Basis Commodities – Australian Crop Update – Week 14, 2023

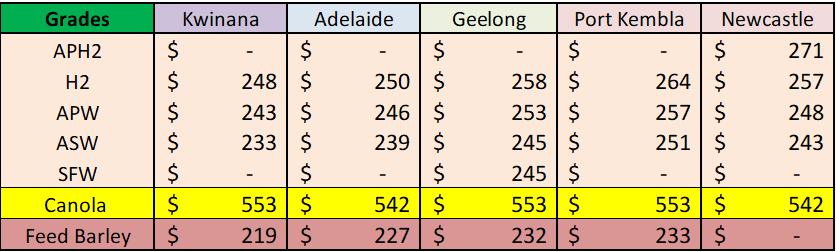

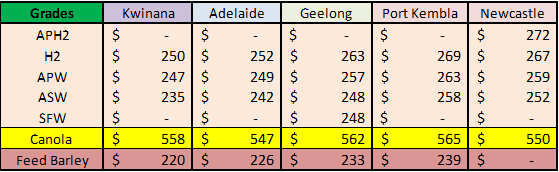

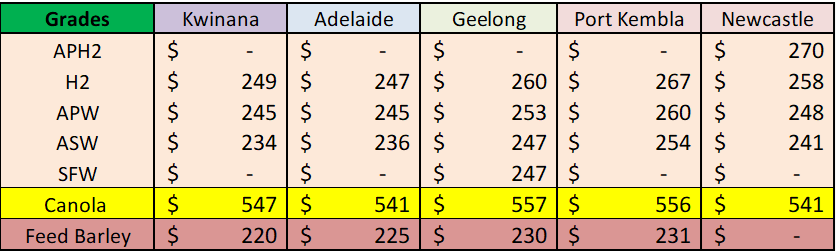

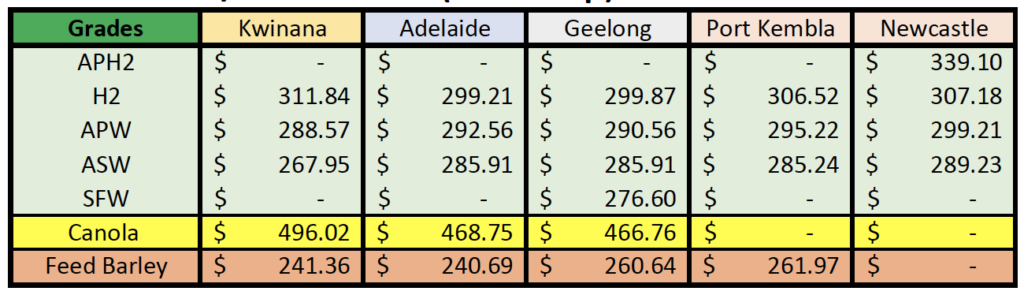

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Australian Grains & Oil Seed Market

The Australian domestic markets ended the week mixed with cash buyers returning following the sharp selloff in CBOT wheat which saw wheat bids up AUD$10-15/MT. The trade bids continue to bounce around on the back of how hard the exporters are chasing ex-farm supplies against direct to port grain loadings. Canola was AUD$50-60/MT higher in all zones, with the continued recovery in Euronext and Canadian futures. The other takeaway from the week is the misalignment in the current weather and the extended outlooks. A sizable proportion of Australia’s cropping areas received good rains in the past week, although falls were patchy in some areas as opposed to drier longer term forecasts. For the time being there are no concerns as we go into the planting season.

Elsewhere Grain Trade Australia (GTA) provided an update on China’s ban on Australian barley imports. The WTO Dispute initiated by Australia in response to AD/CVD Measures implemented by China on Australian barley exports was expected to report in March 2023. Advice is the Panel’s Report can be expected soon. Under China’s standard processes interested parties to AD/CVD measures can apply for review on the anniversary of the respective measures, based on a change in circumstances. China’s Ministry of Trade/Commerce (MofCOM) have recently advised Canberra that an interested Chinese industry stakeholder has requested an interim review of the AD/CVD measures on barley from Australia. Under its regulations, it is understood that MofCOM have up to 60 days to consider such applications and whether it may initiate a review of the measures. Until such time, Australian Barley is still banned from export to China, but it does continue to suggest there is growing momentum behind some kind of change in Beijing’s stance when industry participants feel comfortable enough to ask for a reconsideration of the Chinese Government’s stance.

