Australian Crop Update – Week 22, 2023

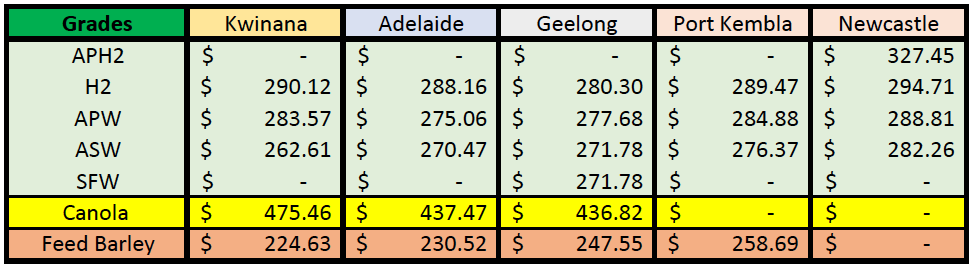

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Australian Grains & Oil Seed Market

Australian domestic values continue to strengthen amid expectations of a dry season and sluggish farmer selling. All port zones were firmer as traders lifted bids for supplies in up-country storage sites and domestic consumers reduced short positions. Sorghum bids are steady to softer with the downturn in Chinese demand and Australian supplies now expensive against other feed grain alternatives, such as Brazilian corn. The longer-term dry weather outlook is impacting medium term decision making and it’s not just about the east coast. Western Australian (WA) bids were 5% higher across both wheat and barley for the week. With that said, this week rain has appeared in the 10-day forecast for much of the country and some rain has fallen in southern WA which re-enforces the point that any discussion on the size of the Australian crop at this stage is more a weather forecast than fact.

Early forecasts for Australia’s 2023/24 wheat crop are coming in at around 28-29 Million Metric Tonne (MMT) based on a similar planted area of 12.5 – 13.0 million hectares and a return to average yields around 2.2 tonne per hectare. Forecasters favour having a below average yield bias for the coming season based on the seasonal weather outlook, but we prefer to leave this outside the balance sheet until the yield is no longer seen as achievable, which is some way off yet.

Ocean Freight Market & Export Stem

The freight market remained range-bound over the past week where very little of note is happening. Commodity traders across all the products seem to be lacklustre which is maybe indicative of the general economic malaise affecting the world at the moment. There are potential signs in Southeast Asia of another micro cycle emerging however the relative up/downsides (standard deviation) are much less than we have seen over the last two to three years. Handymax vessels in Southeast Asia feel a bit tighter, but in truth, it’s a bit notional and too early to call at this stage. The market is again seeing larger ships earning lesser rates. Panamax levels are in the mid $8k’s pd for pacific round voyage and sub $5k for Atlantic b/h. Ultramax tonnage is fixing between $9-10k for pacific round voyage and Japan spec Handymax’s between $9-11kpd. Supramax and handymax tonnage is not discounting much at all for b/h to Cont/Med at the moment – pretty much a full round voyage rate applies.

There was 737KMT of wheat, barley and canola added to the stem with more than 500KMT or 70% of it to be shipped from WA. There was 478KMT of wheat shipments put on the stem in the past week including 373KMT from Western Australia. There was also 107KMT of barley added to the stem in Western Australia in the past week as well as 58KMT from Victoria.

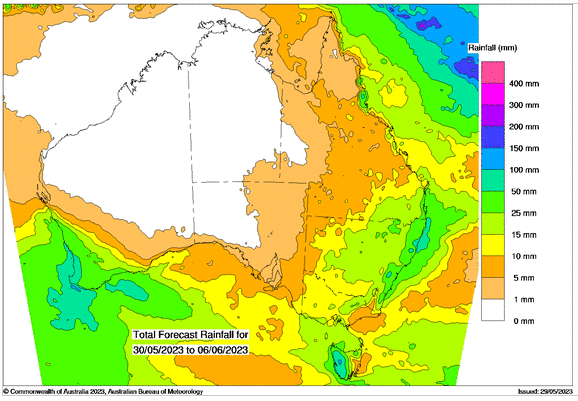

Australian Weather

With weather turning dry throughout May, reports have surfaced that the topsoil is starting to dry out in a few areas which is not only breaking the linkage with the better subsoil moisture further below, but also is impacting germination strike of later sown crops. However, the 8-day forecast is for rain across most southern areas.

AUD – Australian Dollar

The Australian dollar was slightly weaker on Monday morning when valued against the USD trading at its year-low of 0.6517. The AUD/USD pair continued its downward trend on Friday. On the data front last week, Australian Retail Sales failed to meet expectations, remaining unchanged from March. This lackluster performance reflects the challenges faced by consumers due to the impact of rising interest rates and persistent inflation.

The post Basis Commodities – Australian Crop Update – Week 22, 2023 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.