Australian Crop Update – Week 2, 2022

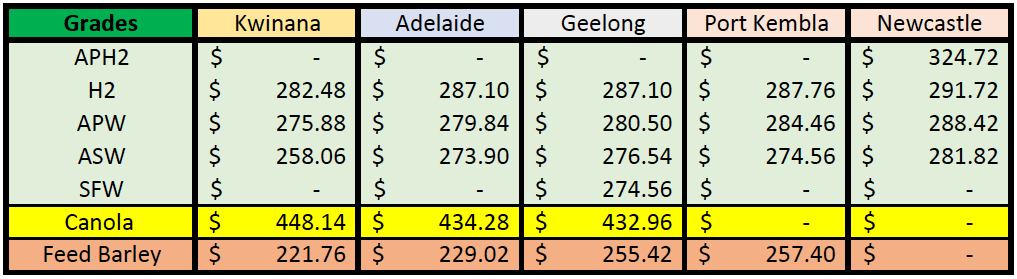

FOB replacement values using the Australian track bid/offer (AUD) – not a FOB Indication

Market Update

Happy New Year and welcome back to our weekly commentary.

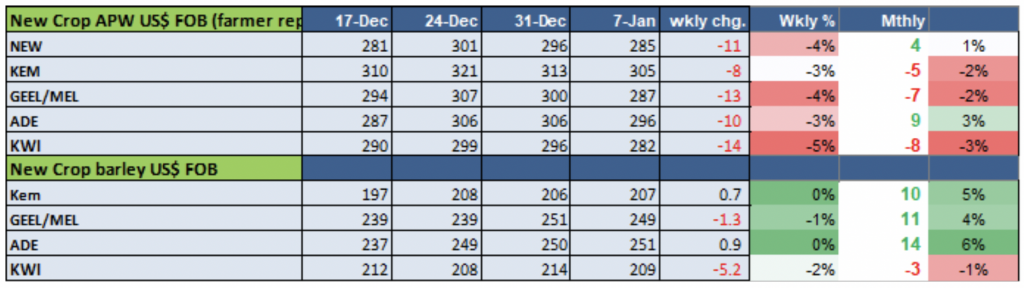

Wheat prices fell across all zones last week in line with the general decline in U.S. futures. However, quality remains a major problem. Half of the Western Australian wheat receivals were low protein ASW at <9% protein and about 75% of the New South Wales wheat crop is either SFW or GP quality which is sub 150 FN and not suitable for food milling. There is also about 0.75-1.0MMT of feed wheat in South Australia.

Global barley values have been steady in recent weeks in seasonally light trading. Australian barley quotes remain comfortably the cheapest origin at $266 FOB (Adelaide). Internal barley prices in Australia were firmer last week despite declines in wheat values as exporters struggle to attract farmer selling. Farmers are in no hurry to sell barley, which is typically their lowest-priced crop, to meet early shipments. Most appear content to wait and see what the planting weather looks like in March. Truck shortages through southeast Australia also appear to be playing a part, with more of the barley crop held on farm compared to wheat and canola, which eliminates using rail.

