Australian Crop Update – Week 49

Harvest and Weather Update

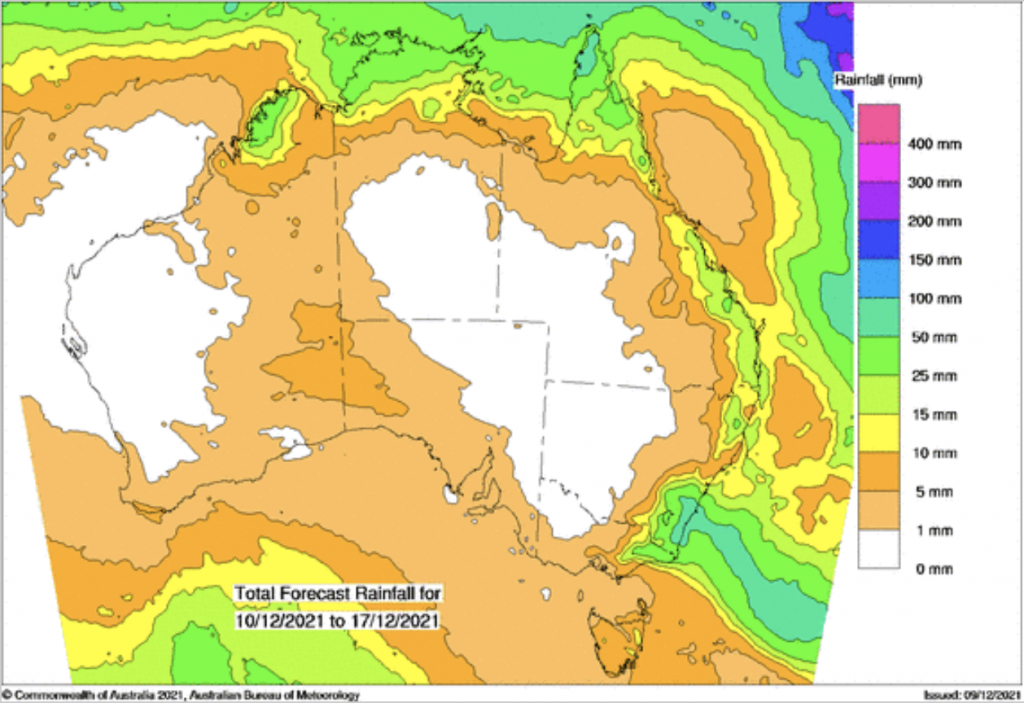

The Australian domestic markets are starting to work through the aftermath of the torrential rains that fell across NSW a week ago, downgrading the quality of a large percentage of the state’s grain harvest. Harvest, which is a third complete in NSW, was underway again in the latter part of the week, but progress will be slow and the harvest in NSW may extend into January which is very late.

Harvest is advancing more quickly in other states. Victorian quality has been good with a reasonable percentage of H2 and APW coming out of the Mallee. South Australia’s grain deliveries are also advancing with quality reasonable.

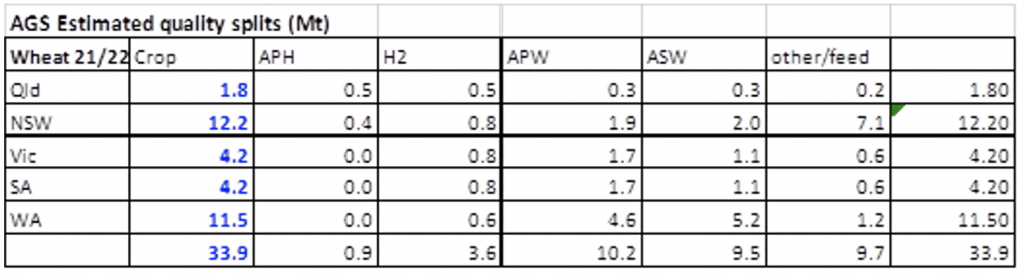

ABARES issued its December crop report where they put national wheat production to 34.4MT. Barley production was forecast at 13.3MT and canola at 5.7MT. But the issue is quality and less so quantity now.