Australian and Chinese officials will meet next week to discuss how to normalise trade, a source told Reuters, as diplomatic ties thaw. Under the WTO dispute process, the findings on whether trade rules have been broken and any remedy will be distributed to all WTO members within three weeks of the final report, and its recommendation adopted within 60 days unless there is an appeal. Assistant Trade Minister Tim Ayres said on Friday that Australia was “confident that the applications that we’ve made would be successful in the normal course of events” but was also discussing the WTO case with China. Trade Minister Don Farrell held a video meeting with his Chinese counterpart Wang Wentao in February, which was followed by a video meeting of trade officials. Trade officials will meet in person next week, a source told Reuters. “Minister Wang and I agreed to enhanced dialogue at all levels, including between government officials, to pave the way for the resumption of trade,” Trade Minister Don Farrell said in a statement to Reuters on Friday, in response to questions “Our government officials are meeting to continue to lay the ground work for the resumption of trade.”

Ocean Freight Market & Export Stem

Pressure remained on spot freight prices amid further signs of economic uncertainty and a lack of full blooded buying – a pattern exacerbated by renewed uncertainty over the Black Sea corridor and fresh warnings from Russia.

Lacklustre coal cargo enquiry in Southeast Asia has pulled the rug out from under owners last week within the region. Without an influx of fresh business early this week we could well see a more rapid reversal across all sizes in the Pacific as we go through the Easter period. Coal has been the big market driver since March and without it the market is crumbling. Supramax tonnage has eased from US$14/14.5k pd early in the week by about US$3kpd for pacific round voyage and large handys are off a little less – abt US$2kpd over the week to US$11-12kpd sub. Period numbers remain firm and have not moved much since rates appeared to top-out late last week. Longer term optimism remains from owners side (1yr plus time charter ideas are all around US $14k) but we now feel the market is following a similar profile to the period immediately post Chinese New Year. Medium to long term optimism is presently not being matched by achievable spot rates and a large gap is emerging which stifles operator activity. It feels like more volatility is on the way. Just a slither of positivity is enough for owners to push rates quickly higher, but likewise the market hits full retreat quickly when charterers sniff weakness…..a situation suggestive of a fine balance between supply and demand.

Finally, Black Sea and Azov routes into the Sea of Marmara also showed signs of further fatigue, with falls of up to US$5/MT along some routes. That came as Russian authorities continued to give off conflicting views, linking the end of the 60-day grain corridor extension to the pace of Russian exports, and then threatening to cut off wheat and sunflower exports amid high prices.

On the shipment stem side of things It was a strong week for wheat additions onto the shipping stem in Australia and this was dominated by the west. There was 913KMT of wheat added to the stem in week 13 of 2023. This was the third largest weekly wheat additions since January. Western Australia accounted for 538KMT of the wheat additions which is its largest week so far for the 2022/23 MY. Western Australia has added about 1.3MMT of wheat to the stem in the past four weeks and about the same in the four weeks prior.

