Australian Crop Update – Week 34, 2023

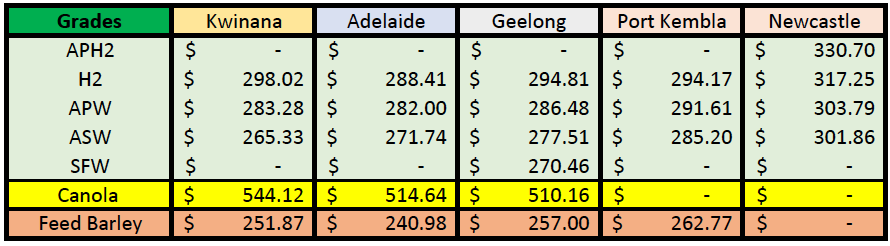

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Australian Grains Market Update

Australian domestic markets were firm last week, despite a weaker AU dollar and US wheat futures falling. The most notable gains in domestic cash markets were in canola where prices were up USD12 per metric tonne (MT) to USD16/MT across the port zones. There is still limited farmer selling, with farmers quite comfortable holding on to their crops for the time being. Yield prospects are also weighing on decisions, as are the ongoing uncertainties associated with the impact of likely drier conditions associated with the El Nino phenomena. Cool to cold temperatures and wet conditions featured in the south of Australia during the week, whilst the north has been dry, with higher than usual daytime temperatures.

Most growers in Queensland (QLD) and Northern NSW have already lowered their yield expectations, and are hoping for average yields at best, due to the dry season. Some crops have been pushed to early maturity in northern regions. September rain and temperature forecasts will remain important in shaping crop yields in Northern NSW, QLD, and Central and Northern WA.

There has been enough rain in Australia’s southern cropping regions to keep these areas on track for above-average yields. During the week, the International Grains Council said there were reports that China has secured some barley cargoes from Australia at around U$275 CFR China, for Sep-Oct shipment but there were some concerns amongst the trade here re phytosanitary requirements that were supposedly still being worked through at a government level.

The Grain Industry Association of Western Australia August crop report states that WA’s total grain yield potential has slipped more than 1 million metric tonnes (MMT) in the last few weeks as a result of continued dry conditions in much of the state’s grain growing regions. In the Central and Northern regions of WA, grain yield potential has fallen and will continue to fall further if rain doesn’t pick up in the next month. Recent light rain in the northern parts of WA has given those growers a short reprieve from what was shaping up as being a very poor year. Further south, the situation is more mixed with patches of very dry areas amongst those still hanging on, to extremely wet waterlogged areas closer to the coast. For many growers, the potential for a good year is still there, although regular or meaningful rain will be needed.

Ocean Freight Market Update

A big clear-out of available tonnage in Southeast Asia has taken the steam out of the Ocean Freight market over the past week. Anyone with shipping slots has now been covered so charterers have some space to sit back and assess whether the market has a genuine impetus or the recent increase will cease. Similarly, many owners appear to have also cleared out their available vessels in the near term so they are happy to wait before re-pricing for deferred positions. For now, we would say there is enough demand that the gains of the last 10-14 days will hold for the near term, but conversely, the market isn’t showing enough demand to push things much higher and with the news out of China increasingly bearish, we suspect the market may weaken in the short to medium term.

Australian Weather

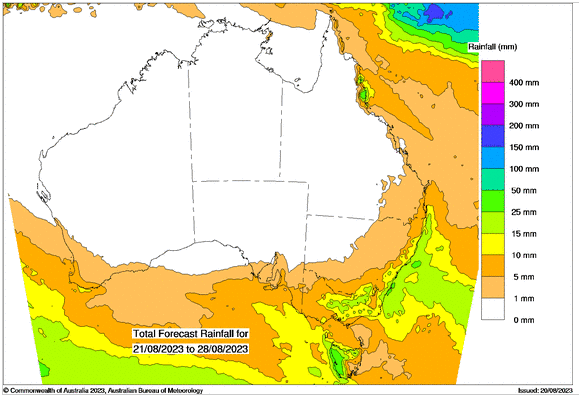

Last week, WA, South Australia (SA), Victoria (VIC) and NSW all recorded rain including a small amount in northern NSW.

The Australian Bureau of Meteorology’s climate outlook released on Thursday confirmed that Australia is set to see below median rain and above median temperatures from September to November. The long-range forecast is influenced by several factors, including likely El Niño development, potential positive Indian Ocean Dipole development, and record warm oceans globally.

8 day forecast to 22nd August 2023

Source: http://www.bom.gov.au/

Weekly Rainfall to 14th August 2023

Source: http://www.bom.gov.au/

AUD - Australian Dollar

The Australian dollar stands on shaky ground as risk sentiment remains fragile, amid growing uncertainty surrounding the state of the Chinese Economy. Equities fell during trade on Friday, with the Hang Seng leading losses with key indices marking their lowest level this year. While Chinese policymakers announced a series of reforms and interest rate cuts designed to boost confidence across capital markets, the moves offered little support to risk assets.

With the Yuan failing to make inroads against the USD, the AUD remains under pressure struggling to make any headway on moves above US$0.64. Having dipped toward US$0.6380, the AUD looked set to test Thursday's low at US$0.6363, before finding support and trading sideways bouncing between US$0.6380 and $US0.6410 into the Friday close. Longer term some of the banks now expect the AUD to dip below 60 before the end of the year.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.