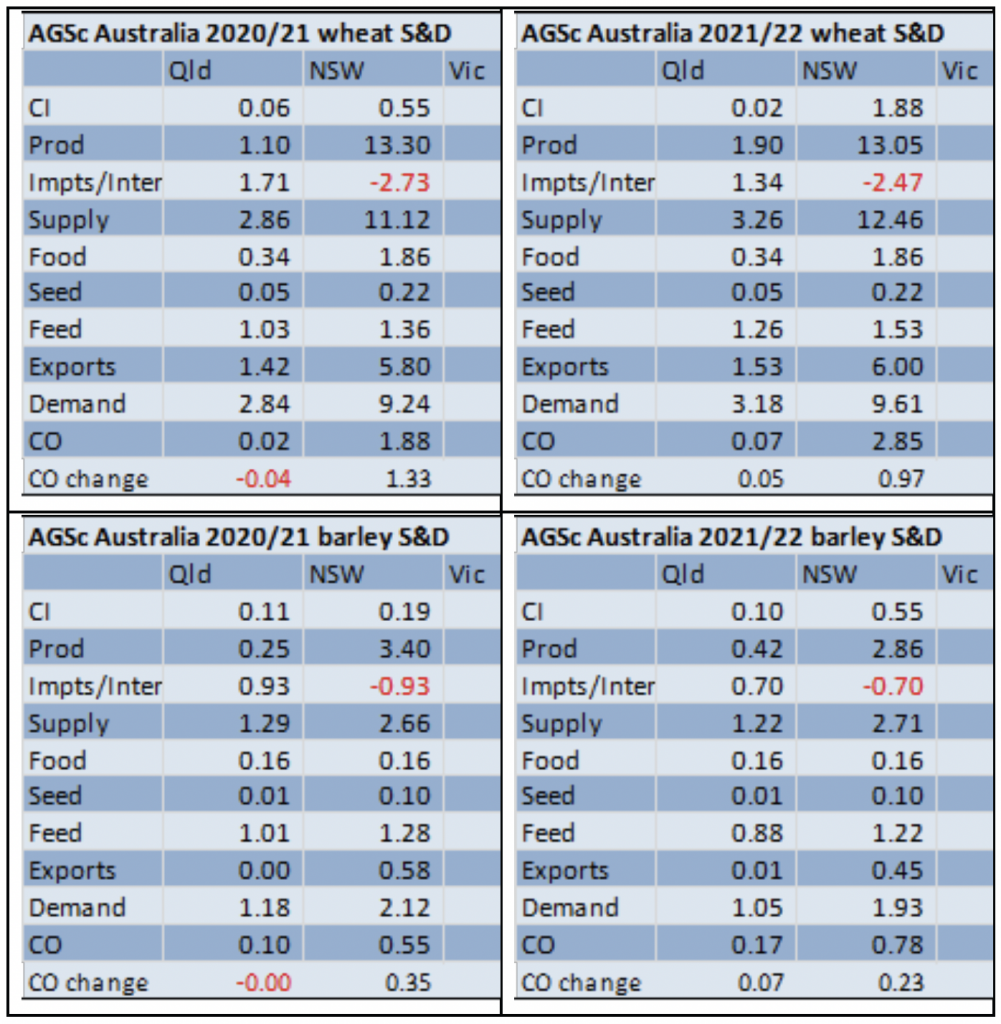

Our Analysts AgSc updated their Australian production and supply demand estimates yesterday. We have raised the national wheat production number to 36.2MMT which included 13.0MMT in New South Wales and 12.2MMT in Western Australia. Barley production is down on last year at 12.9MMT, while canola production is sharply higher at 6.1MMT on the back of the 3MMT plus Western Australian crop. We have raised Australian wheat exports to 24.5MMT, barley to 7.0MMT and pegged canola exports at 4.2MMT. Export capacity and a slow start will limit the volume of shipments.

Australian Supply and Demand

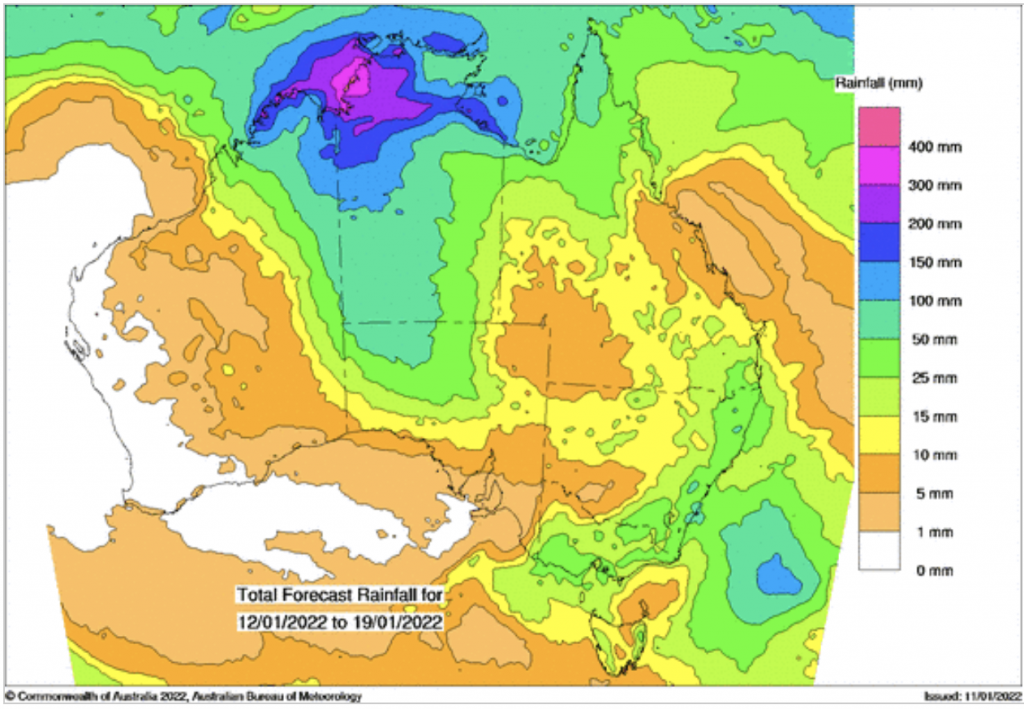

Australian Weather

Ocean Freight

Post-holiday lethargy, high fuel prices and a rumour concerning Indonesian coal bans is causing a slow start to the year for the ocean freight market. It seems the downside is gaining a bit of momentum in terms of expectations and rates in Asia are sliding accordingly. However, it’s hard to define where the real medium-term outlook is heading. Large Handymax’s are still holding a premium but it’s hard to see that lasting when Supramax is at such a discount. We also expect more participants to return to work next week so maybe volumes will pick up a touch again. However, we have an early Chinese New Year that then blends straight away into the Beijing Olympics.

Currency – AUD

The Australian dollar advanced above 0.72 U.S. cents amid an uptick across commodities and commodity currencies. The uptick in demand for commodities, coupled with a surge in domestic retail sales allowed the AUD to break resistance at 0.7190. However, the AUD remains firmly range bound. Inflation is now the primary driver behind monetary policy expectations globally and another robust print for U.S. inflation will all but guarantee a March rate hike and amplify the likelihood of four rate adjustments through 2022 and see the AUD break back below 71 cents.

To receive this information directly to your inbox as soon as it’s released, sign up for our newsletter below.

The post Australian Crop Update – Week 2, 2022 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.