Basis Commodities – Australian Crop Update – Week 23 2022

Market Update

According to our analysts and ABARES, we are looking at third consecutive winter crop where wheat production will be over 30MMT. Barley production is forecast at 10.9MMT with canola projected at 5.6MMT. Total winter crop production, including pulses and oats, is forecast to come in at 50.9MMT.

Other forecasters are saying the wheat crop will be larger. However, our analysts have raised some cautionary flags such as a late break in South Australia and excessively wet weather in Southern Queensland and Central West New South Wales which is already hampering planting the winter crop production in these areas. Dry weather is a building concern in Western Australia.

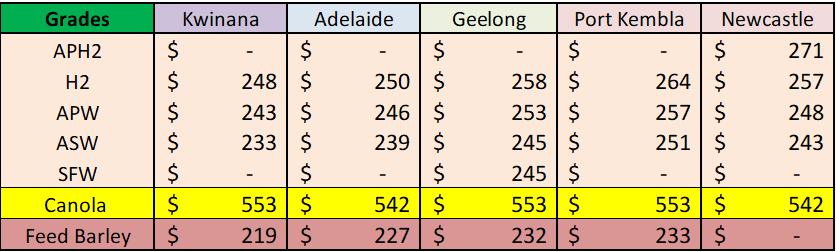

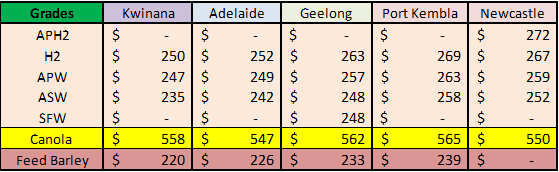

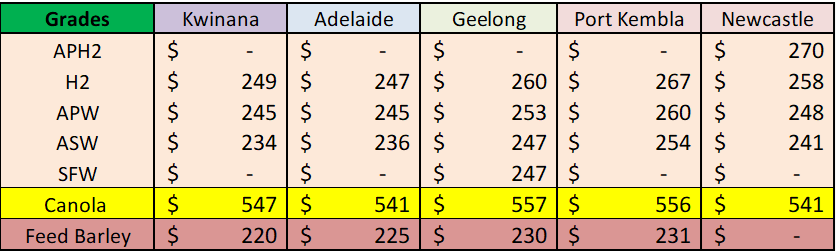

Cash Markets

Cash markets ended last week mixed with zonal factors driving price activity. Difficult logistics and tightening supplies are keeping the northern grain markets supported, but bids in the southern markets softened as more rain was received. Barley values across eastern Australia remain well supported. Overseas demand was up over the week although many private buyers remain unable to consider current pricing levels as they sit well above their costs of replacement given current prices for the various end products.

That said, we are starting to see an inverse to new crop begin to appear in Fob values across wheat and barley.

Australian Balance Sheet Update (AgScienta)

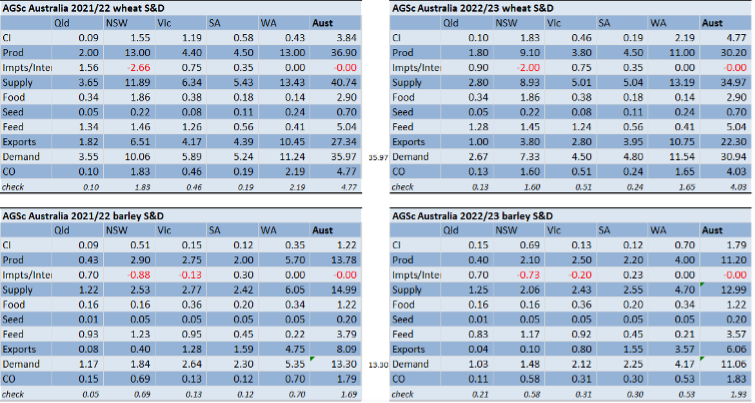

Our analysts have cut back their forecast for Western Australia’s 2021/22 wheat exports for the third and fourth quarters due to shipping delays. Shippers are reporting loading delays of up to 2-4 weeks, depending on the port. This lifts the Western Australia 2021/22 wheat ending stocks up to 2.2MMT.

For the 2022/23 season, we have raised the Queensland wheat areas to 900,000 hectares on the back of smaller chickpea plantings. Other wheat areas are unchanged, and we are working on a national wheat area close to unchanged on 2021/22, barley down 3-4% and canola up by 10% and more in places.

