Australian Crop Update – Week 36, 2023

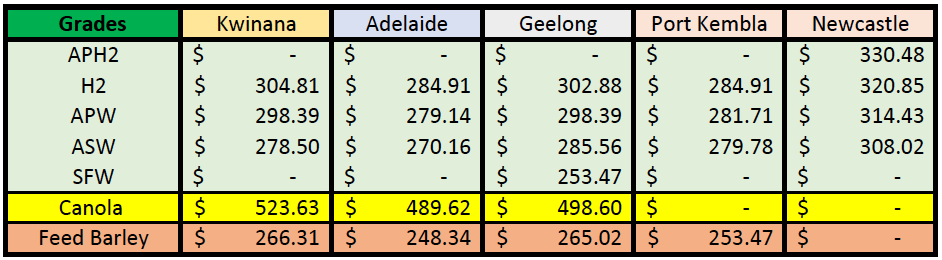

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Australian Grains Market Update

Wheat and barley bids in the cash market remained firm as traders tried to encourage some level of farmer selling. Canola was weaker as traders reflected the sell-off in Canadian and French futures. Lentils continued to find the bid side as well. The AUD was off ¾’s a cent and is now trading below 64 cents.

APW is quoted at around USD 300 FOB. International Grains Council (IGC) lifted its APW export quotation by USD 4 to USD 308 FOB with the ASW also up USD 4 to USD 294 FOB. Farmer selling on the new crop is close to non-existent with the ongoing dry weather in the north and shrinking crop expectations. Northern crops in Queensland (QLD) and Western Australia (WA) were under pressure last week with the daily temperatures in the high 20’s to low 30’s with no rain.

Australia exported 2.704 million metric tonnes (MMT) of wheat in July up from the 2.56MMT in June. QLD and New South Wales (NSW) wheat exports slowed considerably in July while shipments from other states remained strong. Indonesia was the largest destination with 637 thousand metric tonnes (KMT) followed by China with 628KMT. Australia has shipped 1.55MMT of wheat to Indonesia in May/June/July compared to 990KMt in the same period last year. Australia’s Oct/Jul wheat exports topped 7MMT in July with another two months remaining in the 22/23 marketing year. Barley exports continue to slow with just 382KMT shipped in July. A further 285KMT of sorghum was exported in July.

Australian Pulse Market

Australia exported 34,954 tonnes (T) of chickpeas and 127,316T of lentils in July, according to the latest export data from the Australian Bureau of Statistics. The chickpea figure is down 41 percent (pc) from June exports of 59,622T, while the lentil figure is down 18pc on the month. On chickpeas, Pakistan with 23,184T, the United Arab Emirates on 3579T, surprise entrant Canada on 2535T and Nepal on 1851T were the four biggest markets for July shipment.

India on 61,667T was the largest market for lentils, followed by the UAE on 26,769T, Bangladesh on 1708T and Sri Lanka on 16,754T. Australia is continuing to export its biggest than ever lentil crop of 1.4MMT, and ABARES last week lifted its forecast for new-crop lentils to 1.2MMT, up 25pc from the initial June estimate.

Ocean Freight Market Update

There was 880KMT of wheat added to the shipping stem in the past week but only 70KMT of barley. The wheat was spread across all states with 293KMT in WA, 210KMT in both South Australia (SA) and NSW, and 160KMT in Victoria (VIC).

The freight market remains relatively firm but is devoid of a big story or event to catch the headlines with almost all load areas seeing slight freight rate improvements. On a macro level market fundamentals have not changed and give little support to the market. High oil prices and queues at the Panama Canal are adding fuel to owners being more circumspect on what they book forward given the way the market is holding. So there is something of a stand-off on forward rates with all parties eyeing the early October Golden Week holidays in PRC as a potential circuit-breaker on current sentiment.

Australian Weather

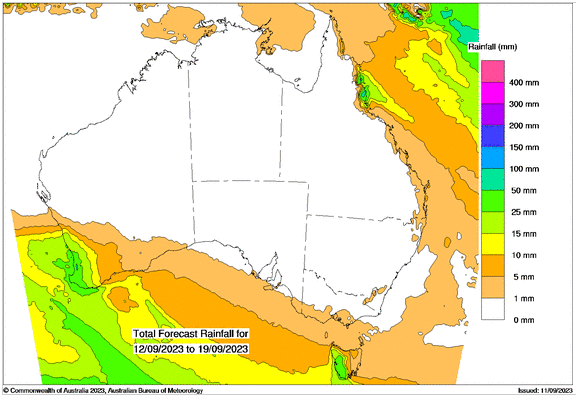

Most of the southern cropping zones received some light rain last week which will help preserve yield in these parts. This included 5-15mm across southern WA. There was 5-20mm across much of SA’s cropping areas with the lightest falls in the most northerly parts. VIC received 5-12mm across the major areas. Southern parts of NSW also received some light rain. Cool weather and showers will help limit southern yield reductions in September, but more rain is critical to finish crops and lock in current yields.

Last week’s vegetation index levels only showed modest declines across the cropping regions which is in line with normal seasonal declines. Spokespersons from the Australian Bureau of Meteorology noted that areas of severe rainfall deficiency had expanded and soil moisture was below average across large parts of the country threatening crops. "Since May 2023, areas of severe rainfall deficiency have persisted in south-west, Western Australia, and expanded along eastern Australia," the spokesperson noted. "Serious deficiencies (totals in the lowest 10% of periods since 1900) have expanded inland across north-eastern New South Wales into Queensland."

8 day forecast to 19th September 2023

Source: http://www.bom.gov.au/

Weekly Rainfall to 11th September 2023

Source: http://www.bom.gov.au/

AUD - Australian Dollar

The Australian dollar is slightly weaker opening the week as it continues to fend off a stronger US dollar from sending it further lower as markets contemplate central bank posturing, debt market gyrations and the outlook for global growth. The AUD/USD pair traded back and forth on Friday near the crucial resistance of 64 US cents. Last week the Reserve Bank of Australia (RBA) extended its interest rates pause for a third consecutive month as it assesses whether the sharpest increase in borrowing costs in three decades has done enough to slay inflation. The RBA left its cash rate on hold at 4.1%, the highest since mid-2012, at its September board meeting on Tuesday. On Thursday all eyes will be on the release of the employment data from the Australian Bureau of Statistics which will measure the percentage of the total workforce that is unemployed and actively seeking employment during the previous month.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.