Australian Crop Update – Week 43

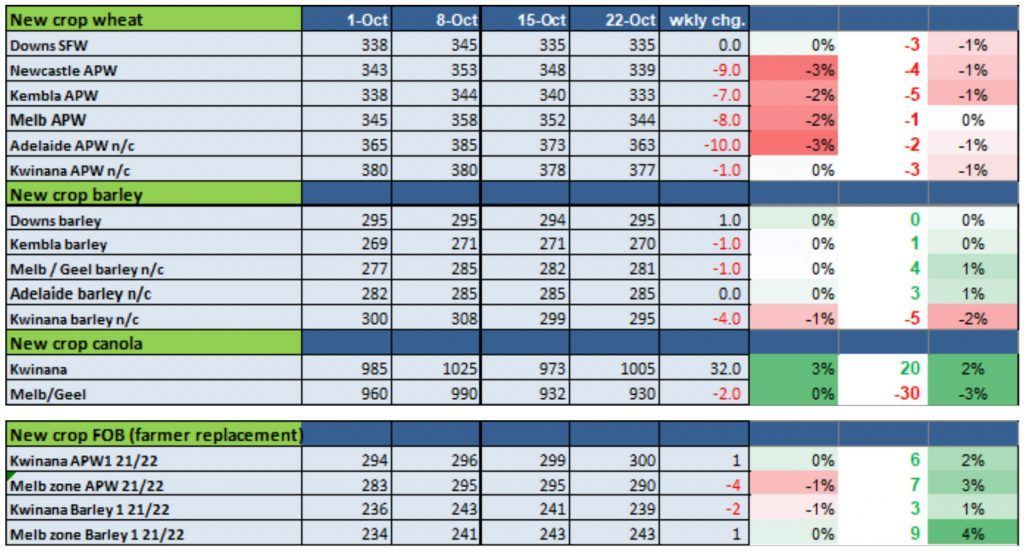

FOB replacement values using Australian track bid/offer (AUD) – not an indication.

Harvest Update

Local markets were mostly lower before the rally in US wheat futures on Friday. Harvest progress remains slow with cool overnight temperatures and high humidity limiting harvest progress in Southern Queensland and Northern NSW last week. Harvest in Western Australia’s Geraldton zone is progressing, although CBH is still to issue its first harvest report for the season. Early yield reports from Western Australia are coming in better than expected, following the dry finish. Overall, Australia’s harvest is yet to crank up and probably won’t happen until early November.

Our analysts are keeping the national wheat production at 32.0MT coming into harvest but our bias is that production is likely to edge higher on the back of better yields with the mild spring. We could see another 33.0MT crop in 2021.