Source: https://www.agscientia.com.au/

A lot of the wheat has been downgraded to GP and lower with some patches of ASW and the odd paddocks of APW.

Feed wheat is being offered into feed markets across the east coast. Good quality wheat bids came down with the weaker dollar and declines in U.S. futures, but higher prices are still being demanded and ASX futures for the January contract are still above 400. Feed barley came under pressure last week with markets turning from all bids to all offers on the realisation the big feed wheat event will displace a lot of barley feed demand.

Exporters are quoting Western Australia APW1 10.5 pro at a US$375 FOB vs ASW with no protein guarantees at $320 FOB. Feed wheat is being offered ex eastern Australia at $305-310 FOB.

Australia is off to a quick start to the 21/22 export program, unlike 20/21 where wheat carry in stocks were drawn down by drought. Australia exported 1.478MMT of wheat in October. Barley exports were solid at 482KMT.

Ocean Freight

We have seen the firmest week for a month as owners really found they had some traction again. In general, rates in Asia have improved about $2-3k per day this week. It still doesn’t feel like the market will fly again in the near term, but for sure rates have moved forward off-the bottom of the curve. The big question is whether this week’s renewed activity from China represents the end of a period of applied restraint or is it merely a temporary loosening of a tightly held economic noose.

Currency – AUD

The Australian dollar fell through trade on Thursday, unable to sustain the weeks upward trajectory amid a risk-off tone that enveloped financial markets. Added uncertainty surrounding the state of the Chinese property market. While Chinese officials have stepped into curb restrictions imposed on the property market and sought to add stimulus in a bid to contain any contagion event, there are ongoing concerns these failures will spill over into the broader Chinese economy. With investors moving away from risk assets, the AUD gave up highs at 0.7180 shifting toward below 0.7150.

| USDA Report Summary

The initial feel of the report was bearish wheat, neutral corn and slightly supportive barley. However, on closer inspection we feel wheat and corn were both neutral. The USDA raised global wheat production and lowered U.S. wheat exports. Forecast U.S. exports are now down 15% or 4.1MMT from 20/21 and 21/22 wheat stocks were raised by 0.4MMT. On the global front, wheat production was raised by 2.6MMT to 777.9MMT. As expected, USDA lifted Australian production by 2.5MMT to 34.0MMT. They also raised Russia by 1MMT to 75.5MMT, Canada by 0.6MMT to 21.7MMT and the EU was up by 0.3MMT to 138.7MMT. Wheat exports were raised by 2.3MMT to 205.5MMT. Australia was increased by 2MMT to 25.5MMT and the EU was raised by a further 0.5MMT to 37MMT. Ukraine was lifted by 0.2MMT to 24.2MMT, Indian was up by a further 0.3MMT to 5.3MMT. It was a neutral report for corn with limited changes. However, changes to wheat will impact corn. With larger feed wheat exports from Australia, it’s likely to erode some corn demand in the Pacific. USDA didn’t make any changes to the US 21/22 corn balance sheet. Global barley production was cut by 0.7MMT to 145.5MMT (down 13.9MMT on last year) while global exports were raised by 0.5MMT to 34.1MMT (-1.7MMT on last year). USDA raised Australian barley production by 13.0MMT. They cut EU barley production by 1.2MMT to 52.8MMT and trimmed Canada by 0.1MMT to 7.0MMT. Australian barley exports were raised by 0.5MMT to 8.5MMT (8.3MMT last year). We think this will be a challenge, given Australia hasn’t got access to Chinese demand which will necessitate a high proportion of the Saudi demand, which we don’t think is there with current market dynamics. |

To receive this information directly to your inbox as soon as it’s released, sign up for our newsletter below.

The post Australian Crop Update – Week 49 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.