Basis Commodities – Australian Crop Update – Week 4, 2023

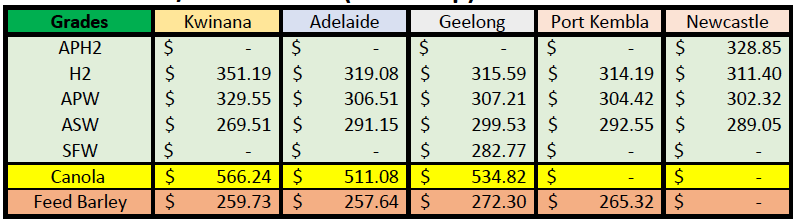

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

The Winter crop harvest across Australia is almost complete with the Victorian harvest winding down in the Wimmera, Geelong and Western Districts. Traders are reporting that several private storages were redirecting grain deliveries to alternative sites after their own storages filled.

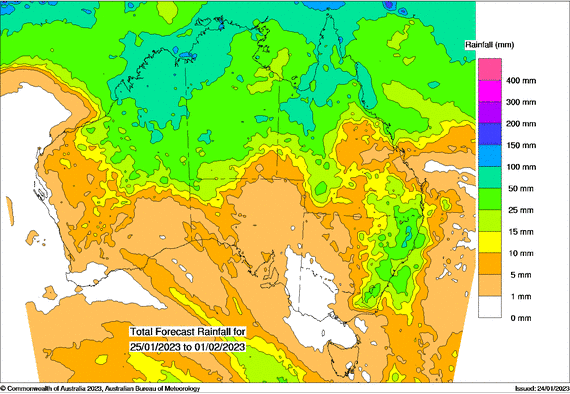

Southern Queensland growers are anxious for another rain for sorghum crops with paddocks drying out sooner than expected from last year’s deluge. Early planted sorghum is in good shape and on track for above average yields but later planted crops need rain in the coming weeks. Harvest is expected to start in the coming weeks.

Domestic markets were quiet but weaker last week as exporters pulled bids back in line with overseas weakness, but it does not appear to be getting any easier to secure grain from the farmer.

There is a real contrast between the domestic markets and the export-orientated track bids. The east coast domestic markets remain firm on short covering and slow farmer selling. Deferred offers are scarce. The exporter driven track bids have fallen $20-40/MT across Queensland, New South Wales and Victoria in the past four weeks or so, with smaller declines in South Australia and Western Australia. The biggest declines in the east coast have been in the milling wheat grades with the smallest in the feed categories. Canola bids fell by a further $30-40/MT last week across most zones with the declines in Canada and the Matif as well as news out of Germany about proposed regulation changes to biofuels legislation.

Exporters continue to sell Aussie feed wheat into Asia at $340-345/MT cost and freight levels which is about $10/MT above South American corn. It was interesting to see that Thai buyers bought a cargo of feed wheat for Mar/Apr at $340/MT cost and freight which is likely to be sourced from Australia. They also secured a second cargo at $325/MT cost and freight for a July shipment which coincides with the arrival of safrinha harvest in Brazil. We think this sums up the export market well. Global buyers see values getting cheaper in the second half of 2023. This is making it difficult for exporters to put on sales at the margins they became accustomed to through the 2022 season, putting pressure on export margins. All of this is further complicated by slow farmer selling who are holding off for higher prices, or for tax reasons.

Local prices will be driven by global relativities in the coming months. Slow farmer selling just means the exporter becomes more cautious about making further sales if they haven’t already got the coverage. Global buyers source supplies from someone else as we see East Africa switching back to Black Sea supply. Domestic buyers don’t have this luxury.

Barley prices have retained a bid side feel supported by continued speculation about an end to punitive Chinese import tariffs. Australian and Chinese trade ministers will meet for the first time since 2019 following a breakthrough on the sidelines of the Davos forum in Switzerland last week.

Shipping Stem and Ocean Freight

The past week represented the largest week of shipping stem additions in a couple of months. There was 1.3MMT of wheat, barley and canola added in the past week as well as some legumes in South Australia. Most of the additions were wheat (930KMT) with more than half of these in Western Australia. Barley additions were steady at 240KMT. The monthly breakdown of the shipping stem by departure dates shows that exports are now running at near capacity for January and February with strong wheat, barley, and canola shipments. Australia is seeing solid feed wheat demand into Southeast Asia at around $340/MT Cost and Freight levels, and this is limiting the downside of ASW (Australian Standard White) wheat in the west.

On ocean freight, there is not much new to say this week with the Year of the Rabbit upon us and activity at a bare minimum. For those of us still left in the office, the only point of discussion is the same as the last 2 months… what will happen after the holidays? There is an almost universal expectation that the freight market will bounce purely on sentiment alone, however that is where the agreement stops. Depending on where you are sitting in the market, there is a 50/50 split over whether the ocean freight will improve or collapse back down to current levels.

The bottom line is, no-one really knows what will happen, but it is notable that we are seeing plenty of period demand from operators. However, even here there is a caveat, in that operators are happy to fix index linked deals despite the currently low market environment…They are hedging their bets both ways.

Australian Dollar

From a year-end level near 0.68, the AUD/USD has spent some time above 0.70 already this year, aided by a weaker USD and big Chinese Yuan gains, the latter as markets moved to price in a quicker China growth rebound from the end of its zero covid strategy. Our bankers NAB (National Australia Bank) now see AUD/USD spending much of the first half of 2023 above 0.70, with their end-Q2 forecast at 0.74. The AUD is now seen moving into a 0.75-0.80 range in the second half of 2023! Others are a little less bullish and certainly it feels like we are only in the foothills of this global recession which in theory should see the USD re-emerge at some point.

The post Basis Commodities – Australian Crop Update – Week 4, 2023 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.