Basis Commodities – Australian Crop Update – Week 12, 2023

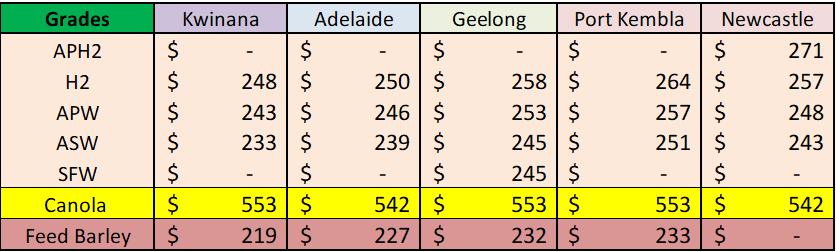

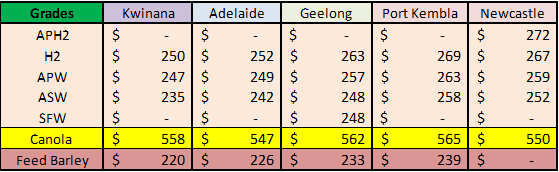

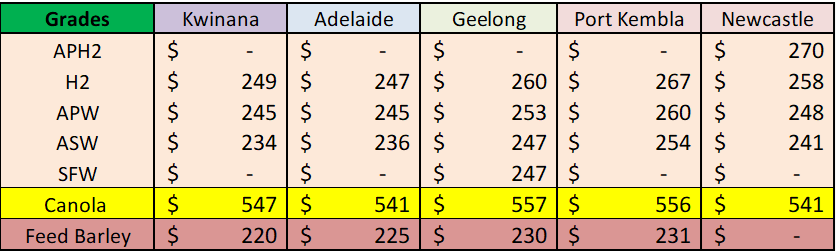

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Australian Market Review

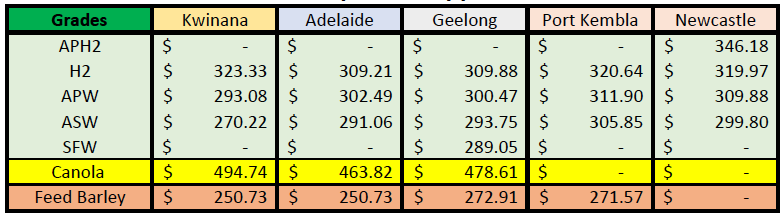

The Australian cash markets were mixed over the past week. Canola was sharply lower in all states with the washout in European and Canadian futures. Bids to the grower were down AUD40-60 and are now over AUD100 lower than a few weeks ago. One gets the impression that farmers have been slow on the canola sales program, which is surprising, and have been caught flat-footed with the recent sharp selloff following the record large 8.2MMT Australian Crop.

The wheat market was generally firmer last week. Traders are still driven by short covering against export commitments and slow farmer selling. It is expected the shorts will persist through April and into May given the size of the export program. However, the inverse to the northern hemisphere’s new crop is sure to have an effect, unless we get support from the weather and the re-emergence of the fabled El Nino. The need to reengage with the global market varies state by state, but with a 39MMT wheat crop and 9.8MMT of this exported through January, we expect that this will happen at some point. The question is when?

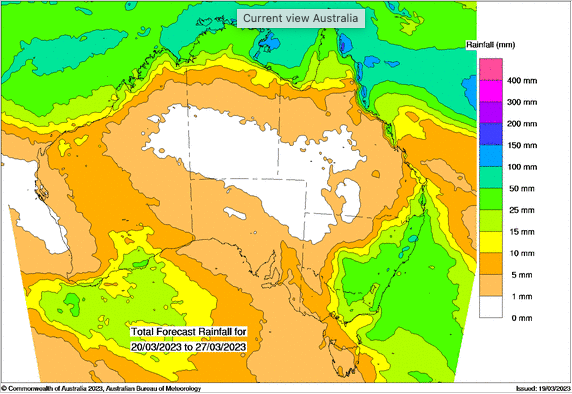

It should be said that El Nino related drought risks are offering some background support but recent rain across Queensland (QLD) and New South Wales (NSW) is already eroding some of this. Elsewhere, the moisture profiles are relatively healthy, so it is difficult to get too anxious at this point. It is something to watch though.

