Australian Crop Update – Week 44

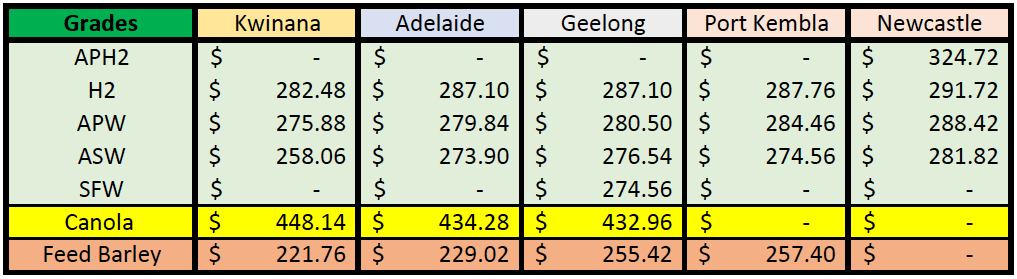

FOB replacement values using Australian track bid/offer (AUD) – not an indication.

Harvest and Weather Update

It’s still very early days for Australia’s 2021 winter grain harvest. Harvest is still at least 2-3 weeks away in Victoria and Viterra has only taken about 1000MT of grain deliveries in its entire network.

Stormy, unsettled weather slowed last week’s harvest activity. There was 5-40mm of patchy storm rain across Southern Queensland, although the heaviest falls were generally to the east, so it missed the larger cropping areas. Northern New South Wales also saw some isolated storms, although only a few areas saw any significant rain. Daily showers across Western Australia’s cropping areas slowed harvest progress with totals of 10-40mm for the week across most areas. Unsettled weather is set to continue across eastern Australia next week with southern New South Wales and Victoria likely to see rain (15-40mm) in the second half of the week. The La Niña and negative IOD weather patterns are expected to result in a wetter than normal start to summer.

Grain Markets

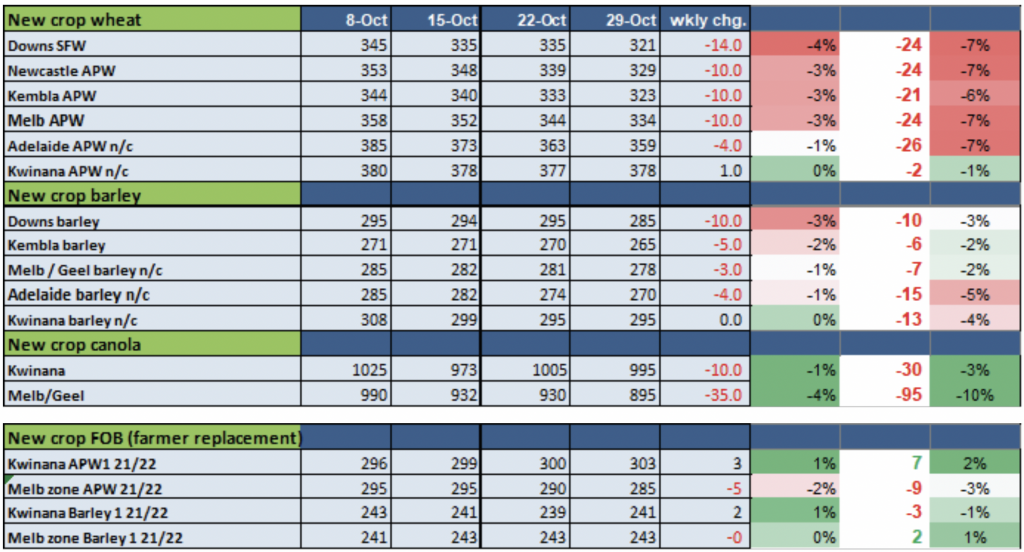

Domestic markets came under pressure on increased farmer selling ahead of harvest. Wheat bids were down $5-15/MT except for Western Australia where Kwinana was steady. Barley bids were off $3-10/MT, again apart from Kwinana which was unchanged. Canola bids were down $10-35/MT. East coast wheat and barley bids came under pressure during the week on increased farmer sales ahead of harvest.

Prices for higher protein grades were stronger in the later part of the week which suggests there is a limited amount of high protein wheat coming off so far.

On a cash basis, Australian wheat and barley is comfortably competitive. IGC kept its indicative export quote for Australian APW wheat at $327/MT FOB Adelaide with ASW at $323/MT and feed barley export at $271/MT FOB Adelaide, and these feel about right. In terms of stem availability though, 2021 is just about done and Jan/Feb is getting tighter by the day.

Ocean Freight

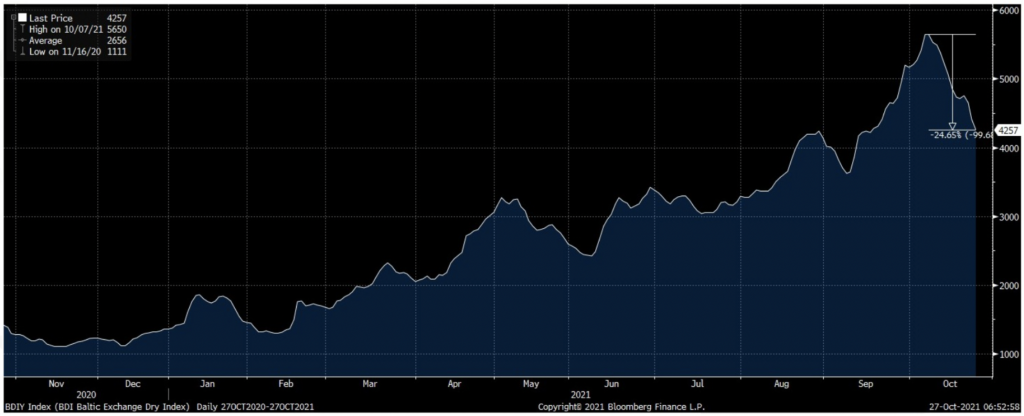

Last week was extremely quiet. Charterers are holding off because they believe this is the correction they have been waiting for and owners are not willing to fix at a short-term dip. Lack of demand across the board on the near position seems to be the main reason for the correction. The bullish argument remains congestion in China and COVID inefficiencies still influencing tonnage supply. Bunkers remain firm and the current sentiment suggests they will remain so for the near term at least.

Broadly speaking, Supramax and Panamax have dropped around USD 8-9k for the benchmark Pacific Round Voyage. Handymax is holding better, but the spread to the larger Supramax suggests the Handymax will also have to ease.

It’s easy to forget that in 2004-2009, the last time we saw a substantial narrowing of S&D, we saw large fluctuations and it was not a straight line up nor down. Maybe we are seeing the same type of volatility?

Currency

What a difference a week makes. The market is currently pricing almost a 40% chance of a hike in interest rates in February next year. Data released over the weekend showed China’s factory activity contracted more in October than expected with high input prices and power disruptions.

The strongly inflationary data put a fire under the USD which saw material gains against the AUD.

In what is shaping up as a big week for the Australian dollar, today’s PMI’s out of China will be closely watched with market participants keen to gauge how the domestic manufacturing sector is navigating supply chain stresses and power outages.

To receive this information directly to your inbox as soon as it’s released, sign up for our newsletter below.

The post Australian Crop Update – Week 44 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.