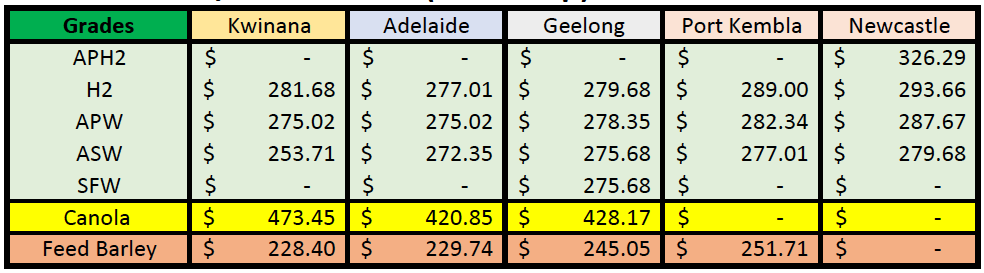

Basis Commodities – Australian Crop Update – Week 21, 2023

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Australian Grains & Oil Seed Market

Australian cash markets remain variable between the various port zones. East coast bids are edging higher as the offers retreat with continued dry weather. Markets are edgy and domestic buyers are nervous about the dry weather outlook. Sharp declines in cattle prices in recent months is encouraging feedlots to keep pens full which is ensuring good demand for northern feed grains. Sorghum prices under pressure as Chinese demand disappears at current prices which are expensive against South American corn.

Planting is around 70% complete and most areas are looking for rain to maximise germination and top up soil moisture levels.

Dry weather concerns also extend to South and Western Australia. Most areas are >75% planted with most of the crop expected to be seeded by early June. But it’s the dry weather which is now dominating farmer selling decisions. Local markets are edging higher at the same time global values are in decline. This means export margins are also in decline if they haven’t already disappeared.

The Grain Industry Association of Western Australia (GIWA) has reported that the states planted area is expected to decline by about 8% as farmers lower plantings with the drier outlook. Most of the decrease is in canola which they are saying will fall by 18%. They said this is more a reflection of the timing of the rain compared to last year. Forecasters have generally pulled back numbers for canola plantings nationally by 5-8%. GIWA said the state wheat area will be back slightly on last year with the dry weather in the Geraldton and northern Kwinana zone. Barley will be also back slightly with wheat benefiting more from the lower canola plantings than barley.

Ocean Freight Market & Export Stem

It was much of the same last week with very little happening of note in ocean freight. The freight market is threatening to become range bound. It feels like a malaise of apathy is pervading the freight world which is above and beyond what we would normally expect for the mid-year months. Over the last two years we have seen multiple significant influences on the market simultaneously playing out to a greater/lesser degree resulting in extreme unpredictability. Now we are in the opposite situation – there is very little happening with a roughly balanced supply and demand scenario. Rates everywhere else went sideways again or notionally eased.

Nearly 1MMT of wheat was added to the stem in the past week. Western Australia accounted for 474KMT of the wheat additions with 296KMT in South Australia and 163KMT in New South Wales. A further 30KMT of wheat was also added in Queensland.

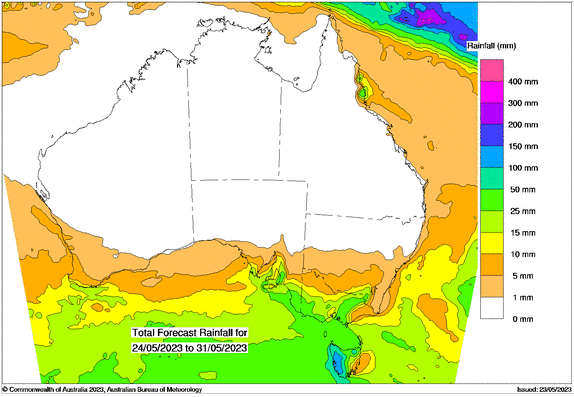

Australian Weather

Nearby weather forecasts offer no significant rain in the next couple of weeks. Extended weather models have been forecasting El Nino for some time and the drier than normal weather is already evident. At the same time, crop forecasters are projecting production based on average yield assumptions. Forecasters are cautious about lowering yields on weather predictions, so the balance sheets don’t become a weather forecast with planting still going on in some areas. However, forecasters still need to have a bias on the likely yield outcomes based on increased chances of below average in crop rainfall and the impact this will have on yields. Caution needs to be taken in the approach, as we have seen on many occasions, where areas have grown average to above average crops with below average rain because of the timeliness of the rain that did fall. It’s very early to be market down crops in mid-May when planting isn’t even finished.

AUD – Australian Dollar

The AUD tracked sideways through trade in a quiet start to the week. An absence of headline news flow and ongoing uncertainty surrounding US debt ceiling negotiations allowed investors to sideline major bets. Having found support on moves approaching US$0.66, the AUD struggled on moves above US$0.6650 and is now firmly entrenched within broader support and resistance handles.

After the uncertainty of the March banking crisis, the AUD has tracked between US$0.6580 and US$0.68. Unable to shake off near-term yield disadvantages and extend toward US$0.70, yet supported by longer-run expectations of a correction in rates and inflation pressures, the AUD is unlikely to see any significant shift in fortunes until a break in the current narrative emerges.

The post Basis Commodities – Australian Crop Update – Week 21, 2023 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.