Australian Crop Update

FOB replacement values using Australian track bid/offer (AUD) – not an indication.

Local Markets and Harvest update

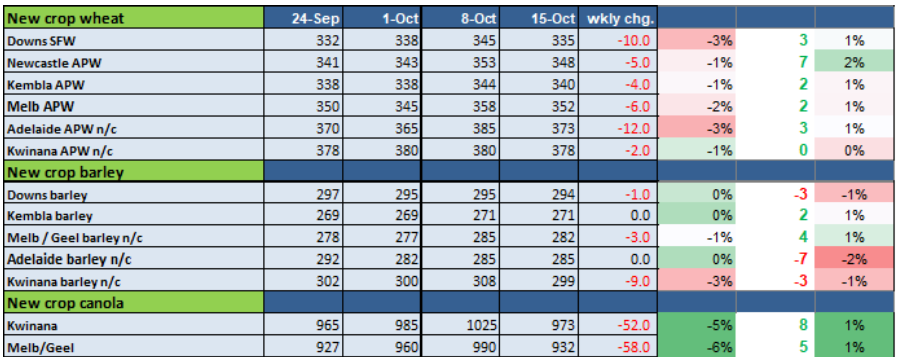

Domestic wheat bids to the grower were back 1-3% for the week as the AUD rallied against USD weakness. Barley bids were softer, particularly in WA and SA. Canola bids tumbled $50-60/MT or 5-6% in line with international markets.

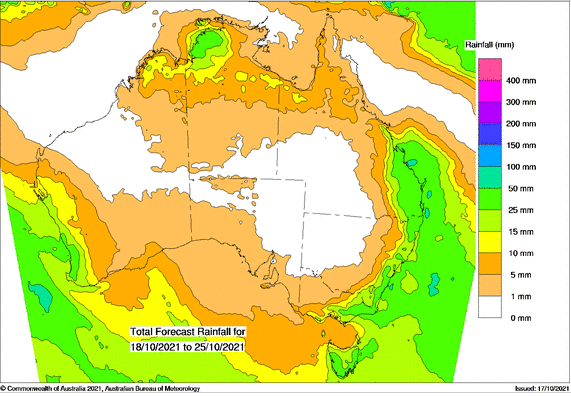

An unstable storm front pulled up harvest in Queensland. In NSW, the heaviest rain was in the east of the Newel Highway (25-60mm) with lighter rain in the west (5-30mm). However, most crops are still green, so yield will benefit from the wet mild finish both in NSW and Victoria. Last week’s late season rain will benefit crops throughout SA. In WA the Geraldton zone has begun harvesting but otherwise, WA is looking forward to rain in the early part of this week.

The unsettled weather is keeping farmers and exporters nervous about crop quality. This and the stronger USD FOB is slowing export sales. In general, most exporters are well sold into the New Year and feel no pressure to make sales given the competitive position Australia finds itself in. A general start to wheat harvesting is still a couple of weeks away and at this stage, there is no need to change the expectation of a 32 MMT+ wheat crop.

The only cloud on the horizon – pardon the pun – is the Bureau of Meteorology’s extended forecast which is increasing the chances of above-average rainfall for much of eastern and northern Australia.

So, what does this mean at the FOB level? A sucker punch?

Australia is comfortably the cheapest wheat in the world into Asia and extending its reach into the Middle East and Africa. The issue for the exporters is not demand, it is how many slots they have and how they can maximise export elevations between barley, wheat, canola and pulses. Export sales of Australian wheat are well above the farmer bid. Traders are achieving big margins on the sales that are made today, but they are also taking on forward price risk and this needs also to borne in mind.

Buyers on the other hand see a bin-busting crop, the grower not selling and therefore they wait, expecting prices to come down. However, I contend this year that the export sellers don’t need to chase the domestic track market down. With limited options, overseas consumers will come to them for their Q1 or Q2 needs or face the lottery which is the possibility of Russian export quotas or missing out altogether and being forced into more expensive or lower quality, an important consideration often overlooked, originations.

With high ocean freight rates being added into the mix, it is fair to say global buyers are balking at the current prices. Even Egypt’s GASC and Pakistan both passed on tenders last week without making any purchases. However, week on week we seem to get more expensive at the FOB level. The global consumer still has much to do, particularly given the problems being faced climatically in the Middle East and China. Reports that Iran may import as much as 8MMT of wheat in the 2021/22 season were particularly supportive given most will come from Russia. It has raised questions for the surrounding countries import prospects, including Pakistan, which has been on the buy side for some time now. It is also raising questions as to what role India and the US will play in putting a break on FOB prices march upwards.

FOB barley prices continue to be underpinned by the strength in European feed grain markets, Russia’s slow export program and limited appetite for Australian exporters. We expect this situation to continue in the near term.

WASDE

US ag markets finished the week mixed. USDA delivered its October WASDE which showed larger than expected soybean and corn supplies while US and global wheat supplies continued to tighten. Concerns of tight US corn and soybean supplies are fading, but this has been overtaken by improving demand aided by the strength in energy markets. Global wheat export supplies will remain tight through to the northern hemisphere winter wheat harvest in mid-2022.

Ocean Freight – Bulk and Container

At the risk of sounding like a broken record, bulk ocean freight is still an incredibly hard market to call and it is not just charterers who lack conviction. Owners are as confused as the rest of us about the market (though of course outwardly very confident!) and hence it is difficult to get them to rate forward at anything less than today’s spot rates – irrespective of what FFA’s indicate (unless they are higher!!).

Bunker prices are continuing to creep northwards and are adding more uncertainty into future rating.

On a practical level, the delays from various anti-covid measures across the globe are causing scheduling problems and are tying up vessels at times due to quarantine procedures which hardly helps when all supply chains are under pressure for one reason or another.

Container shortages continue to exist in Australia. Strained trade relations and global supply chain imbalances caused by COVID-related issues are limiting Australia’s ability to utilise empty containers for grain and pulse export. Consequently, there are less 20ft containers available and vessel schedules are constantly changing as lines look to manage their sailing schedules and equipment efficiencies. Unfortunately, although we have seen a slight decrease in the Shanghai container index over the last week, this seems set to continue.

Currency

The Australian dollar advanced for the fifth day in a row on Friday, touching a 5-week high. Set in context it was trading as low as 0.7170 in late September. The Aussie found its feet last week on the back of upbeat equity market movements which in turn were spurred on by better-than-expected quarterly earnings and retail sales figures in the US. Adding further support to the Aussie is reports that the Chinese central bank expects the Evergrande issue to be ‘“controllable”; easing market concerns about a chain reaction affecting the world’s second-largest economy. Closer to home, the relaxation of COVID-19 restrictions in Sydney and Melbourne also buoyed domestic markets.

To receive this information directly to your inbox as soon as it’s released, sign up for our newsletter below.

The post Australian Crop Update appeared first on Basis Commodities.

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.

Newsletter Signup

Thank you for signing up to the Basis Commodities email newsletter.

Please try again later

Quick Links

Basis Commodities Pty Ltd

PO Box 340, Northbridge

NSW 1560, Australia

Basis Commodities Consulting DMCC

PO Box 488112

Dubai, UAE

Copyright © 2024 Basis Commodities Pty Ltd. All rights reserved.

site by mulcahymarketing.com.au