Excessively wet conditions are still slowing winter crop plantings in the New South Wales Central West. The region has seen 175-250mm of rain in April/May which has significantly slowed plantings. A lot of the early planted canola became water-logged and will have to be replanted with wheat or barley. In a lot of cases, it is still too wet for this and they are already outside the optimum planting window. We are hearing of farmers preparing to aerial plant wheat as paddocks will many areas still weeks away from being able to hold machinery, assuming there is no more rain.

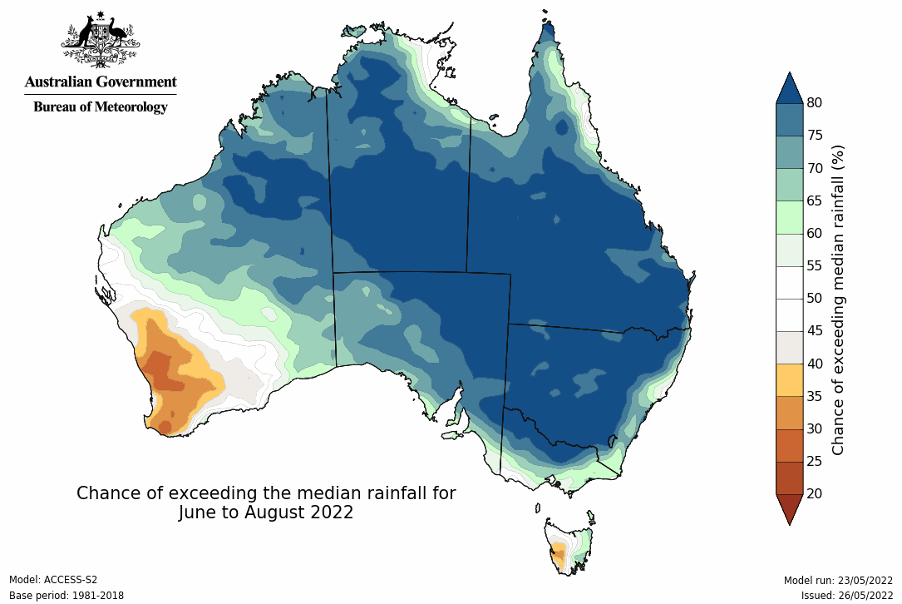

We are using above 10-year trend yields for wheat, barley and canola. Extended weather forecasts for the winter point to a continuation of the wetter than normal patterns across eastern Australia on the back of the lingering La Niña and the likelihood of a negative IOD emerging. Both of these patterns support the wetter than normal winter weather for eastern Australia. Dry patterns in Western Australia are a concern, with the BOM’s extended ACCESS model forecasting this likely to persist through the winter.

We are working on a national wheat crop of 30.2MMT and barley at 11.2MMT. Canola production will exceed 5.0MMT based on the higher plantings. Domestic feeding is already starting to ration in some industries. Northern feedlots are reportedly already winding back numbers. We are working on a 10-15% reduction in the northern COF numbers in the next six months but this comes off the record high JFM 22 quarter. The Vic dairy industry is also likely to cut back on grain feeding from September forward when the spring arrives and farmers have to pull back the volume of grain feeding. Some other industries, like chickens and pigs are not expected to ration.

We are forecasting 2022/23 wheat exports of 22.3MMT and barley exports of 6.1MMT.

Ocean Freight

The ocean freight market has seen an easing over the last week with charterers’ bids evaporating for Asian business. Owners are generally not discounting forward positions yet, but spot tonnage is having to face lower levels to get fixed and our team sense the owners are getting nervous. The Atlantic remains weak, and the Pacific is coming down to parity so we don’t see there will be much decline in the back haul numbers which would help freight moving back to the Atlantic.

At this stage sitting on your hands looks like the best strategy.

Australian Dollar

The Australian Dollar jumped after the RBA announced a 50 basis point interest rate increase which surprised most of the markets and economists. The RBA is now seeing inflation higher than they expected a month ago as global raw material costs and a domestic energy price have been pushed up sharply. It then gave up those gains and actually began trading lower than pre-meeting levels. The 0.7270 resistance region now represents a solid area of resistance while the 200 day moving average also sits around 0.7250.

The post Basis Commodities – Australian Crop Update – Week 23 2022 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.