Australian Crop Update – Week 31, 2023

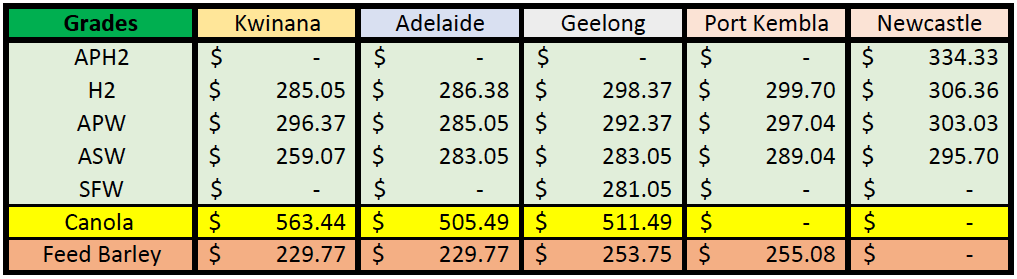

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Australian Grains Market Update

Local Australian markets were firmer last week given the news from Ukraine that Russia had started its bombardment of grain storage and port assets. The Australian farmer responded by firming their selling ideas across all port zones and pushing international bids further away from any new business. Some port zones are still showing old crop premiums for wheat where exporters are still chasing some tonnage, but most are reflecting discounts to the new crop bids. New crop APW is about $285-295 FOB equivalent. Barley is around $220-225 FOB with most in the Australian trade expecting the Chinese ban on Barley to be lifted at some point in August.

That said a significant amount of the gains were handed back in the later part of the week with market participants hesitant about pushing ag markets higher without the support of confirmed balance sheet losses or export demand to support the higher prices.

Australian Grains Industry Conference 2023

Last week the annual Australian Grains Industry Conference (AGIC) was held in Melbourne. The overall tone was subdued with continuing concerns about the imminent arrival of El Nino conditions in Australia, a lack of export competitiveness and increased volatility associated with the Black Sea conflict. There was some positive sentiment around hopes for increased grain exports to India and a resumption of barley business to China although these were tempered with phytosanitary/quarantine concerns.

Ocean Freight Market Update

Another week of struggle looms for shipowners. The market remains weaker in the north with fewer trade options, so owners are tending to look south for business where there has been an up-tick in demand. Panamax has traded sideways in the recent past. Yet again it's mostly coal stems and steels/generals backhaul business that are providing the impetus.

Very little cargo interest is evident, and the conclusion of the Black Sea Grain initiative has left a small build-up of tonnage in the eastern Mediterranean. Persian Gulf ships have firmed slightly in line with better numbers out of East Coast Africa but we're not sure it has broken the USD10kpd barrier just yet. Period numbers for modern tonnage remain relatively high but Owner with sub-index tonnage is being more pragmatic. Bunker prices rose about $20pmt last week which caught out a few voyage charterers.

We expect more of the same over the next few weeks - maybe a few minor variations here and there but nothing seismic. For now, we cannot discern any major drivers which will impact the ocean freight market prior to Sept/October.

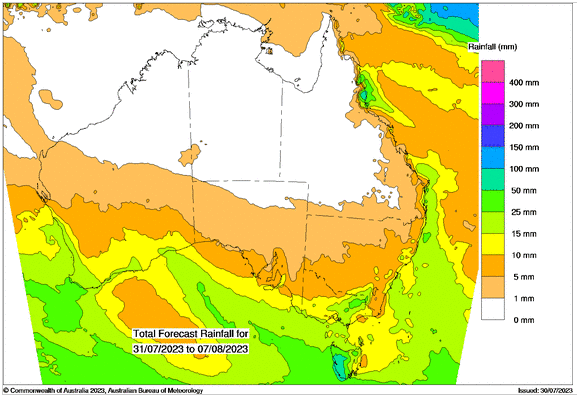

Australian Weather

Over the last few weeks, dry weather has not helped farmer engagement to sell down their old crop positions. It has been a “dry” July for most cropping regions with most areas only seeing 30-40% of the normal monthly rainfall. The latest normalised difference vegetation index (NDVI) weekly anomalies showed crop conditions are declining in the northern areas of Western Australia and New South Wales and southern Queensland. It is not irreversible, but it will be in two to three weeks for the northern areas without rain, particularly if temperatures start to climb. Crop conditions through Southern New South Wales, Victoria, South Australia and Western Australia are very good. Farmers are saying crop conditions for this time are as good as last year and the data tells a similar story. We are slated to see some showers this week.

8 day forecast to 7th August 2023

Source: http://www.bom.gov.au/

Weekly Rainfall to 31st July 2023

Source: http://www.bom.gov.au/

AUD - Australian Dollar

The Australian dollar is slightly weaker to start the week when valued against the USD. Last week, Australian inflation slowed more than expected in the second quarter thanks to falls in the cost of domestic holidays and petrol, suggesting less pressure for another interest rate hike in August and sending the AUD sharply lower.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.