Wales wheat exports will be feed wheat. Australia’s combined low protein ASW and feed wheat exports will be around 10MMT of the forecast 24.5MMT national wheat exports. We think maybe only 2MMT will be higher protein wheat with the balance mid protein milling wheat.

On the demand front, it’s been reported that China has secured 4-5MMT of Australian wheat and the Philippines has bought close to 1MMT of feed wheat. So, the sense is a significant amount of work on selling the non-milling crop has already been done. The shrinking ASW discounts to APW is confirmation the lower quality harvest is finding strong demand at current values.

Australian Weather

Ocean Freight

The week proved to be quiet over-all with Indonesia’s ban on coal exports continuing to overshadow the freight market. Handymax, which have proved such a bastion of strength over the past year, eased from mid-$20k’s per day for a Pacific round voyage to sub $20k on the back of very weak Southeast Asian demand. We still feel the markets will be relatively quiet and under pressure until mid February.

The post Basis Commodities – Australian Crop Update – Week 4 2022 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.