Basis Commodities – Australian Crop Update – Week 6, 2023

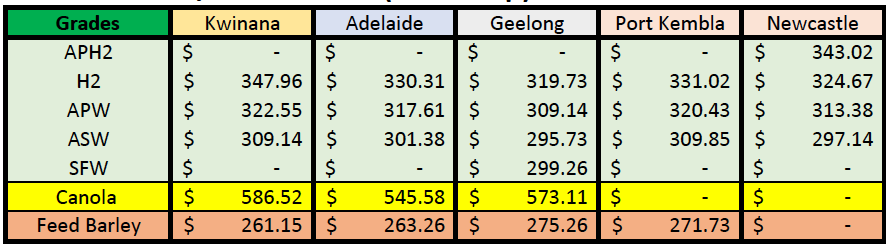

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Domestic grain bids have been variable across Australia over the past week. Domestic markets on the east coast remain thin and tight, which is keeping values supported. Farmer selling remains slow, particularly for barley. While farmer sales have been slower than normal for this time of year, there are signs selling is improving with a firmer tone in domestic bids.

Grain exporters have been sniffing around for H2 wheat against recent sales into Iraq. Asian feed grain buyers are maximising volumes of feed wheat at current prices with another couple of cargos sold into South Korea last week at $340/MT cost and freight for a June/July shipment.

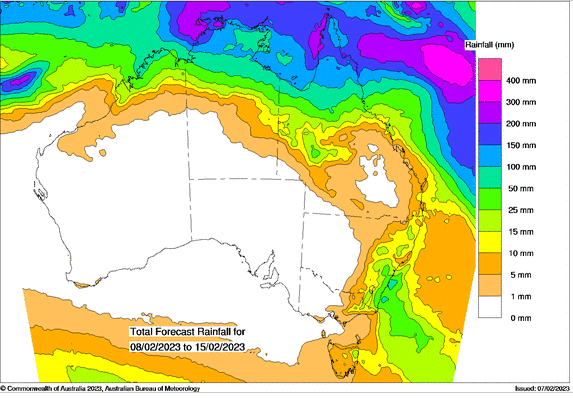

Southern and Central NSW received 15-25mm of rain over the past week which is keeping soil moisture levels wet ahead of new winter crop planting in 8-10 weeks.

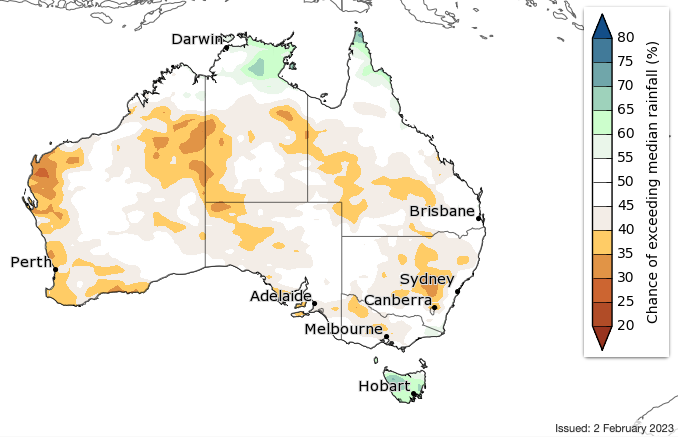

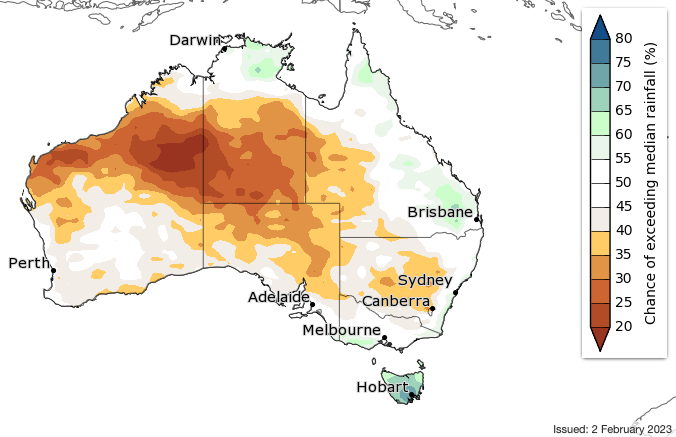

Australia’s extended climate outlooks are returning the normal with the La Nina pattern set to fade, after more than six months of wetter than normal outlooks. This was confirmed in the BOM’s latest climate outlook statements. For February, most of the country has close to equal chances of above or below median rainfall. For February to April, most of the country has close to equal chances of above and below median rainfall. But it hasn’t shaken the La Nina pattern completely.

Shipping Stem and Ocean Freight

It was a solid week for the Australian shipping stem, although the total volume of grain added was down on the previous two weeks.

One of the most interesting observations was the volume of pulses added out of South Australia (SA) and Victoria (VIC) over the past two weeks, with 200KMT of lentils put on the stem. 108KMT of this was added in SA alone last week. We have also seen 70KMT of Faba beans over the same time period.

For wheat, there was 435KMT added to the stem over the past week, down from 880KMT in the previous week. There was also 175KMT of canola and 107KMT of barley.

ABS will be out with Australia’s December grain exports this week which is expected to show near record shipments out of Western Australia and SA as the shipping pace gains traction.

From an ocean freight perspective, last week saw the first real trading days post the Chinese New Year holidays. The market was talked notionally firmer, but it is very hard to tell whether this is reality or just positive sentiment from the last month pushing into a self-fulfilling prophecy. The Pacific is more positive than the Atlantic, although that might easily be attributed simply to regional players being behind their desks again. Bunker prices have also risen substantially over the past two weeks, which has taken a lot of the “dip” out of the market.

Australian Dollar

The AUD tumbled below 70 cents on Friday night after the US dollar surged higher on the much better than expected January jobs numbers.

The post Basis Commodities – Australian Crop Update – Week 6, 2023 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.