Basis Commodities – Australian Crop Update – Week 17, 2023

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Australian Grains & Oil Seed Market

Domestic markets were steady to softer over the past week. Export covering for wheat was steady with the bids trying to pull it lower but there appears to be enough depth of demand to keep values supported. The sorghum market is again softer week on week on the back of lower buying interest from bulk/container customers, citing cheaper alternatives and a bearish sentiment globally for feed grains. The canola market has also quietened down in the past month with grower selling decreasing after the high prices seen two to three months ago. Barley prices have firmed slightly in the wake of the news that China may remove their tariffs in the future, although some of this was already priced in and most analysts feel this will have more impact on 2023/24 values. The barley prices will likely go into a holding pattern for the next three to four months until a result is finalised.

The Chinese Ministry of Commerce has announced a review of its existing anti-dumping and anti-subsidy duties on barley imports from Australia, a major move toward reducing the ongoing trade tensions between the two nations. The ministry gave details of the barley tariff review in a statement on Friday, confirming an earlier announcement from the Australian government on Tuesday. In return for the review, Australia has agreed to temporarily suspend its case against China at the World Trade Organization. In the Friday statement, the Chinese government said the review would begin on April 15 and would finish within one year. The ministry said the decision had been made in response to a request from the China Alcoholic Drinks Association to end the tariffs and made no mention of a deal with Australia. The Australian government said this week that the review would take between three and four months to complete, but there is no mention of that timeline in China’s statement.

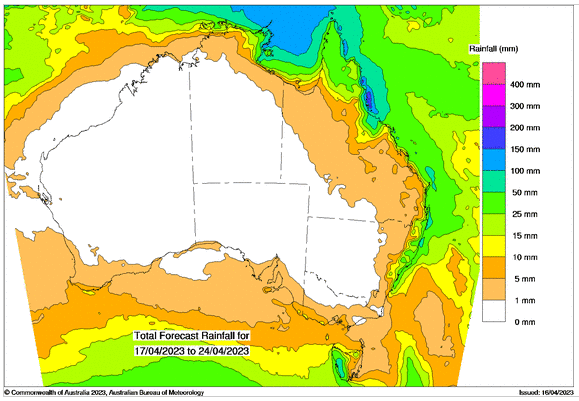

Farmers are busy planting pulses and canola across Australia’s southern cropping zones, and this has extended into the central regions. Canola plantings started in earnest over the past week. The general feeling is that canola plantings will remain large, although probably back a little on last year as farmers in the more marginal canola areas ease off a little. Pulses are also being planted in the south. Most farmers will wait another week or so before starting to plant wheat. Australia’s southern cropping areas received more rain last week, but the central and northern areas are looking for rain to replenish the topsoil which is dry.

Ocean Freight Market & Export Stem

It appears the ocean freight environment is showing signs of firming. Smaller ships feel like they bottomed out at the end of last week and there was plenty of fresh enquiry to begin the week. Several very cheap fixtures for spot/ppt tonnage from Australia have emerged but this is not representative of where the market sits today. A few spot ships remain but beyond that the tonnage list looks thin for the next few weeks. China remains a sleeping giant, so coal is still the main driver for Supramax/Ultramax market in Asia. When the coal is quiet, freight eases off and vice-versa. Period rates have followed the same pattern as the previous four to five months and remained detached from spot rates.

Only 30KMT of barley was put on the stem over the past week (Port Giles, South Australia). There was 134KMT of canola added to the stem. This included two Panamax vessels in Western Australia and 24KMT into Riordan’s at Geelong. It was a busy week for pulses with 52KMT of lentils put onto the stem. Most of this was in South Australia but there was also 12KMT put on the stem into Geelong. There was 25KMT of faba beans added in Pt Adelaide and 55KMT of sorghum put on the stem into Brisbane.

Pulses Market Update

According to the latest export data from the Australian Bureau of Statistics, Australia exported 84,879 tonnes (MT) of chickpeas and 223,581MT of lentils in February. The chickpea figure is down 20 percent from the 106,183MT shipped in January, but the lentil figure is up 83pc from the 122,464MT shipped in the previous month to what is believed to be a new monthly record for Australia. Bangladesh was the biggest market by far for chickpea exports, taking 56,957MT, or 67pc, of the total, with Pakistan on 10,506MT and the UAE on 6,583MT the second and third-largest markets respectively. India was the major market for lentils, taking 122,504MT, or 55pc, of the February total. Bangladesh on 47,156MT was the second-biggest market for February-shipped lentils, followed by Sri Lanka on 15,745MT.

Australian Weather

South Australia received widespread rain on the weekend with 15-25mm across most of the state. Most of Victoria received 15-25mm with the rain extending into Southern New South Wales, however the rainfall was lighter and patchier towards the centre of the state.

AUD – Australian Dollar

AUD/USD continues to trade below most banks fair value estimate of 0.70 and has traded below this level for the last 12 months. The two-year interest rate differential with the US is also weighing on AUD/USD along with predictions commodity prices will decline by 15% to 20% this year.

The AUD is expected to recover later this year as market participants price an eventual recovery in the global economy.

The post Basis Commodities – Australian Crop Update – Week 17, 2023 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.