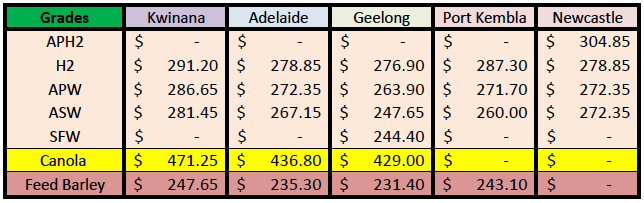

Australian Crop Update – Week 5, 2024

2023/2024 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

Wheat and barley bids are holding steady, but canola was mostly down $5-10 yesterday in most port zones. Nearby domestic demand is more intent on swapping supplies rather than adding to length, which is expected given the lacklustre demand seen from Asian importers.

Australia’s wheat exports in December climbed to 1.4 million metric tonne (MMT) up from 1.13MMT in November. Western Australia (WA) accounted for 717 thousand metric tonne (KMT) of the December exports. China was the largest wheat destination with 252KMT followed by the Philippines with 207KMT and Indonesia with 165KMT. China’s Oct/Dec exports of 701KMT are 959KMT less than the same time last year and Indonesia’s Oct/Dec exports of 509KMT are 685KMT less than the same time last year.

Barley exports for Dec were 1.3MMT. WA accounted for 651KMT with 469KMT from South Australia (SA) and Victoria (VIC) 168KMT. China was the major destination with 1.16MMT with 123KMT going to Japan. China has taken 2.52MMT of barley in Oct/Dec and 2.95MMT since exports resumed. Japan has taken 300KMT of barley in Oct/Dec, which slightly down on last year's 334KMT for the same period. Australia has shipped 3.1MMT of barley in Oct/Dec which is 47% of the AGS Oct/Sep forecast.

There was 564KMT of canola exported in Dec with 426KMT of this shipped from WA. WA has exported 1.1MMT of canola in the Oct/Dec.

The Australian domestic markets ended last week mixed. Sorghum values fell USD18 per metric tonne (/MT) to levels we’re export competitive against US sorghum into China. That equates to about USD265/MT FOB vs US Sorghum at USD251/MT FOB Gulf. Yields from the early sorghum harvest in Southern Queensland (QLD) are coming in better than expected and rain is boosting yield expectations for the remainder of the crop, most of which was planted later than normal because of the limited rain in early spring. It is forecast that the sorghum crop will end up being at 2.1MMT due to larger than expected plantings and solid yields.

Australian feed wheat and barley drifted lower last week with the ongoing rain, weakness in sorghum and the slow export sales pace. Wheat in general was lower approximately USD3-4/MT last week. However, traders commented that ASW was up USD2/MT later in the week as container packers chased supplies against nearby commitments. It is reported that other Asian countries are buying ASW at current values and it was reported as being traded into the Philippines at the 288 CFR level.

SA and WA wheat was steady to firmer on exporter short covering. SA wheat is difficult to buy, and exporters are having to work to get coverage against nearby needs. WA appears to be similar as farmers appear to be holding on to their sales as we get closer to sowing and also nearby rainfall.

Australian Pulse Update:

Bulk shipments of Australian pulses are continuing at pace including pre-sold cargoes of faba beans to Egypt taking their normal route via the Suez Canal. Growers are selling modest amounts of chickpeas, faba beans and lentils to traders and export accumulators in a mostly flat market, with activity expected to pick up from March as they look to sell parcels to finance their new-crop inputs. Rain in QLD has lifted production prospects for the mungbean crop now being planted, and prospects for the upcoming winter-crop plant are positive across south and eastern Australia following good rain for most regions since November.

Chickpeas:

Chickpea values have dropped USD7 to 14/MT in the past month to reflect a slowdown in accumulation for bulk export ahead of Ramadan. The upcoming harvest of India’s rabi chickpea crop, and of Pakistan’s crop too, has South Asian buyers considering local supply. Australia’s current chickpea crop is estimated by ABARES at 528,000 metric tonnes (MT), and trade sources say carry-in from the previous harvest has mostly been the rain-affected CHKPM.

Faba beans:

Three bulk vessels carrying faba beans from southern Australia are currently enroute to destinations in Egypt, and another has departed Port Adelaide last week.

Lentils: Lentil exports in December were almost 240,000MT with India leading the way followed by Turkey and Bangladesh.

Ocean Freight & Shipment Stem Update:

With the Chinese New Year holidays on our doorstep, the activity levels in the far east have noticeably started the slow down. Fewer cargoes are appearing in the market and tonnage lists are growing with owners open to taking lower than last done levels to have their positions covered over the holiday period. Bunkers have eased slightly over the past week helping swing the equation more in the charterer's favour. The Atlantic has remained more stable with the grain loading areas again gaining ground over the past week. The optimism on the forward curve remains strong and owners are bullish that the market will start to bounce in the second half of February. The main driver behind this sentiment remains the reduced capacity in Panama Canal and the Red Sea conflicts both helping tighten tonnage supply and increase the tonne-mile ratio.

670KMT of wheat, 260KMT of canola and about 140KMT of barley were added to the shipping stem in the past week. Most of last week’s wheat additions were in WA (366KMT) with VIC and SA also accounting for about 130KMT. There was 30KMT of durum added in Newcastle, New South Wales (NSW). WA accounted for 170KMT of the canola additions last week with the other 90KMT in SA.

The barley was split between SA and WA

Australian Weather:

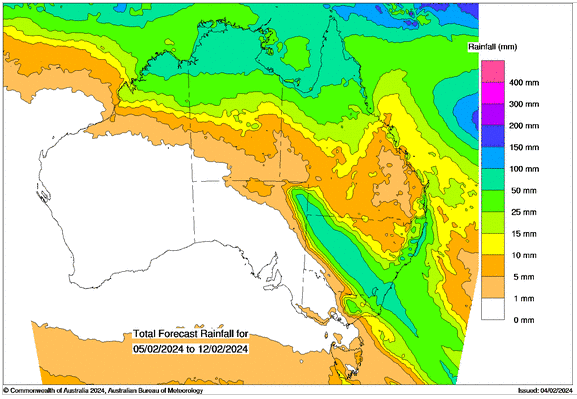

NSummer rains across large areas of Australia’s grain production regions has lifted optimism about the 2024 crop expectations. Above average summer rain means that cropping areas will have the benefit of moisture reserves to draw on, if needed. While winter crop planting is still several weeks away from starting, analysts are already predicting large crops. Commonwealth Bank is foresting Australian wheat production in 2024 at 31.4MMT, up from last year’s crop of around 25.5MMT. They are also tipping large barley and canola crops at 12.7MMT and 5.8MMT, respectively. Fertiliser imports for the 2024 winter crop are reportedly strong with many farmers left short of supplies last year.

8 day forecast to 12th February 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 22nd January 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar is slightly weaker to start the week when valued against the USD trading at 0.6477. The AUD/USD plunged more than 0.90% on Friday after a robust US Nonfarm Payrolls report triggered a jump in US Treasury yields as investors disregarded a rate cut by the Federal Reserve in March. In a Reuters Poll, analysts unanimously expect the Reserve Bank of Australia (RBA) to keep the interest rate steady at 4.35% in its February policy meeting.

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.

Newsletter Signup

Thank you for signing up to the Basis Commodities email newsletter.

Please try again later

Quick Links

Basis Commodities Pty Ltd

PO Box 340, Northbridge

NSW 1560, Australia

Basis Commodities Consulting DMCC

PO Box 488112

Dubai, UAE

Copyright © 2024 Basis Commodities Pty Ltd. All rights reserved.

site by mulcahymarketing.com.au