Basis Commodities – Australian Crop Update – Week 4 2022

FOB replacement values using the Australian track bid/offer (AUD) – not a FOB Indication

Market Update

Domestic markets remain quiet for the most part. From a demand point of view the export capacity is being dominated by feed grain, lower quality milling wheat and canola at healthy elevation margins. Demand for the remaining milling grade wheat is holding to a hand to mouth buying pattern and feels expensive into the Middle East and East Africa as Black Sea and Argentinian values remain competitive.

Execution remains difficult and a number of ports around the country are suffering from congestion. In terms of capacity, most sellers are now looking at June forward as China seems to have quietly picked up a lot of the remaining first half stem.

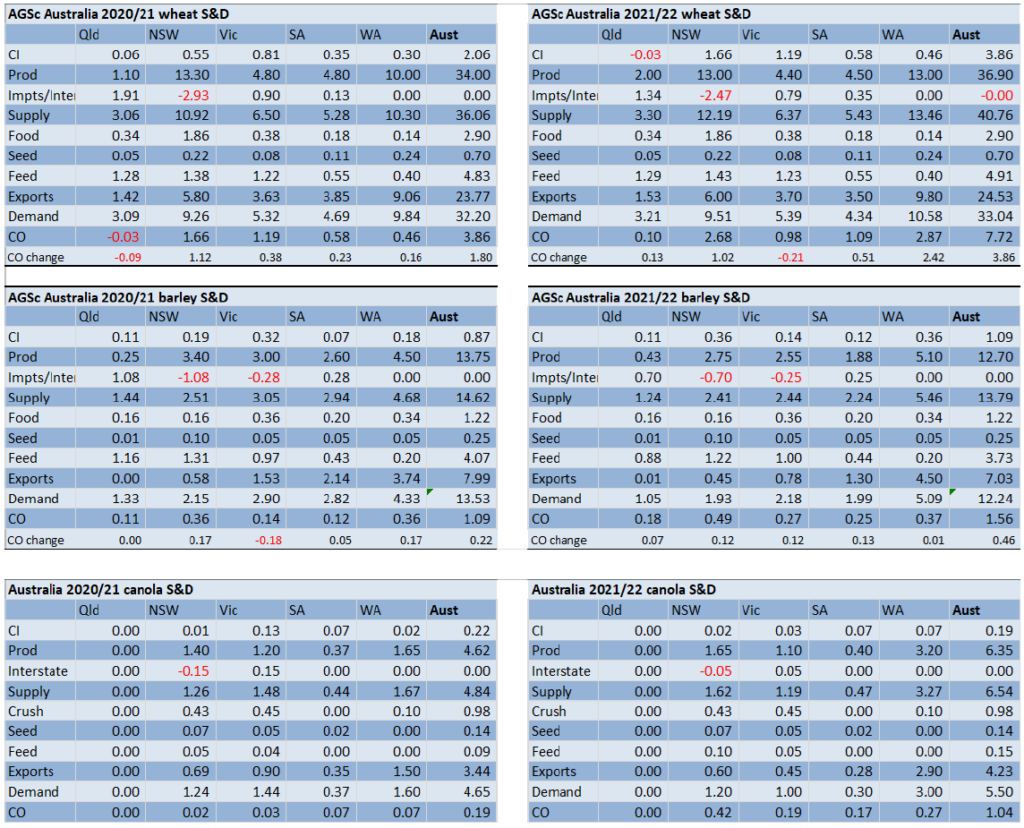

Our analyst Agscientia raised their final 21/22 national wheat production update to 36.9MMT on the back of the massive Western Australia deliveries. Barley production is 12.7MMT, canola 6.35MMT and sorghum 2.33MMT. Larger plantings and favourable seasonal conditions have come together to allow Western Australian farmers to eclipse the previous record large harvest by over 30 percent, according to the Grain Industry of Western Australia (GIWA). GIWA said Western Australia produced just over 24MMT of all grains. The exceptional result was a function of a record planted area of 9.2 million hectares, up 7.8 percent on last year and a fifth more than the previous record harvest. Other contributing factors were the early plantings dates, good early moistures as well as mild temperatures which allowed the crop to get off to an excellent start. The favourable early start also prompted farmers to boost fertiliser applications, GIWA said.

The USDA delivered its February WASDE report last week which was in line with pre report expectations. USDA sharply reduced South American soybean production estimates for a second consecutive month while only making a small cut to corn output. This sent soybeans higher with bigger gains in corn as soybean futures have already factored most of the production losses. Funds were large buyers of corn and soybean following the report and to a lesser degree wheat. Soybean and corn futures set eight-month highs.

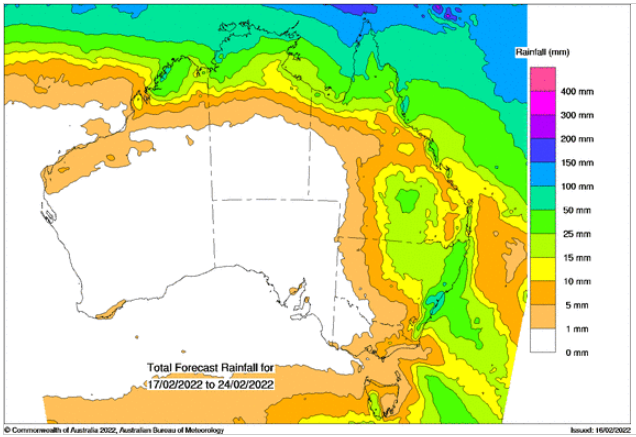

Weather

Ocean Freight

In ocean freight, owners have been trying to drag the market upwards with charterers that had waited for a clear market picture to emerge after the CNY/Olympics suddenly scrambling for cover. However, by early this week the sentiment was softening.

Australian Dollar

The AUD remained range bound.

The post Basis Commodities – Australian Crop Update – Week 4 2022 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.