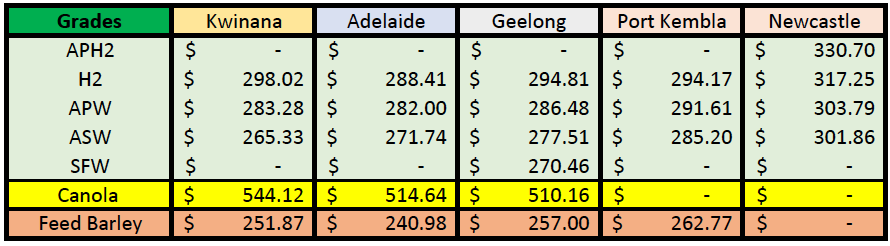

Australian Crop Update – Week 35, 2023

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Australian Grains Market Update

Australian activity in the domestic market was limited in the past week on the back of little to no farmer selling. Northern New South Wales (NSW) and Queensland (QLD) markets remain firm as crop expectations shrink and end users prepare for 12 months of tight supplies. QLD feedlots are holding record cattle on feed numbers and cattle prices are back to the 2018/19 drought lows. The bottom line is the cheap cattle prices offers feedlot margin when grain prices are high.

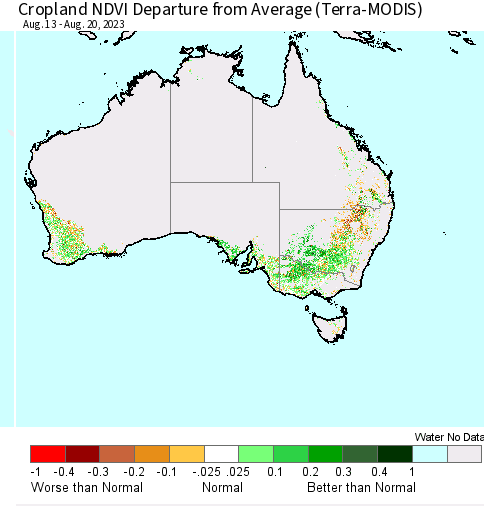

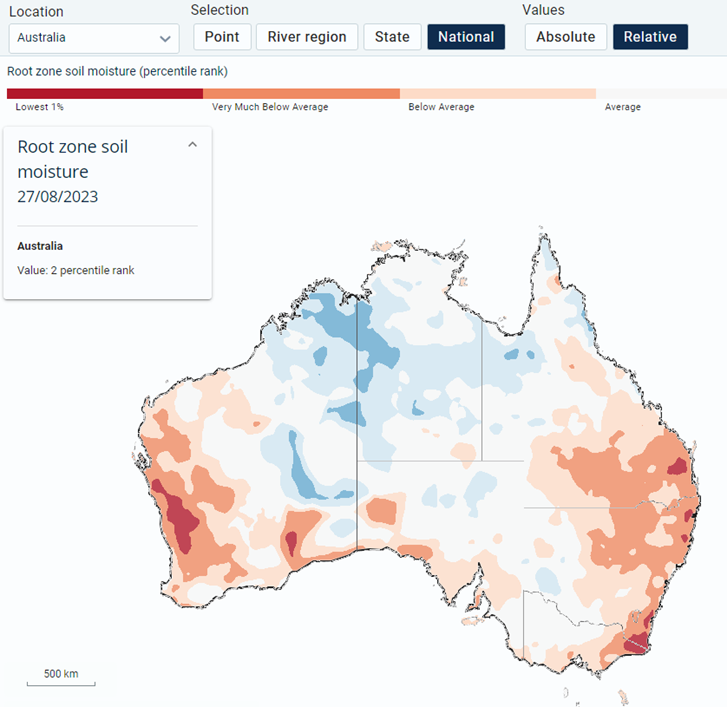

Crop conditions in the Southern QLD and Northern (NSW) continue to deteriorate with anecdotal evidence saying crop conditions are no better than 2019/20. Crops are a little better in the eastern areas in the north, but these are also slipping with the ongoing dry, warm weather. Normalized Difference Vegetation Index (NDVI) anomaly data was mixed with declines in the northern cropping zones and steady to better across southern cropping areas. However, traders are reporting that the line where crops are in decline is progressively moving south. By far the biggest declines in the NDVI ratings were in the north of Western Australia (WA) zones last week which plummeted with the ongoing dry weather. Production estimates have been cut in Northern NSW reasonably sharply but estimates haven’t been reduced as much in the north of the WA cropping zones. The extremely dry soil moisture levels are clearly playing a large roll in these sharp declines. These crops are running out of moisture and its being reflected in the sharp NDVI declines.

The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) will publish its September crop report next week where we expect them to drop the wheat crop below 26 million metric tonnes (MMT) and barley below 9.5MMT. There are some higher forecasts circulating but there is limited market confidence behind them.