Australia exported 417,215 tonnes (MT) of feed barley, 55,720MT of malting barley and 50,115MT of sorghum in January, according to the latest export data from the Australian Bureau of Statistics (ABS). January’s feed barley exports represent a drop of 61 percent from the December total, with the largest customers being Saudi Arabia on 115,219MT, Jordan on 91,280MT and the Philippines on 56,332MT.

Australian Pulse Market

Australia exported 92,287MT of chickpeas and 149,266MT of lentils in January 2023. The chickpea figure is up 49 percent from the 62,078MT shipped in December to reflect increased new-crop availability after a delayed harvest in Queensland. Lentils shipments dropped 9 percent for the month from 163,196MT shipped in December. Ports in Victoria and South Australia have tended to concentrate on exporting canola and wheat due to the export elevation on offer and this has left little room for pulses. The major destinations for January-shipped chickpeas were Pakistan with 41,382MT and Bangladesh with 38,225MT. Lentils saw Turkey export 35,155MT followed by India on 32,315MT and Bangladesh on 28,225MT.

Ocean Freight and Export

News hit the wires that Russia was willing to extend the current safe export corridor agreement but for only 60 days, not the 120 days the Ukrainians wanted. Russia wants to see better access for its Ag exports but that would mean the US/EU would need to ease or end the current banking and insurance sanctions that are in place. It’s hard to see that happening in the current climate of mistrust. The main question now, is if the 60 days is agreed, what do the shipping companies do? Many vessels have been stuck for 40 to 60 days waiting to load in Ukraine and the current vessel count is near 100 trying to get in or out of the Black Sea. There are a lot of moving parts for the trade in relation to Black Sea Ocean freight.

In the Pacific, it was another week of uncertainty and de ja vu. The market has stalled again and is showing signs of weakening on the larger ships. It feels like there has been a pullback in Indonesian coal stems which has taken the steam out of the Southeast Asia scene – given it was the primary driver behind the recent market run-up. Put simply, If more stems do not emerge this week, then the market gives back its gains. Alternatively, more cargoes will see another jump. The jury is out for the time being. The real win for cargo interests has been the rapid fall in bunker prices. Singapore bunker prices are heading toward the low $500’s pmt vlsfo – almost $100pmt lower than a month ago.

Australian Weather

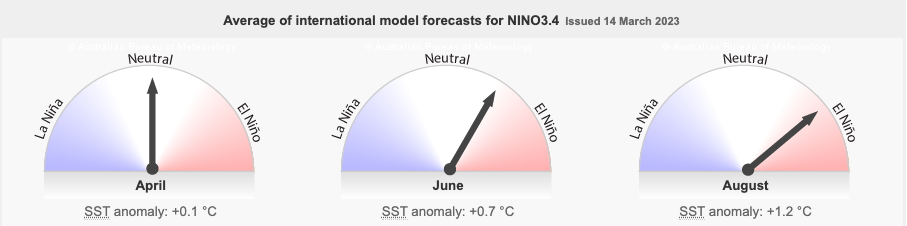

QLD and parts of NSW received rain over the past week. QLD received general rain of 40-80mm while NSW saw patchy rain which benefited about 20-25% of the cropping area in the north and the central west. The Australian Bureau of Meteorology (BOM) declared the La Niña phase has ended in the tropical Pacific Ocean. The El Niño–Southern Oscillation (ENSO) is now neutral (neither La Niña nor El Niño). International climate models suggest neutral ENSO conditions are likely to persist through the southern autumn. However, there are some signs that El Niño could form later in the year. Hence the Bureau has issued an El Niño WATCH. This means there is a 50% chance of an El Niño in 2023.

Source: http://www.bom.gov.au/

Source: http://www.bom.gov.au/

AUD – Australian Dollar

The Australian dollar was slightly stronger at the end of last week when valued against the USD. The AUD/USD currently trades just above the 0.6700 mark and is drawing support from bank bailouts that ease fears about widespread contagion which boosts investors’ confidence. This undermines the safe-haven US dollar and benefits the risk-sensitive AUD. Nothing like the market getting ahead of itself…

The post Basis Commodities – Australian Crop Update – Week 12, 2023 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.