Basis Commodities – Australian Crop Update – Week 2, 2023

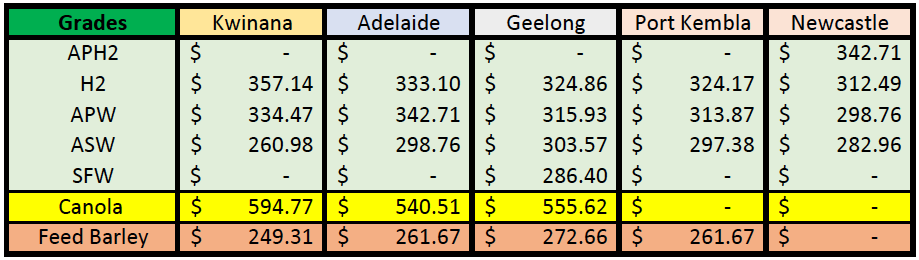

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Happy New Year and welcome to 2023. We hope you all enjoyed the festive period and made time to relax with family and friends. We’re looking forward to a fantastic year ahead!

The past week offered our first real look at the domestic markets for a few weeks with most traders returning from the holiday period. Domestic markets were broadly lower with the declines in overseas markets.

Given this is our first report of 2023, it is best to assess market activity in terms of the changes witnessed over the past three weeks.

Barley bids have strengthened considerably while wheat is a little softer, which along with a stronger AUD, has seen a consolidation in barley values in US$ terms. Farmer replacement barley from Kwinana and Adelaide has climbed by $25/MT in the past month. The timing of the relative increases in barley values coincides with the increased optimism for a resumption of trade with China following the meeting with Penny Wong and her Chinese counterpart in Beijing. While nothing has been confirmed, exporters are pricing a change in policy, after the Chinese New Year. Although there is nothing official, the tone does seem to have changed. Chinese state-owned coal importers are making inquiries about pricing Australian coal, and meat is again being sold in Chinese shops. As a side note, it seems to us that the Chinese are the masters of commercial pragmatism – witness ongoing Australian wheat imports and South American Corn. Australian Feed Barley is the cheapest global feedgrain by a country mile so the motivation for a change would seem to be there!

Wheat prices have been mixed over the past month depending on the zone. Western Australia’s higher protein wheat bids have strengthened relative to ASW, which represents the bulk of the crop this year as it did last year. 68% is ASW or GP as per CBH latest receival report.

Harvest is wrapping up in most areas with only the latest production areas still going. The national harvest is 90-95% complete and we can start to analyse what it is telling us.

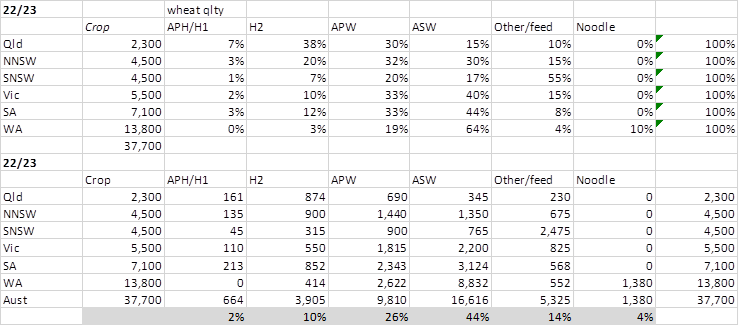

Note that there are some differences between the national crop estimates appearing with NAB Bank leading the charge at a whopping 42MMT. Our Analysts have raised their wheat number to 37.7MMT.