It’s being generally reported that China has bought 1.2MMT to 2.0MMT of Australian barley in the past four weeks since they lifted the import restrictions with buyers there to do more. Trades have been reportedly done at US$270-275 c&f levels and brokers are reporting buyers are still there at US$275 plus values. This keeping the new crop farmer bid well-supported. Early barley shipped are already on the stem (reportedly) and this will be shipped from old crop supplies. Wheat export demand is slower where traders are saying Asian buyers are waiting for cheaper prices based on Black Sea values at US$250 FOB. Australian exporters will be reluctant to take on this risk given the farmer is cashed-up and production estimates in retreat.

Ocean Freight Market Update

More than a million tonnes of wheat, upwards of 650 thousand metric tonne (KMT) of barley and close to 400KMT of canola have been added to the shipping stem over the past few weeks. It feels like the freight market is on the cusp of another push with a slow build up of demand reaching a critical point. It has happened almost by stealth because for much of last week the markets looked flat and maybe under a modicum of pressure. The Singapore holiday didn’t help but this week has dawned with a definite feeling of tightness again on the nearby positions. Pockets are showing strong gains such as USG and PG/WCI whilst others like ECSA and Southeast Asia are managing to hold. It's hard to put a finger on any definitive single commodity or region that is driving events. There appears to be a more general "across the board" effect whereby charters leave fixing late and are caught when the market unexpectedly tightens. The only common thread we would note is that we are seeing an uptick in trader-based activities across most commodities.

Panamax sizes stayed relatively static last week with Atlantic focussed biz coming off while Asia held steady. Front haul numbers are heading back into the mid/low $20k's per day whereas last week it looked like they would break $25k at one point. Conversely Supramax/Ultramax vessels are experiencing strong demands especially from USG/ECUS positions. Good spec Ultramax Vessels are now a parity to Panamax for front haul. In the MEG it was a similar situation with an unexpected dearth of tonnage visible from Wednesday onwards last week and Charters scrambled to cover. Supramax and Ultramax numbers in the region are edging up towards mid-teens for trips to Asia. Large Handymax’s are fixing in the low teens and firming.

Australian Weather

The Australian Bureau of Meteorology (BOM) issued its latest seasonal outlook update where they maintained the El Nino alert and said a positive IOD is likely for the spring. This is unchanged on previous updates. They said SSTs (Sea Surface Temperature) in the tropical Pacific are exceeding El Niño thresholds and have continued to warm slightly over the last fortnight. SSTs are likely to remain above El Niño thresholds until at least early 2024.

The Vegetation index levels stabilised across eastern Australia’s the northern cropping in August thanks to the mild temperatures. Veg index levels across southern NSW, Victoria (VIC) and South Australia (SA) also steadied at levels that are comfortably above the 20-year average. Some areas are even a little better than this time last year while others are down on last year but remain historically favourable. Veg index levels improved in WA driven by the Lower Great Southern and the Esperance zone with the other parts modestly better. Soil moisture levels are very dry across the northern cropping areas of Western Australia and eastern Australia.

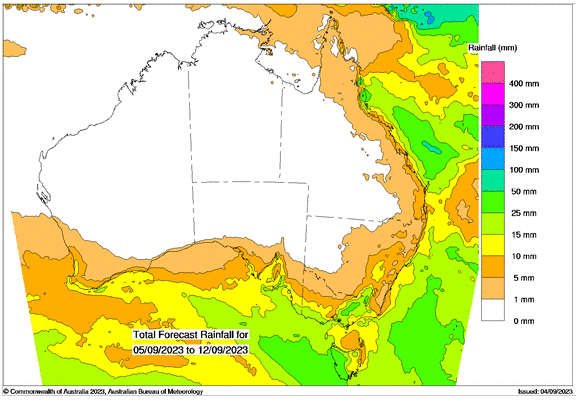

Forecasters still suggest that the national wheat production for the 2023/24 season is at 26.6MMT and barley at 10.2MMT based on the current condition. Wheat production numbers have already been adjusted based on the dry weather in the northern cropping zones and the reduced plantings in Northern NSW. It all comes down to the spring weather and the BOM is forecasting a drier and warmer than normal September. The market is cautious about building weather forecast into the yields as the weather hasn’t been as bad as earlier predictions and many areas in the southern cropping zones are only one decent rain away from above average to well above average yields. Nonetheless, yields will be a function of the weather in Sep/Oct. Northern crops will come in earlier than normal with a warm/dry September, which is forecast.

8 day forecast to 12th September 2023

Source: http://www.bom.gov.au/

Weekly Rainfall to 5th September 2023

Source: http://www.bom.gov.au/

AUD - Australian Dollar

The Australian dollar is slightly weaker on the open this week when valued against the Greenback. The Australian dollar failed to capitalise on the surprisingly upbeat Caixin Manufacturing PMI for August. The Caixin China General Manufacturing PMI came in at 51 in August, 1.8 points higher than the July reading. It was the third time in four months that Chinese manufacturing conditions expanded, indicating that the sector was improving.

The Australian dollar didn’t strengthen despite being a proxy for Chinese economic prospects trading below 65 US cents.

On the local data front for Australia, all eyes will be on the interest rate decision by the Reserve Bank of Australia (RBA), which will be announced on Tuesday. According to a Reuters poll, RBA Governor Philip Lowe will keep interest rates unchanged at 4.10% but will keep doors open for more hikes.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.