Basis Commodities – Australian Crop Update – Week 51, 2023

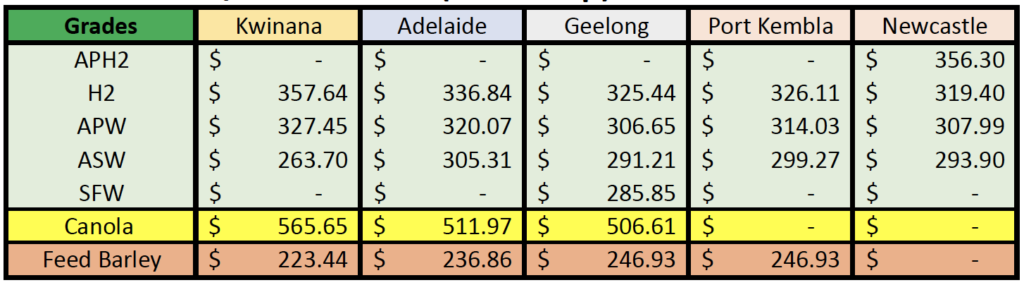

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

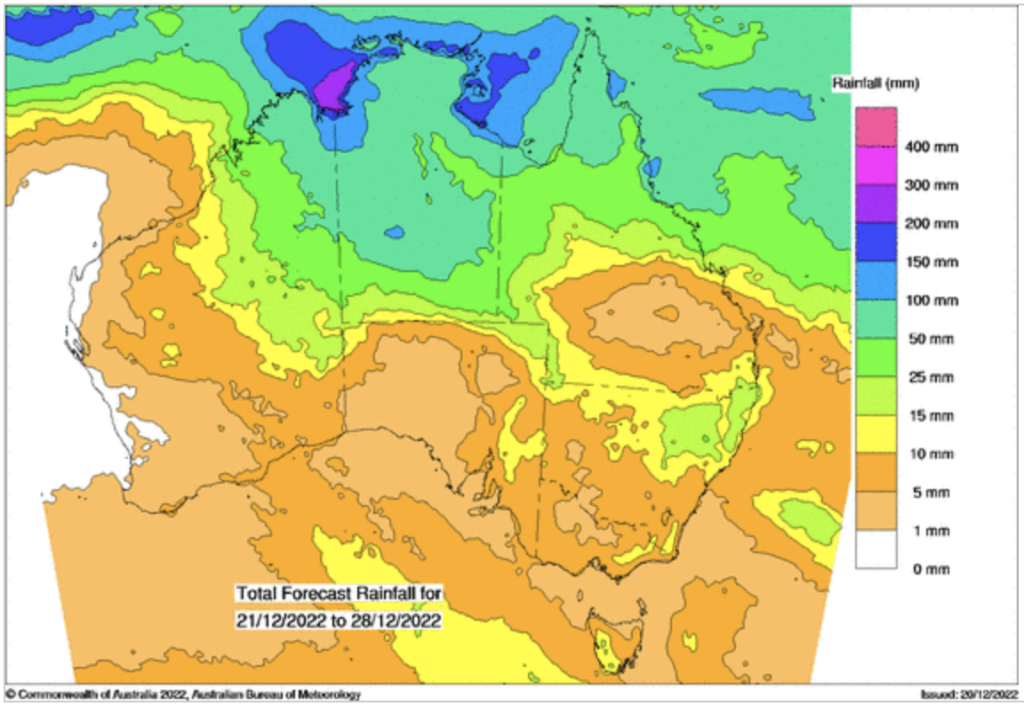

Another week of mostly fine weather made for another big harvest week last week. As of the 12th of December, the main bulk handlers had received over 24MMT of grain. There have not been any major changes in the harvest patterns over the past week. We continue to see big yields (record or near record high) for Western and South Australia.

In New South Wales, farmers are wrapping up in the North and Central West with reports of lower than expected yields. Numerous farmers have said that crops looked 3-4 t/ha, but most have come in in the low 2’s or even lower. There has been a lot of vegetation, but yields did not match the vegetative mass as the excessive spring moisture took its toll through the pollination and filling. Quality has been variable. The protein has been reasonable but there are lower test weight, falling number and screenings issues which will provide opportunities to those buyers who are prepared to be flexible with specifications.

GIWA (Grain Industry of Western Australia) released its December crop estimates this week which pegged the total 2022/23 winter grain gravest at 24.7MMT up from the 24.0MMT last year. They said grain yields in many cases were record high and this justifies the larger crop forecasts, wheat proteins were lower due to the dilution effect of the high yields and other quality parameters were good with low screenings and high-test weights. As expected, wheat proteins were also lower than normal last year.

In the cash markets wheat bids were firmer with the recovery in futures and a weaker Aussie dollar.

Ocean Freight

It feels like Asia has signed off for the year with many market players already travelling for an elongated break. At risk of sounding like a broken record, Asia has gone sideways again over the last seven days. There is enough business to prevent the market collapsing but not sufficient to stop it easing. China remains quiet on spot business. There has been a steady flow of Australian grain cargoes into Indonesia and Philippines for Q1 but in a busier and more interesting market these would not warrant a mention!

Merry Christmas and Happy New Year

As we wrap up for 2022, we’d like to wish you, your families and loved ones a very Merry Christmas and Happy New Year. For those who celebrate at this time of year, we hope you all enjoy the festive period and have time to relax with family and friends. We look forward to working with you in the new year and beyond.

The post Basis Commodities – Australian Crop Update – Week 51, 2023 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.