Basis Commodities – Australian Crop Update – Week 13, 2023

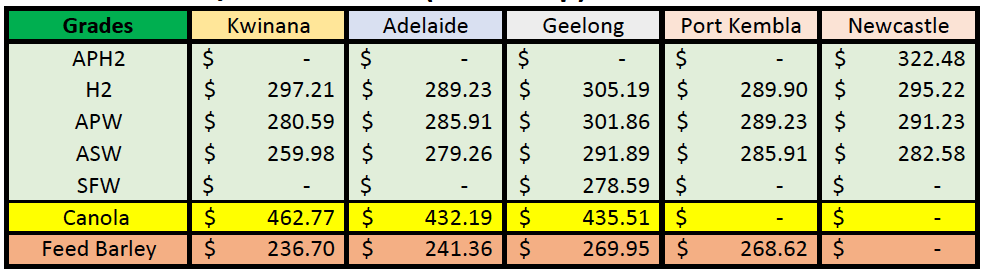

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Australian Market Review

The Australian Domestic market finished sharply lower at the end of last week as buyers pulled wheat, barley and canola bids lower in response to the sharp declines in global markets. In response, the farmer selling still appears to have slowed and for smaller volumes. The Farmer is already well sold, with most of the grain held in the major bulk handlers storage already committed to sales, However, the farmer is still sitting on sizable on farm supplies that are still to be marketed. As an example, Victorian farmers grew an extra 1.85MMT of wheat, barley and canola in 2022/23, according to the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) March crop report. Bulk Handler GrainCorp’s annual reported grain deliveries into Victorian storages were less than 100KMT more than 2021/22. Other bulk handlers will have increased their share of farmer grain deliveries, but farmers are still holding a lot of grain on farm. The same goes for New South Wales, but the smaller crop means there is not the same abundance of surplus supplies needing to find their way into export pipelines.

Australian barley values continued to fall in sympathy with the global decline in wheat and in competition to European new crops that are in good shape coming out of dormancy.

Australian Pulse Market

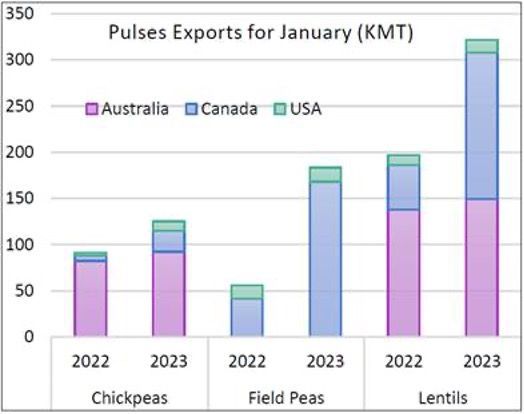

Prices for Australian faba beans, lentils, mungbeans and chickpeas have risen in the past month, thanks to healthy demand. March has also seen increased exports into South Asia and this has built confidence in forward business. In its quarterly Australian Crop Report, ABARES has lifted its production estimates for faba beans by 26%, field peas 11%, lentils 34% and lupins by 45% from the previous figure released in December. The chickpea estimate has been revised down 9%.

Interestingly on a year-on-year basis, pulses exports from the three major exporters took a big jump at the start of this year. In January 2023, combined lentils export out of Australia, Canada and the United States were up 64% on the previous year, while the chickpea figure was up 37% year on year.

Ocean Freight and Export

It was a quieter week for the shipping stem additions in Australia. It’s too early to be making a judgment, but maybe the washout in global markets and the discontent with export pricing and competitiveness are already being felt in the stem additions. In addition, we have just entered into the month of Ramadan which typically has a calming effect on buying interest. There was about 300KMT of wheat added to the stem which is the smallest in eight weeks and less than half of the four-week average. The additions were spread across all states. A further 180KMT of barley was put on the stem with most of this in WA. No canola was added to the stem.

The freight markets were also quiet last week with a lack of cargo interest undermining owners’ attempts to push the Asian market forward. Tellingly, all the Southeast Asia focussed routes on the Baltic indices were marked down over the week which probably indicates where the dearth of cargoes hit most. Indonesian coal shipments are clearly the key player still. If we see a fresh influx of cargoes ahead of the Indian monsoon then we’ll see another jump, but otherwise, and we feel the more likely scenario, the market will continue easing away. We can’t see much else to keep demand up. The Atlantic is trending side-ways and marginally upward – highly likely on sentiment from the Pacific.

Australian Weather

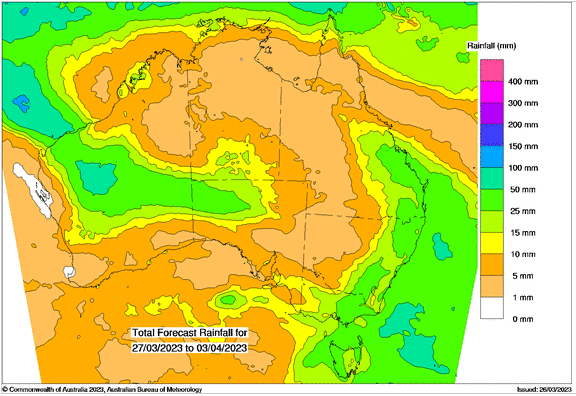

Widespread rain across New South Wales over the past week is also easing dry weather concerns. Most areas received beneficial rain throughout the week, despite the patchy nature of the storms and showers. It was a similar situation in the south in Victoria and South Australia. The unsettled weather is continuing in the coming week but is forecast to clear by the weekend.

Source: http://www.bom.gov.au/

Source: http://www.bom.gov.au/

Finally, the Australian Bureau of Meteorology is calling for drier than normal weather through the autumn.

AUD – Australian Dollar

The Australian dollar closed weaker last week when valued against the USD and closed at 0.6645. The Australian dollar attracted fresh sellers on Friday extending the previous session’s slide. Risk sentiment remains fragile over lingering and spillover concerns to European banks. Next support levels for the AUD/USD are defined now at 0.6620, 0.6560 levels with resistance at 0.6680 and 0.6760.

The post Basis Commodities – Australian Crop Update – Week 13, 2023 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.