Basis Commodities – Australian Crop Update – Week 3, 2023

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

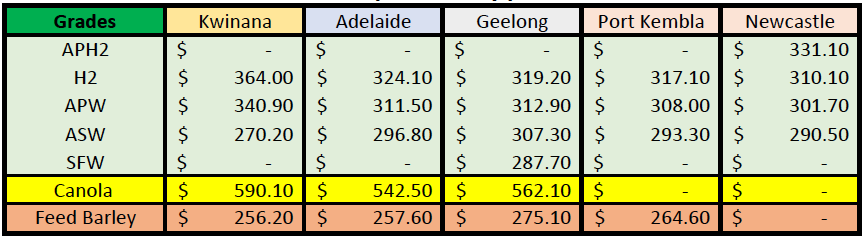

The Australian cash markets saw milling wheat grades moving lower while feed grains moved higher. Western Australia (WA) was the exception where the bids were little changed for the week. Stronger feed grain values are a combination of the New South Wales (NSW) crop situation and slow farmer selling. The decline in the NSW crop vs last year, combined with the quality profile of the harvest has significantly tightened the east coast feed grain balance sheet compared to last year. The other notable change is the quality profile of the crop with more barley making malting quality in NSW this year.

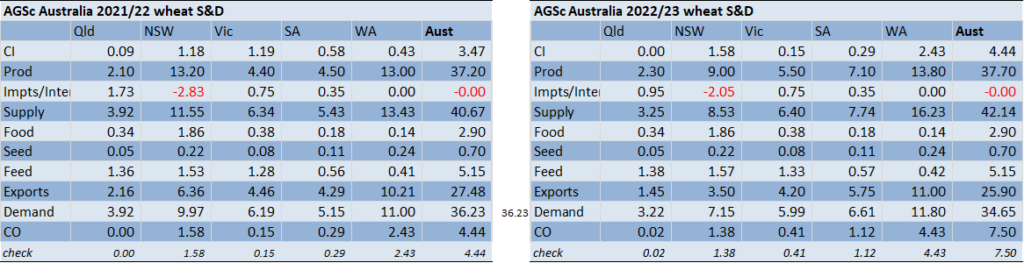

In WA, CBH said harvest deliveries topped last year’s record of 21.3MMT late last week. We have raised our WA wheat forecast by 0.8MMT to 13.8MMT.

In South Australia (SA), Viterra’s total grain receivals for the 2022/23 season are already a shade over 8MMT. This is more than a third more than last year’s final grain deliveries into the Viterra network, with several more weeks of harvest remaining in some areas. We have lifted the SA wheat crop forecast to 7.1MMT from 6.8MMT previously and edged Victoria higher on the back of the SA performance to 5.5MMT.

The net adjustments raise the Australian 2022/23 wheat crop by 1.2MMT (3%) to 37.7MMT.

We have included an update of the state wheat supply and demand below with the larger wheat crop. Note, our wheat exports are smaller than USDA at 25.9MMT because of the state configuration of the crop and limitations in export capacity at the state level.

In terms of crop profile we have updated our numbers as follows :-

Ocean Freight

We could easily copy and paste last week’s report again with sentiment dominated by a feeling nothing will happen until after the Chinese New Year.

The most interesting point over the last week has been bunkers rising about $50pmt across the board – now back over $600pmt for Singapore delivery.

The post Basis Commodities – Australian Crop Update – Week 3, 2023 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.