Australian Crop Update – Week 30, 2023

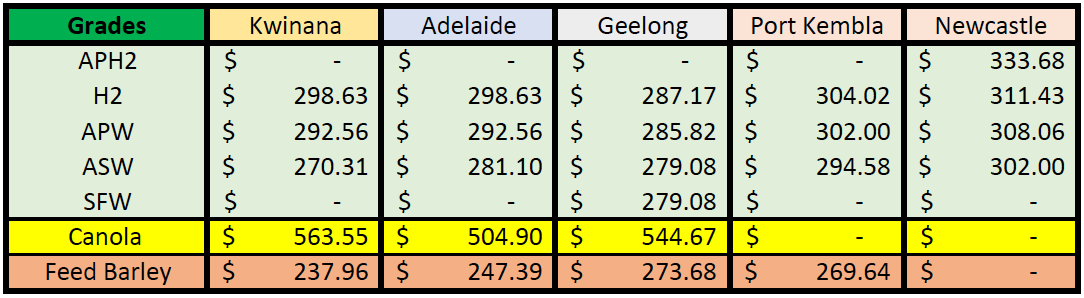

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Australian Grains & Oil Seed Market

The Australian cash wheat markets firmed last week due to the rally in US futures, however the buyers still remain in wait-and-see mode. The cropping regions did not see a lot of rain which firmed values for barley and canola also. Gains were mostly seen in the Western Australian market. However, we feel that the gains will be short lived as Australian grain remains uncompetitive internationally as we get closer to harvest.

The annual Australian Grains Industry Conference (AGIC) will be held this week in Melbourne over the 26th and 27th of July 2023. The Basis Commodities team will be attending, therefore our out-of-office is on. The conference is an industry-run conference for grain market participants and service providers, hosted by leading grain industry associations Grain Trade Australia, Australian Oilseeds Federation, and Pulse Australia. It is a good opportunity to sense the prevailing mood from this origination in terms of tensions in the Black Sea.

On the back of this, we will also issue an update to our Australian balance sheets.

Domestic demand assumptions are largely unchanged. Feedlot numbers in the north are expected to remain high courtesy of the cheaper cattle prices and the ever-increasing capacity. Feedlot operators have shown in recent years they will keep the pens near capacity most of the time. The question in the north is which feed grains and where will they be sourced from. We estimate the Queensland (QLD) feed grain usage for 2023/24 at 2.6MMT with 70% of this coming from the feedlots.

National barley production remains large at 10.1MMT. Favourable weather in the key production areas of Southern New South Wales (NSW), Victoria (VIC), South Australia (SA) and southern Western Australia (WA) help to insulate production despite the dry weather worries in the northern cropping areas. This also allows sizable exports from the southern cropping areas. We have boosted barley feeding at the expense of wheat with the big spreads which we expect to continue. Feedlots, poultry, and pigs continue to maximise barley feeding. Nonetheless, this still allows for exports of more than 6MMT, which won’t be easy given the Black Sea pricing and how uncompetitive Aussie barley is into Saudi, which has been the major export destination in recent years.

It is expected that China will lift its anti-dumping measures on Aussie barley imports. China is more comfortable with its feed grain imports now as they have Brazilian corn as well as a sizable volume of downgraded domestic wheat which is expected to flow into domestic feed channels.

Ocean Freight Market Update

The freight market continues to be quiet. Handmax had a tough week. Plenty of tonnage supply saw rates under real pressure in the near term. Nice Japanese ships are only able to achieve around $7kpd. Supramax and Ultramax had small upticks in activity last week as the Indonesia / Pacific Round Voyage Coal provided some demand side impetuous. Ultramax sizes were being talked above $10kpd again for ships south of CJK (Chinese, Japanese, and Korean).

Unfortunately, we have seen this same chain of events time and again over the last two months where a subdued market gets occasional spurts from Indonesian coal demand, with the market subsequently easing off when the coal stems dry up. We can't see any substantial positivity until October when the Indian monsoon ends at this stage.

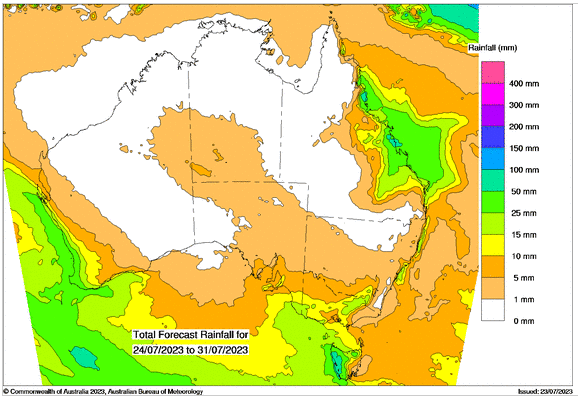

Australian Weather

Australian cropping regions will remain mostly dry over the next 10 days, with little rain to be seen in key growing areas. Dry areas in northern WA cropping zones and northern NSW are expanding. More enquiry for drought feeding is emerging daily firming new crop pricing and this is something we need to keep an eye on as tensions in the Black Sea grow. The dry weather pattern is a major concern for winter crops where yields will be a function of the rainfall and temperatures from August 15 through September and October.

Australia’s Bureau of Meteorology (The Bureau) said Central and eastern Pacific Sea surface temperatures (SSTs) are exceeding El Niño thresholds. Models indicate further warming is likely, with SSTs remaining above El Niño thresholds until at least the end of the year. Some other agencies are saying ocean temperatures in the mid Pacific have already reached El Nino thresholds. The Bureau said the Indian Ocean Dipole (IOD) is currently neutral. All models suggest a positive IOD is likely to develop in late winter or early spring. A positive IOD typically decreases winter–spring rainfall for much of Australia.

day forecast to 31st of July 2023

Source: http://www.bom.gov.au/

Weekly Rainfall to 23rd July 2023

Source: http://www.bom.gov.au/

AUD - Australian Dollar

The Australian dollar edged upward through trade on Monday, finding support amid weaker US PMI data. The US dollar retreated after the composite PMI index fell to 52, down from 53.2 last month and well below consensus expectations, amplifying calls for the Fed to call an end to its rate-tightening cycle. The AUD crept toward US$0.6750, amid rising expectations of widespread China stimulus. However, gains were pared back as reports pre-politburo meeting notes suggest fiscal stimulus will be targeted.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.