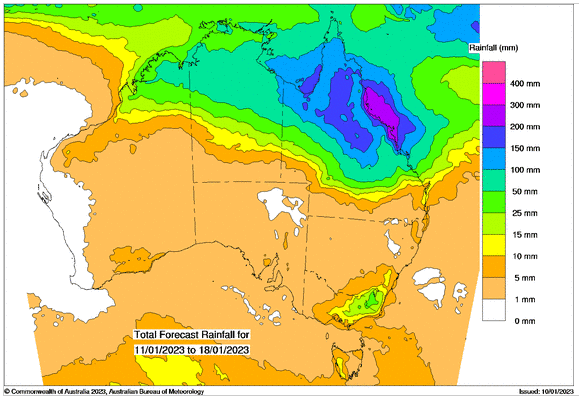

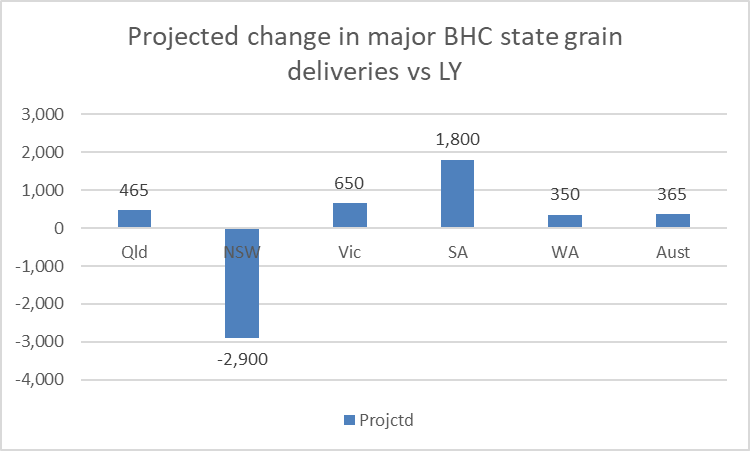

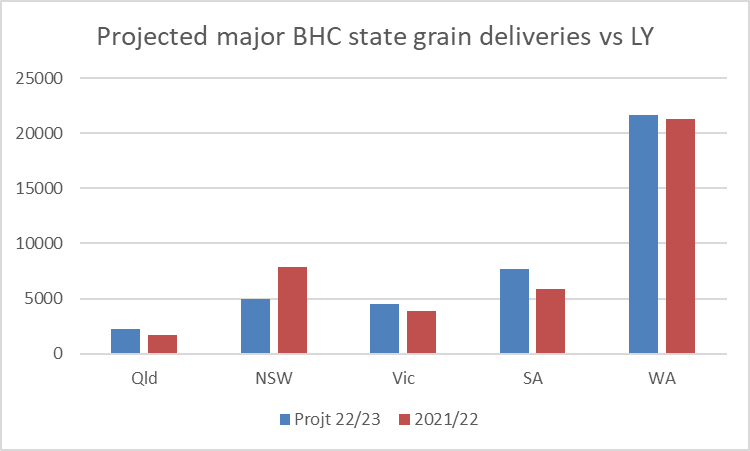

Yields have been very good in the northern half of Western Australia but not as good in the south where they suffered from dry weather early in the season. Wheat deliveries are only marginally higher than last year, and the harvest is ending. Production problems and abandonment in New South Wales (the second largest production state) have also limited the upside to the Australian crop. A smaller NSW crop is offset by the larger crops in Queensland, Victoria, and South Australia.

In terms of crop profile we have updated our numbers as follows :-

Shipping Stem and Ocean Freight

Shipping stem additions have been solid over the Xmas / New Year period. There has been 2.4MMT of wheat added to the stem in the past four weeks including the past week. Close to 0.5MMT of barley and 0.4MMT of canola has been put onto the stem in the same period. West and South Australia, as the main export states, have accounted for the bulk of the additions. East coast additions have been slowed by the delayed harvest but are improving, although internal logistics are still a challenge.

In terms of ocean freight, the expected weakness has continued into the new year. Right now, we are caught in the middle of that period at the end of the western hemisphere seasonal holidays but prior to the early Chinese New Year where, it would seem, there is little incentive to get on with anything. That said, there remains a widely held perception that the market will follow expectations and firm again immediately after the Chinese New Year. Any operators stuck with ships open in the next two weeks are taking any rate they can get. The caveat is of course that these rates are at the bottom of the barrel and only available for quick vanilla business. Owners are holding out (relatively) on longer haul fixtures or anything perceived as difficult with forward paper now a premium for all periods.

It should also be noted that global container freight rates are also back down toward the pre-pandemic lows as the Container Freight Index below shows.

Australian Currency

The AUD$ was higher into 2023 with a weaker USD$ but also optimism of a thawing in trade relations between Australia and China pushing it about 69 cents to the USD.

The post Basis Commodities – Australian Crop Update – Week 2, 2023 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.