Basis Commodities – Australian Crop Update – Week 21 2022

Market Update

Last week was an interesting one for the old crop cash markets. Cash bids rallied strongly before the surge in values bought out fresh famer selling which allowed end users and trade shorts a much-needed buying opportunity.

There is no doubt soaring grain prices are likely to result in a rationing domestic demand. This is a view we have already shared but it’s likely to emerge as a reoccurring theme in the 2022/23 season both in Australia and overseas as we remain at these elevated prices. Our analysts, AgScienta, have already started lowering our domestic demand estimates in the recently circulated 2022/23 balance sheets. Feed grain demand rationing will take time with feedlots a prime example of where the domestic demand will ration. Some other industries are also expected to come to a similar conclusion. Agscienta expect the volume of grain users in the dairy industry from September onwards could contract by at least 20%. Rationing is more difficult in other feed sectors, such as poultry.

Export elevation additions have slowed over the past couple of weeks which is likely to reflect loading delays with most ports operating at capacity and a decline in end consumers seeking forward coverage. FOB liquidity is still tight through to September.

So where are we now from an Australian cash position? As we move closer to the northern hemisphere new crop, we struggle to be optimistic that the Black Sea origination will flow in the volumes needed to keep destinations supplied. Good work is being done to increase volumes from Ukraine and in my mind, there is no doubt Russia will find pragmatic partners to trade with, but the challenges are still many with respect to exporting the Black Sea crop. In our view, this will continue to place an enormous amount of pressure on the other origins, specifically the EU and the southern hemisphere now that India has stayed its hand. As such, consumers will need to be mindful of the demand pressure on these supply chains and the logistics attached, even at a time when their local markets are telling them to sit on their hands – these are difficult times indeed.

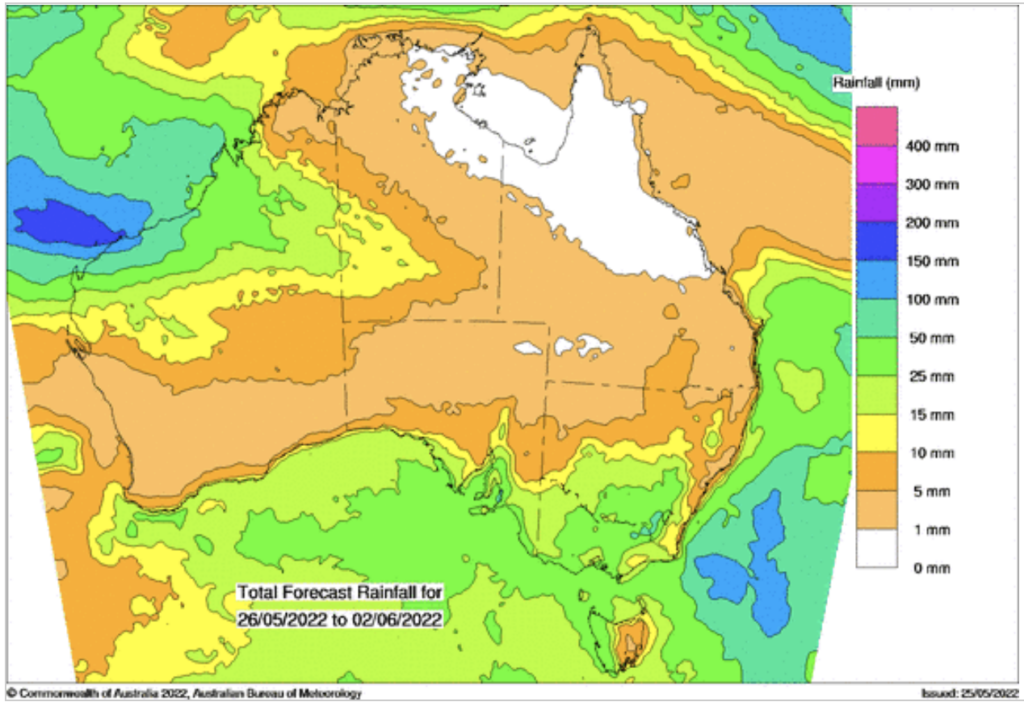

Australian Weather

Ocean Freight

According to our freight team, we need to throw the Baltic index in the trash – index numbers this week bear zero relation to the physical reality in the Pacific market. Numbers for Supramax have rallied and large Handies have quickly re-established the dollar/dwt range we had a few weeks back. Lack of tonnage combined with consistent cargo enquiry seems to be the main drivers. Geared tonnage in Southeast Asia remains a solid premium to panamax which suggests Indo coal is playing a major role here. It’s obviously very difficult to sort fact from fiction, but it cannot be a coincidence that back hauls are still expensive, the Atlantic is becoming tonnage heavy, and the Pacific is tight again. We have also had another push in bunker prices over the last seven days – presently not far from the $1000/mt marker for VISFO from Spore. Unprecedented times continue.

The post Basis Commodities – Australian Crop Update – Week 21 2022 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.