Australian Weather

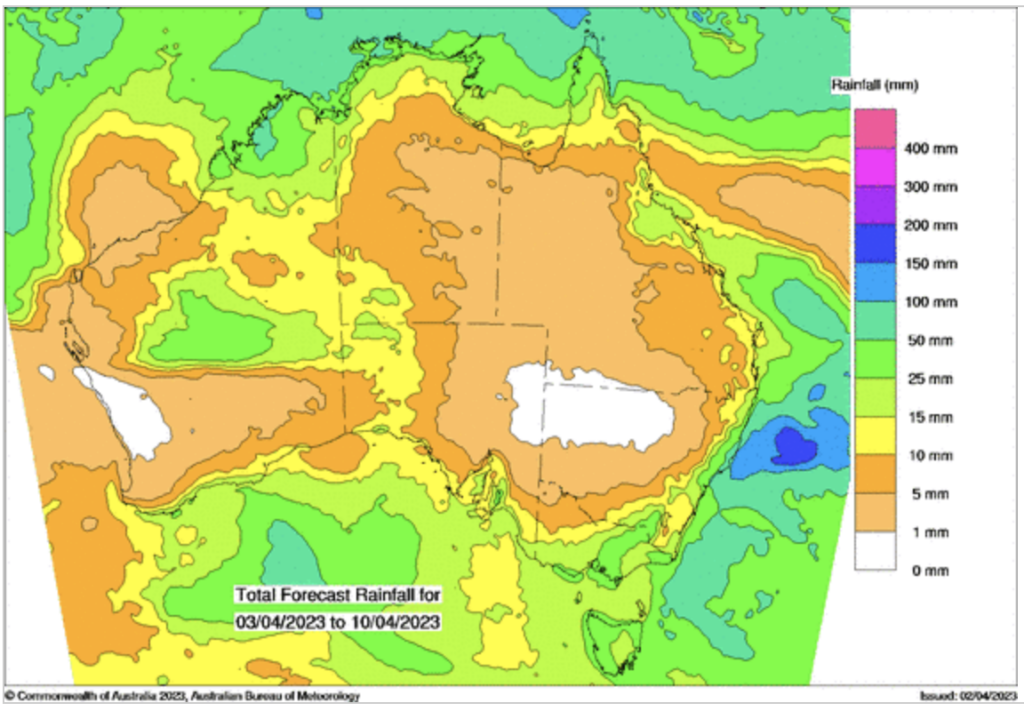

The Australian Bureau of Meteorology’s latest seasonal outlook statement for April to June said below median rainfall is likely to very likely (60% to greater than 80% chance) for the majority of Australia. Days are likely to very likely (60% to greater than 80% chance) to be warmer than median for most of Australia. While the Pacific Ocean is currently ENSO-neutral, but Bureau has issued an El Niño WATCH as we reported last week. This means there is around a 50% chance of an El Niño in 2023.

As reported most areas received welcome rain this week.

Source: http://www.bom.gov.au/

Source: http://www.bom.gov.au/

AUD – Australian Dollar

This week all eyes will be on Tuesday’s Reserve Bank of Australia (RBA) interest rate decision. Australia’s central bank is expected to go for a final 25 basis point interest rate hike to 3.85% on Tuesday, although forecasts from economists suggest the decision on whether to hike or hold rates is on a knife edge. While inflation in Australia rose to a more than three-decade high of 7.8% last quarter, well above the central bank’s target of 2%-3%, the bank signalled again this month a possible end to its current tightening cycle, as it did in December.

USDA Summary

The latest USDA report was also released last week. For corn, The USDA pegged quarterly stocks at 7.401 billion bushels, the smallest in nine years. Prospective Plantings data had 91.996 million acres for corn up 4% from 2022 and 1 million acres more than the average market guess, although there was some caution that wet weather in the south and heavy snow in the Dakotas could complicate planting. The USDA said the U.S. corn crop was 2% seeded by Sunday, matching the average analyst estimate and the five-year average. Planting was most advanced in Texas, while seeding has yet to begin in core Midwest corn states such as Iowa and Illinois.

The expansion in wheat plantings were larger than expected. Acreage data from the Prospective Plantings report show 49.855m acres of wheat for 2023/24. The winter wheat number was raised by 400k to 37.5 million. KS was raised 600k from the January number. Other Spring wheat intentions were 10.57 million acres, compared to the 10.9m trade average guess. Durum area is intended to be 1.78m acres, up from 1.63m planted during the old crop season.

USDA released its first weekly crop progress report of the 2023 growing season and rated 28% of U.S. winter wheat in good to excellent condition, the lowest for this time of year in records dating to 1989, as drought persists in key portions of the Plains wheat belt. Approximately 48% of U.S. winter wheat was produced in an area experiencing drought as of March 28, the USDA said in a separate report last week, a reduction from 51% a week earlier and down from 69% as the year began. However, drought remains concentrated in southwest Kansas and the Texas and Oklahoma panhandles, all key winter wheat production areas.

The USDA did not release figures on planting progress for spring wheat on Monday but said it expected to publish those starting with its next weekly report on April 10.

The post Basis Commodities – Australian Crop Update – Week 14, 2023 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.