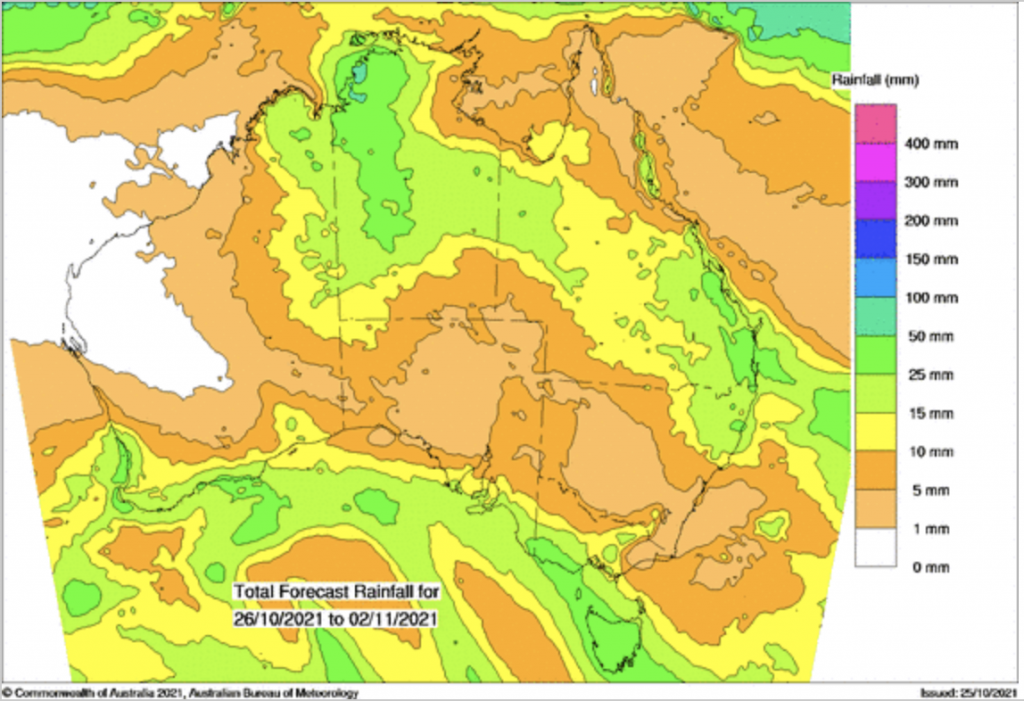

Weather

Grain Markets

On the cash side, farmers are becoming prouder owners of wheat and barley on the back of production difficulties in North America and Russia. At the same time, traders and exporters are happy to wait until harvest pace picks up to engage. The other notable feature of the cash market is that barley values continue to slide against wheat. We see this as a function of depth in export demand for wheat compared to barley. As previously highlighted, exporters are largely sold for December, January and probably most of February. The odd slot remains, but the premium being asked reflects the lack of liquidity for those positions and confidence on behalf of the seller that they will get their number. In discussions with exporters, it seems the Asian exporters have finally woken up to the need to move well ahead of the shipment slots, given the limited choice available to them, and are now looking to cover Australian wheat for March onwards.

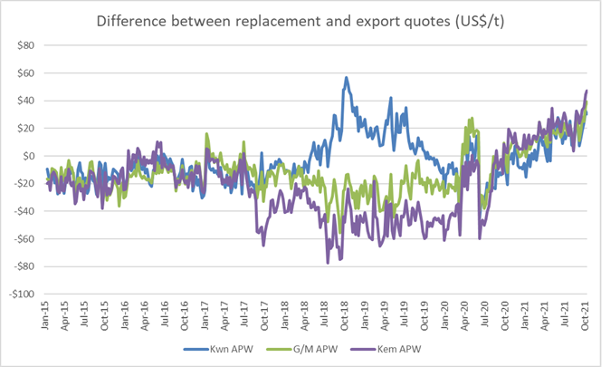

We have been asked a few times ‘what does the elevation margin look like in historical terms?’. The answer is very healthy. The chart below (courtesy of Agscientia) is based on the difference between IGC weekly quarter Australian FOB (Adelaide) APW and the grower replacement based on Profamer best bid plus FOB costs.

Ocean Freight

From an ocean freight perspective, the Pacific freight market slowly crept upward for most of the week but as we enter a new week, the FFA’s have a distinctly choppy feel. It does not take much of a rumour or a new “issue” to push the market either way. Forward paper has eased and there appears a big disconnect between Q1 FFA’s and today’s spot levels.

The underlying wider market remains firm and even if there is a correction, it is highly unlikely we are returning to levels seen 12 months ago. Negative economic news from China does not change the limited nature of the supply-side of the equation, especially for smaller handymax vessels. There simply is not enough new builds being delivered in the next 12 months to satisfy the market. So, any near-term negativity should be viewed in relation to that dynamic.

Container freight remains the greatest obstacle to the container trade with the imbalance of equipment and schedule disruptions continuing. The greatest demand for containers remains repositioning back to China. However, at the same time, we are seeing the Chinese energy crisis start to impact China’s ability to export. Elsewhere, congestion off America’s West Coast has followed similar backups in Hong Kong and Shenzhen as they deal with in the aftermath of Typhoon Kompasu last week.

Currency

The AUD appears to have shaken the shackles that saw it drift between 0.7130 and 0.7360 through much of July, August and September, entering a new trading range and bouncing between support at 0.7460 and resistance on moves approaching 0.7550. However, with gains led by improvements in the risk narrative, the upturn could falter at any moment.

To receive this information directly to your inbox as soon as it’s released, sign up for our newsletter below.

The post Australian Crop Update – Week 43 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.