Basis Commodities – Australian Crop Update – Week 11, 2023

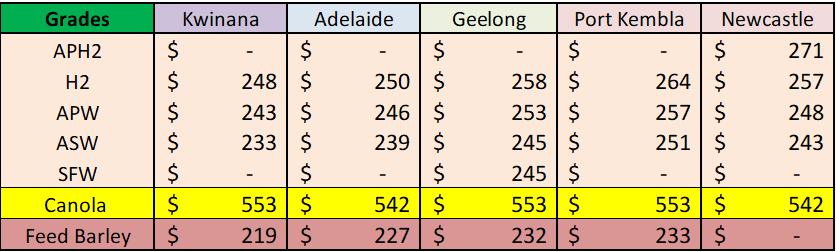

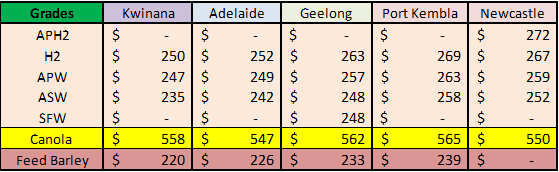

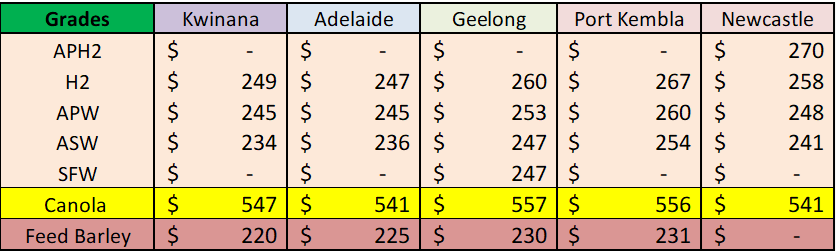

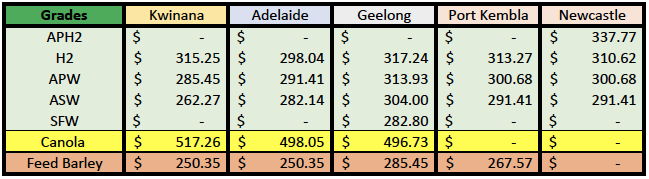

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Australian Market Review

The Australian domestic wheat market was sharply lower at the close of last week as buyers reflected declines in CBOT and Matif while the 2.7% decline in the AUD/USD lessened the impact. Canola saw the largest percentage declines reflecting the massive weekly declines in Matif. Bids for canola in most zones in Australia finished the week 4-9% lower with further reductions set for this week as buyers reflect the 5 euro decline on Friday. Short covering continues to offer support in the trade bids for wheat and barley also. The sentiment is that prices will have to break soon on the pressure on declining global values. At the same time, there is a depth of demand to own grain on the dip to cover shorts.

Farmers are offloading livestock across eastern Australian on dry weather concerns. Livestock’s numbers have been high with the string of favourable seasons. However, they are starting to pare back numbers with the late start to forage planting ahead of winter and El Nino concerns. Meat and Livestock Australia’s feeder steer indicator on pricing is down 6% in the past four weeks and down 16% since late December. East coast farmers will also be responsive to dry weather with further grain sales.

ABARES released its March Crop Report early last week where they raised wheat production to 39.2MMT from 36.6MMT in December. Barley production in 2022/23 was estimated at 14.1MMT, the third-largest volume on record. Canola production in 2022/23 was estimated at a record 8.3MMT, 21% above the previous record of 6.8MMT in 2021/22. The numbers came as no surprise to the market which was primed for a 38.5MMT to 39MMT wheat crop.

ABARES also issued some preliminary forecasts for the 2023/24 season. ABARES flagged smaller winter crop plantings in 2023/24 with the likely drier conditions as flagged by the BOM’s extended weather outlooks. The area planted to wheat is estimated by ABARES to decrease from 13 million hectare in 2022/23 which yielded 39.2MMT to fall to 11.8-12.5 mill ha, for a crop of 28.2MMT. They flagged a larger percentage decline for barley than wheat. Timing of planting rains is critical for the size of the 2023/24 winter crop plantings. The 28MMT 2023/24 wheat crop is a reasonable starting point for the 2023/24 preliminary numbers. The planted area has been high on the past three seasons because of early, general rains.

Ocean Freight and Export

Another 1MMT of wheat was added to the shipping stem in the past week. This included 390KMT in Western Australia, 320KMt in New South Wales and ~160KMT in Victoria. East coast wheat exports now seem to be focused on milling grades after the early feed wheat shipments. There was also 225KMT of barley added to the stem including 165KMT from Western Australia and 60KMT from South Australia. Just over 210KMT of canola was added to the stem in the past week with about 150KMT in Western Australia and 60KMT from New South Wales. Overall, wheat and canola exports are moving very quickly while barley is slower.

Freight markets were flat last week, even with market shorts bidding up capacity for nearby slots. It feels as though there is a market consolidation and the nearby could see rates a little weaker. There is a massive difference between the index and paper at the moment with the physical index lagging almost USD2k stronger than the paper market for March’23. This implies the market will see a minor push. However, there seems to be more capacity available which contradicts that theory hence we see quotes move sideways for the nearby.

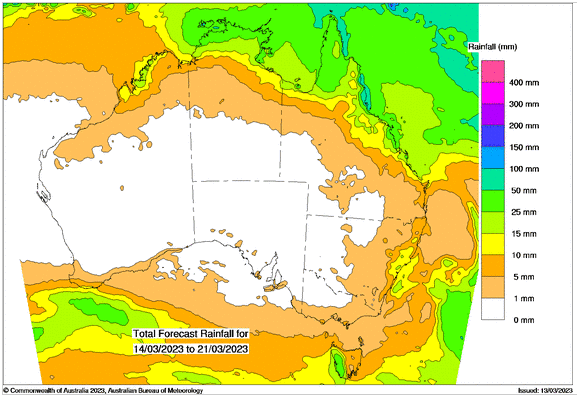

Australian Weather

Central Queensland saw good rainfall last week, which will benefit sorghum crops. Southern Queensland received a storm on Saturday which dropped 20-80mm across the growing region. This will benefit subsoil moisture for summer crops. New South Wales saw 30-50mm, but the southern growing regions and Western Australian saw no rain.

Source: http://www.bom.gov.au/

Source: http://www.bom.gov.au/

AUD – Australian Dollar

The Australian dollar was sharply weaker last week when valued against the Greenback closing the week at 0.6580. Last week the Australian Dollar fell as the Reserve Bank of Australia (RBA) and Federal Reserve had differing views on monetary policy and high beta risk assets met headwinds going into the weekend. The Reserve Bank of Australia raised interest rates for the 10th consecutive meeting, with rates now sitting 3.5 per cent above where they were when the rate rise cycle began. It’s worth noting that recently financial markets were pricing in a cash rate as high as 4.35 per cent.

The post Basis Commodities – Australian Crop Update – Week 11, 2023 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.