Australian Crop Update – Week 37, 2023

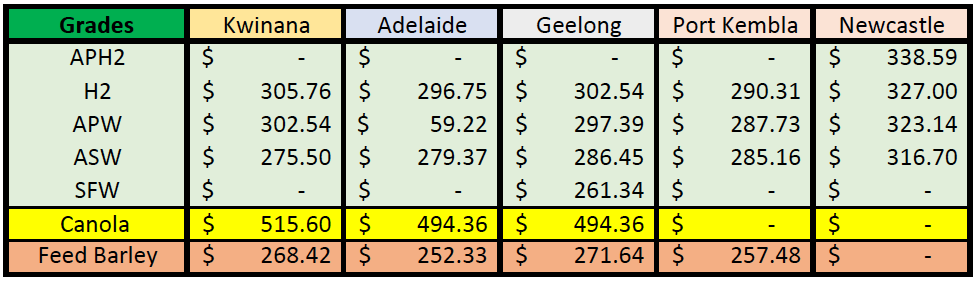

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Australian Grains Market Update

Australian wheat bids were firmer last week on the back of dry weather forecasts and shrinking crop expectations. New crop wheat was up US$6 per metric tonne (MT) during the week, and up over US$60/MT over the last month. Increases were seen across most port zones. South Australia (SA) saw the sharpest weekly gains, although this was largely catching up with other port zones. New crop wheat in Victoria (VIC) is US$300 FOB. Kwinana APW1 was up US$3/MT for the week to US$298 FOB. Queensland (QLD) and Northern New South Wales (NSW) are reflecting larger premiums for wheat which will draw additional supplies into the domestic market for feedlots.

Barley bids were modestly firmer last week across most zones with the crop concerns although gains were not as large as wheat.

Canola bids drifted lower with the selloff in Canadian and French futures.

The 23/24 harvest commenced in Central QLD last week. It is too early to offer any feedback on yields or quality. We expect average yields given the season and the quality should be good with plenty of high protein wheat hitting storages this year.

Australian Pulse Market

The Australian pulse market can be described as a weather market for farmers at this point in time who have high expectations of pricing with little demand. With the European season gathering the attention of international customers, Australia is uncompetitive at this stage across the board for chickpeas, lentils and faba beans. In some cases, farmers expect USD750/MT FOB for new season chickpeas which is well above export parity.

Harvest has commenced in the northern regions bringing in new season chickpeas. However, we are still some five to six weeks away from any real momentum further south for the faba bean and lentil crops. At this stage, crop conditions are favourable for the southern regions and with a drier finish will see lower yields but higher quality. It is expected that pricing will come back at harvest where export opportunities for Australia can be found.

Ocean Freight Market Update

Another week has passed and the market has continued to firm across all segments. The Atlantic is still leading the way where Supramax and Ultramax sizes are now fixing in the 23/24k for front haul business and Handymax sizes are now asking 18/20k level for same. The firmness of the Indian Ocean is now seeping into Southeast Asia where there have been reports of Supramax sizes fixing in the mid/high with rumours of a Ultramax’s fixing in excess of 20k for quick Indo/China coal run. Bunkers still remain firm with prices in Asia around $650/675pmt level in the major ports

It is still hard to pinpoint the reasons behind the recent improvement rates however the longer it goes on, the more faith Owners have in it continuing. All the forward paper is currently trading at a premium to spot levels for the rest of 2023 so charterers are starting to believe this push will be sustained in the medium term.

Australian Weather

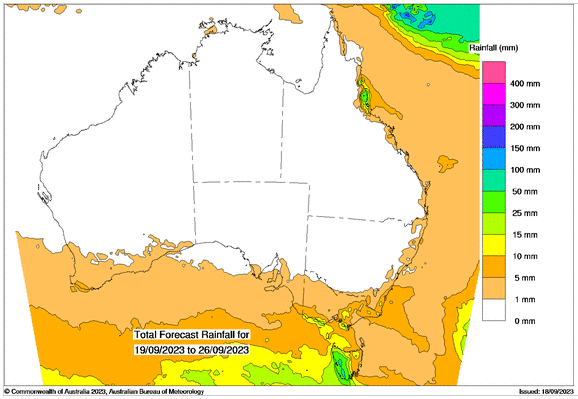

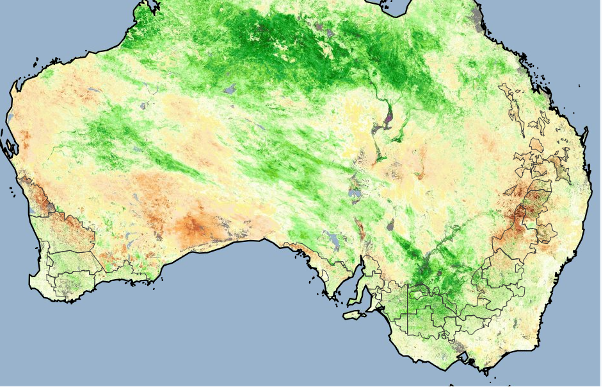

Recent rainfall in southern WA will benefit crops there preventing further downside in the short term.

Weather models continue to report a warm, dry outlook for the coming weeks in most areas although southern VIC and southern SA may get some rain this week.

The models are dry for the second half of September with above average temperatures expected. The Bureau of Meteorology is showing a completely dry October with average daytime temperatures expected to be 2-3 C warmer than normal.

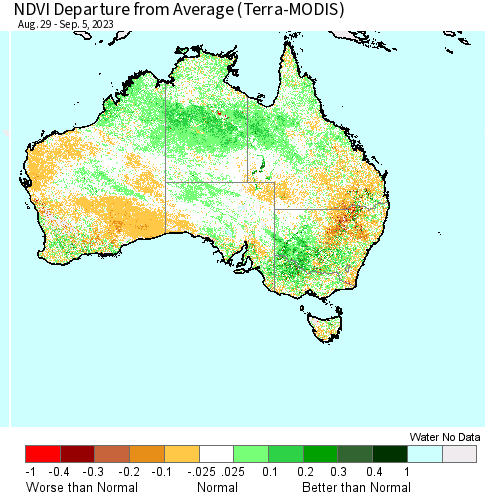

There were sharp declines in the vegetation index anomalies in the northern cropping areas in the first week of September.

Australia is bracing for a hotter southern hemisphere spring and summer this year after the possibility of an El Nino strengthened and the Bureau of Meterology said the weather event could likely develop between September and November.

8 day forecast to 26th September 2023

Source: http://www.bom.gov.au/

Weekly Rainfall to 18th September 2023

Source: http://www.bom.gov.au/

AUD - Australian Dollar

The Australian dollar is weaker to start the week when valued against the US Dollar trading above 64 US cents. The Australian Dollar reversed its course against the US Dollar after registering gains during the Asian session where China retail sales and industrial production grew faster than expected in August. Industrial production grew 4.5% y/y in August, while retail sales, increase 4.6%. The Chinese economy has struggled to rebound amid a property slowdown, declining exports and low consumer demand. The Australian Dollar strength has a direct correlation to the strength of the Chinese economy hence if China is slower then Australia will follow.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.